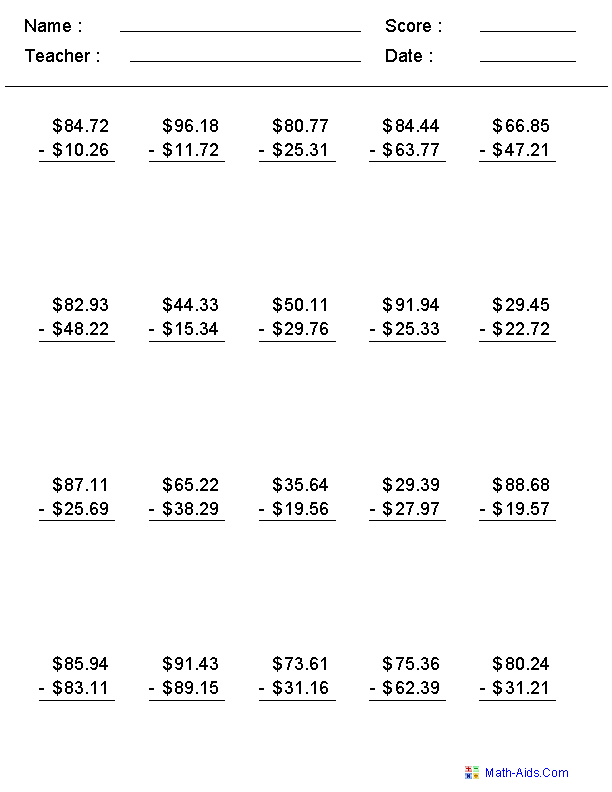

Fun Money Math: Subtract Money Worksheet

Embarking on the journey of teaching children the basics of financial literacy is both challenging and immensely rewarding. Among the fundamental arithmetic operations, subtraction stands out as a particularly crucial skill, not only for mathematical proficiency but also for everyday financial decisions. Introducing kids to the concept of money subtraction through engaging and interactive worksheets can pave the way for a lifetime of informed financial choices. Let's delve into the intricacies of creating and using these educational tools.

Why Money Subtraction Matters

Financial Literacy: Understanding how to manage money, including subtraction, is a cornerstone of financial literacy. It's not just about learning how much is left after spending, but also about planning and budgeting.

Real-Life Applications: Money subtraction directly correlates to everyday tasks such as shopping, budgeting for expenses, and understanding change.

