5 Essential Tips for Completing Your K1 Basis Worksheet

Completing your K1 Basis Worksheet is a critical step in managing partnership income or partnership losses as part of your tax preparation. Whether you're a new partner or a seasoned stakeholder, understanding how to work through your K1 Basis Worksheet correctly ensures you're prepared for tax season and helps in maintaining accurate financial records. Here, we dive deep into the nuances of this form and share five essential tips to guide you through this process effectively.

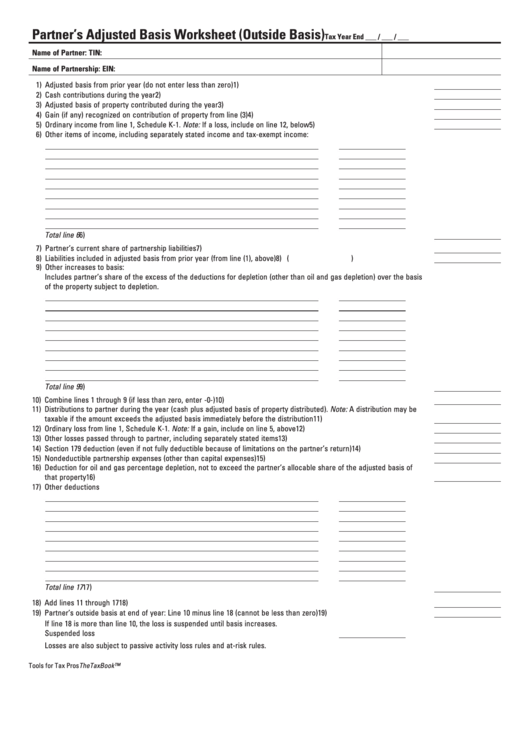

Understanding Your K1 Basis Worksheet

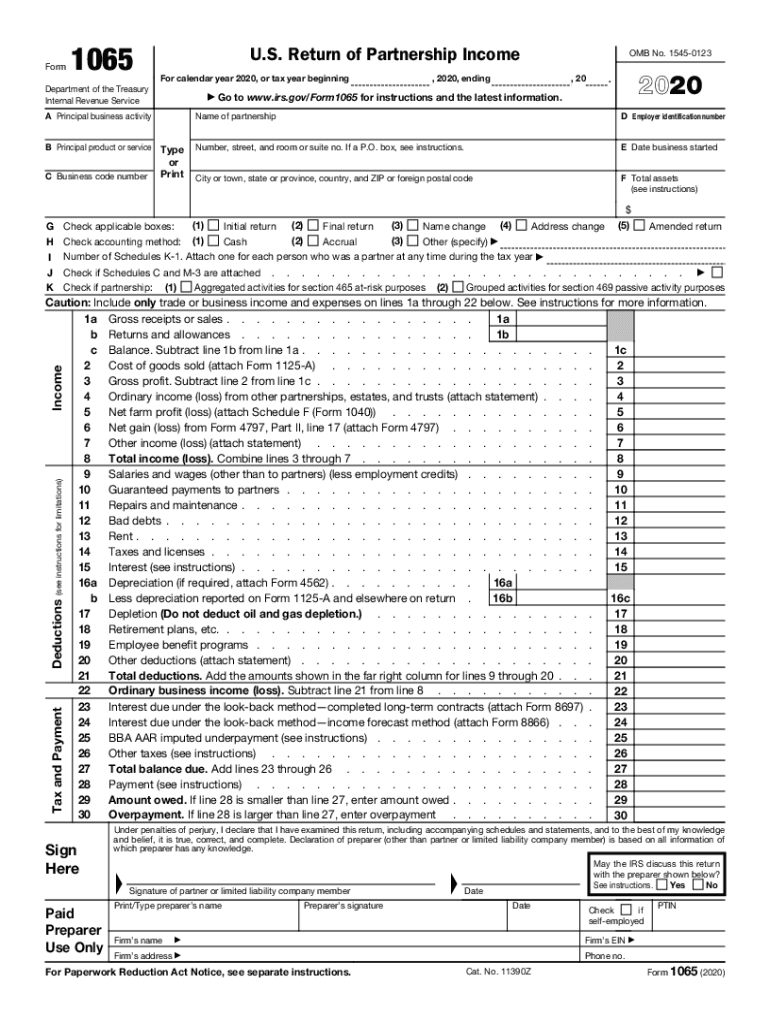

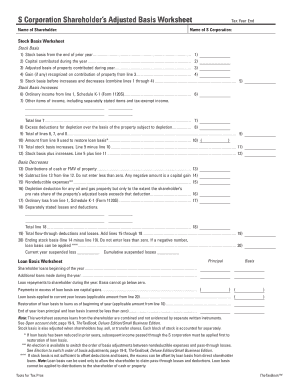

Before delving into the tips, let's briefly cover what the K1 Basis Worksheet is. The K1 Basis Worksheet is a document that helps partners of a partnership or an S corporation to calculate their basis in the entity. The basis represents your investment in the entity, which can influence the amount of losses or income you can claim on your personal tax return. This calculation involves:

- Contributions to the partnership

- Distributions received from the partnership

- Income or losses allocated to you

Tip #1: Properly Track Your Contributions

Your initial investment or any additional contributions you make to the partnership should be meticulously tracked. Here’s how you can ensure accuracy:

- Record Each Contribution: Note down the date, amount, and type of contribution made, whether it's in cash, property, or services rendered.

- Calculate Correctly: Remember that your basis is the sum of these contributions plus your share of the partnership's liabilities (for partnerships that have recourse debts).

- Document Increases: Ensure your K1 Worksheet reflects all contributions that increase your basis, including additional investments and earnings.

Tip #2: Monitor Your Distributions

Distributions from the partnership can reduce your basis. Here's how to manage this:

- Record Withdrawals: Document all distributions, whether they are cash payments, property, or personal use of partnership assets.

- Do Not Exceed Basis: You can't distribute more than your basis without recognizing gain, so always keep track to avoid this situation.

💡 Note: If your distributions exceed your basis, you might have to report the excess as capital gain on your tax return.

Tip #3: Include Income and Deductions

Partnership income or losses allocated to you will adjust your basis:

- Income Increases Basis: Your share of the partnership's income adds to your basis.

