941x Worksheet Guide: Simplify Your Tax Filing

The tax season often brings with it a mix of confusion, frustration, and, for the luckiest among us, a dash of hopeful anticipation for a refund. However, it's easy to feel overwhelmed by the myriad of forms, deadlines, and intricate tax laws. This is where the IRS 941x worksheet becomes your ally. In this guide, we'll demystify the 941x worksheet, provide a step-by-step walkthrough, and help you file your taxes with confidence. Whether you're a small business owner or handling payroll, understanding how to amend Form 941 with Form 941x is critical for accurate tax reporting.

The Purpose and Importance of Form 941x

Form 941x is essential for correcting mistakes on previously filed Form 941s. Here’s why it’s crucial:

- Accuracy: Ensures your tax filings reflect true liabilities.

- Compliance: Keeps your records compliant with IRS regulations.

- Refunds: Allows you to claim additional credits or overpayments if you’ve underreported.

Who Needs to File Form 941x?

You’ll need to file Form 941x if:

- You’ve discovered an error on your original Form 941.

- You’ve over or underreported your tax liability.

- You need to adjust wage or withholding reports.

- You’ve claimed incorrect amounts of social security and Medicare taxes.

Step-by-Step Guide to Filing Form 941x

Let’s walk through the steps of how to file Form 941x:

1. Identify the Error

The first step is recognizing the error. This could be anything from reporting the wrong wage amounts to miscalculating tax liabilities. Common mistakes include:

- Incorrectly reported wages, tips, and other compensation.

- Inaccurate tax withheld.

- Errors in social security or Medicare taxes.

2. Gather Necessary Information

Before you begin filling out the form:

- Retrieve the original Form 941 you’re correcting.

- Have available any supporting documentation like payroll records, tax records, or any amended W-2s or W-3s.

3. Complete Form 941x

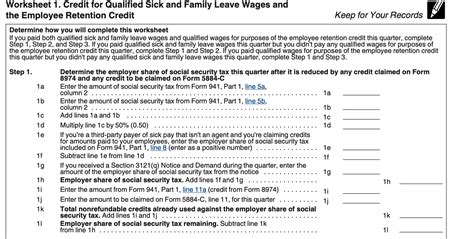

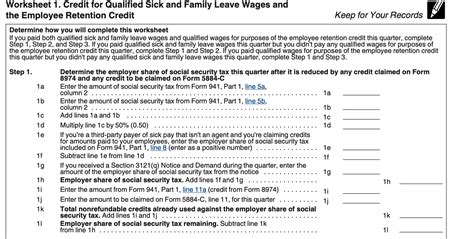

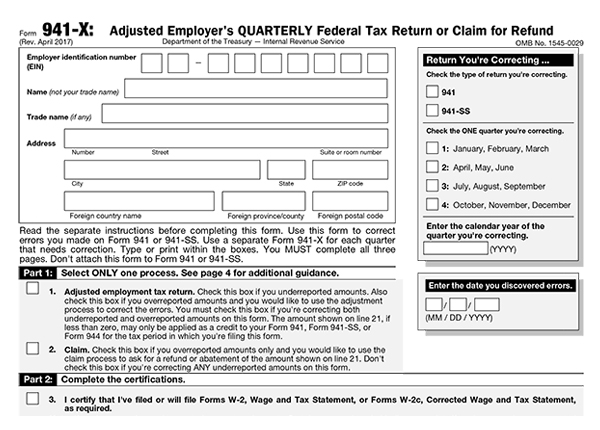

Here’s how to fill out Form 941x:

| Part | Section | Description |

|---|---|---|

| Top of Form | Enter your EIN, name, and address. | |

| Part 1 | 1-6 | Report the corrected amounts for various taxes. |

| Part 2 | 7-15 | Specify adjustments for adjustments for fractions of cents, sick pay, or credit for withholding from nonpayroll payments. |

| Part 3 | 16-21 | Provide the details of the adjustments made. |

| Part 4 | Sign the form and include the date and contact information. |

💡 Note: Make sure to use the most current version of Form 941x from the IRS website.

4. Calculate the Difference

Subtract your original amounts from the corrected amounts. If the corrected amount is less, you may be due a refund or reduced liability. If more, you owe additional tax.

5. File the Form

File Form 941x with the IRS:

- If you owe additional tax, pay it with your Form 941x.

- For refunds, expect a processing time, and the IRS may audit the claim.

6. Update Records

Ensure to:

- Update employee records if W-2s were issued incorrectly.

- Amend Form W-3 when necessary.

⚠️ Note: Once you file Form 941x, any Form 941 filed later for the same period must match the corrected numbers on your 941x.

Common Pitfalls to Avoid

To streamline your filing process, avoid these common errors:

- Failing to check for all errors or only correcting some errors.

- Not using the correct version of Form 941x.

- Missing signatures or missing important parts of the form.

- Incorrectly calculating the underpayment or overpayment.

Conclusion

Filing Form 941x can be straightforward with the right approach. Remember to:

- Identify errors early.

- Gather all necessary documents.

- Complete the form accurately.

- Calculate any tax differences correctly.

- File the form on time and update your records.

By following this guide, you can amend your Form 941 with confidence, ensuring that your tax filings are accurate, compliant, and reflective of your true tax liabilities.

What is the deadline for filing Form 941x?

+

There is no specific deadline for filing Form 941x, but it should be submitted as soon as possible after the error is discovered. However, you must still pay any additional tax owed or claim any refund within the statute of limitations, typically within three years from the date the original Form 941 was filed.

Can I file Form 941x electronically?

+

Currently, Form 941x must be mailed to the IRS as there is no provision for e-filing this form.

What happens if I file an incorrect Form 941x?

+

If an error is found in your Form 941x, the IRS will contact you for clarification or corrections. You may need to submit a revised Form 941x, and potentially face penalties if errors lead to underpayment of taxes.

Can I amend Form 941x more than once?

+Yes, you can file a second Form 941x if more errors are found after the initial amendment.