Creating Effective Subtract Money Worksheets

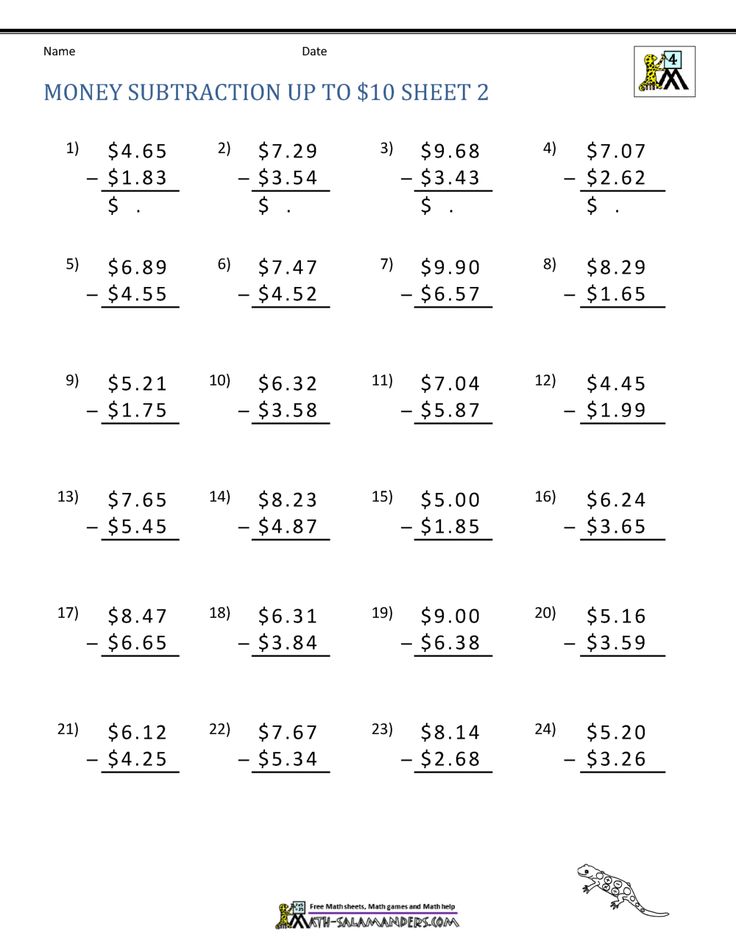

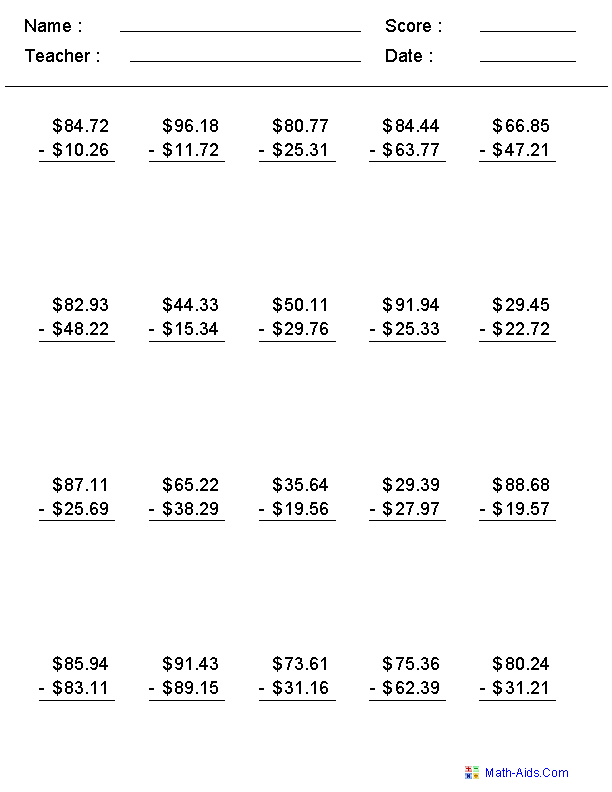

Here are key elements to consider when designing your subtract money worksheets:

- Visual Appeal: Use bright colors, engaging characters, and real-world scenarios to make the worksheets attractive to children.

- Varied Currency: Include various denominations and forms of currency (dollars, cents, euros, etc.) to provide a broad understanding.