- Losses Reduce Basis: Conversely, losses allocated to you will reduce your basis, potentially to zero if not handled carefully.

Tip #4: Consider Partnership Liabilities

Partnership debt and guarantees can impact your basis:

- Recourse Debt: If you have personally guaranteed partnership debt, this can increase your basis.

- Nonrecourse Debt

- Loan Guarantee: Track and include any amount you are personally liable for on your K1 Basis Worksheet.

| Item | Description |

|---|---|

| Capital Contributions | Money or property contributed to the partnership |

| Income | Ordinary income, interest, dividends, and rental income from the partnership |

| Losses | Operating losses, depreciation, and depletion |

| Distributions | Withdrawals in cash or property |

| Liabilities | Partnership debts where partners are personally liable |

Tip #5: Keep Detailed Records

The importance of detailed record-keeping cannot be overstated:

- Maintain Backup: Ensure all financial transactions related to your partnership are backed by documentation.

- Organize Files: Keep your financial records in an accessible, organized manner.

- Regularly Update: Update your K1 Basis Worksheet as transactions occur or at least quarterly.

To wrap up, mastering your K1 Basis Worksheet requires diligence, accuracy, and a bit of foresight. By following these five tips—tracking contributions, monitoring distributions, considering income and deductions, accounting for partnership liabilities, and maintaining detailed records—you'll be well on your way to managing your partnership's tax responsibilities effectively. Remember, understanding and updating your basis is not just about compliance; it's about maximizing your investment and preparing for the financial future of your partnership.

What happens if my distributions exceed my basis?

+

If your distributions exceed your basis, you’ll recognize capital gain on your personal tax return. This excess distribution is treated as if it were a payment in exchange for your partnership interest, leading to a taxable event.

How often should I update my K1 Basis Worksheet?

+

It’s advisable to update your K1 Basis Worksheet at least quarterly or whenever significant changes occur in your partnership’s financial activities.

What documentation should I keep for my contributions to the partnership?

+

Keep receipts, bank statements, or any other proof of your contributions, including detailed notes on property value or services provided if not in cash form.