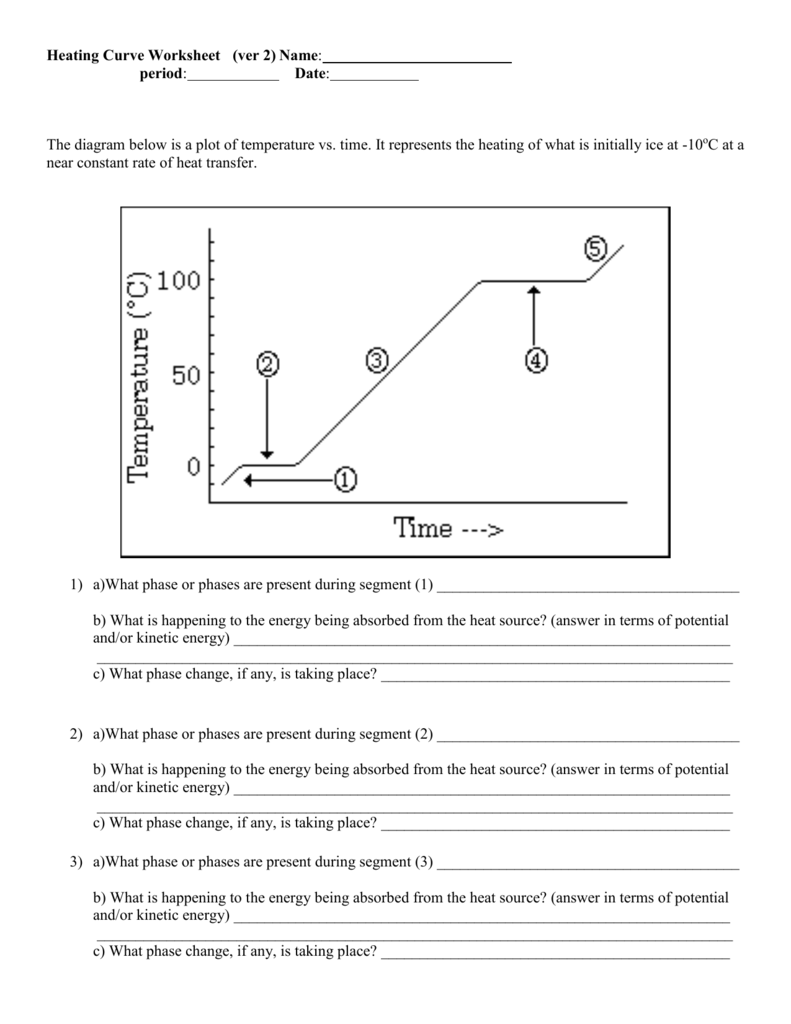

- Progression in Difficulty: Start with basic subtraction involving small amounts, then gradually introduce problems with larger numbers, decimals, and even currency conversion.

Examples of Engaging Problems

- "You have $20. You buy a toy for $15. How much money do you have left?"

- "You need to save $100 for a bicycle, but you already have $67. How much more do you need?"

🍎 Note: When creating problems, ensure they reflect real-life situations to maintain relevance.

Worksheet Structure

| Section | Description |

|---|---|

| Story Problems | Contextual problems where children subtract money to find the change or remaining amount. |

| Fill in the Blank | Children are given partial information and must fill in the missing amount. |

| Challenge Problems | Multi-step subtraction problems or those requiring currency conversion. |

Utilizing Worksheets Effectively

Here's how to ensure your subtract money worksheets are effectively incorporated into learning:

- Interactive Learning: Make the session interactive by letting children physically count out coins or use virtual currency on educational apps.

- Discussion and Explanation: After solving problems, encourage children to explain their thought processes, fostering critical thinking.

- Reward and Recognition: Use rewards or recognition systems to motivate continued engagement with money subtraction.

🌟 Note: Encourage collaboration between students to solve problems together, enhancing their social learning experience.

Enhancing Learning Beyond Worksheets

While worksheets are a fantastic tool, they should be supplemented with:

- Real-world Experience: Allow children to handle money during shopping trips or set up a mock store at home or in class.

- Educational Games: Leverage games that involve money management and subtraction to reinforce learning through play.

🎮 Note: Incorporating games makes learning math less intimidating and more enjoyable for kids.

Summing Up the Journey

In this exploration of money subtraction through educational worksheets, we've journeyed from the importance of this skill in everyday life to the practical steps for crafting engaging learning materials. By integrating visual appeal, real-world relevance, and varying levels of complexity into these worksheets, we foster an environment where financial literacy blooms. The use of interactive methods, like physical counting and virtual simulations, further enriches the learning experience, making money subtraction not just a math problem but a life skill. Through the consistent practice and exposure provided by these tools, children develop a profound understanding of how money works, preparing them for a lifetime of wise financial decisions.

What age is appropriate to start teaching money subtraction?

+

Children as young as 5 or 6 can start learning the basics of money subtraction through simple exercises involving small denominations of currency. However, the complexity of problems should increase with age and understanding.

How can I make money subtraction fun for kids?

+

Integrate games, role-playing activities like running a pretend store, or even using apps designed for financial literacy. Making it interactive and related to real-world scenarios boosts engagement and enjoyment.

Are there any online resources for money subtraction worksheets?

+

Numerous educational websites and platforms offer printable money subtraction worksheets. Look for reputable sites dedicated to education or financial literacy for children.