5 Essential Tips for Your Wisconsin Garnishment Exemption Worksheet

Wisconsin Garnishment Exemption Worksheet Overview

Dealing with wage garnishment can be a stressful experience. If you’re facing this situation in Wisconsin, understanding and properly filling out your Garnishment Exemption Worksheet can significantly impact your financial stability. This guide will provide you with essential tips to navigate through the process, ensuring you claim your rightful exemptions effectively.

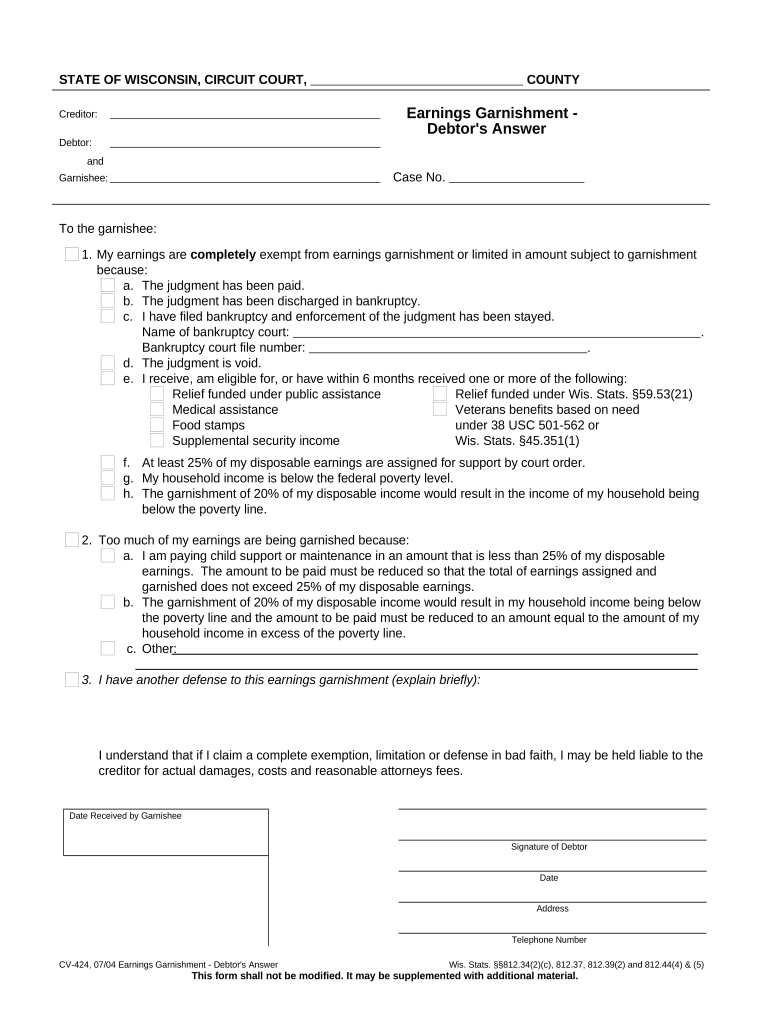

1. Understand Your Rights

In Wisconsin, certain portions of your income are protected from garnishment under state and federal laws. Here’s what you need to know:

- Federal Limits: 25% of disposable income after taxes or the amount over 30 times the federal minimum wage, whichever is less.

- Wisconsin Limits: For weekly wages, 10% up to 45 times the federal minimum hourly wage; for bi-weekly or monthly wages, 10% up to 45 times the federal minimum wage multiplied by the number of weeks in the pay period.

Remember, these exemptions are there to ensure you have enough money to meet basic living expenses.

2. Gather Necessary Documentation

Before filling out your Garnishment Exemption Worksheet, gather the following documents:

- Recent pay stubs

- Information on all income sources

- List of expenses (rent/mortgage, utilities, food, transportation, medical expenses, etc.)

- Any proof of dependency (children, elderly parents, etc.)

- Your wage garnishment order

3. Calculate Your Exemptions

Using your pay stubs and the Garnishment Exemption Worksheet, calculate your exempt income:

- Determine your disposable income. This is your take-home pay after taxes and deductions required by law.

- Apply the 10% rule if your pay period is weekly or bi-weekly.

- If your disposable income is less than 45 times the federal minimum wage, no garnishment can be applied.

- For higher incomes, 10% of your disposable income up to 45 times the federal minimum wage is exempt.

| Pay Frequency | Exemption Formula |

|---|---|

| Weekly | 10% of disposable income, up to 45 times the federal minimum wage |

| Bi-weekly | 10% of disposable income, up to 90 times the federal minimum wage |

| Monthly | 10% of disposable income, up to 180 times the federal minimum wage |

⚠️ Note: Always double-check calculations to ensure accuracy.

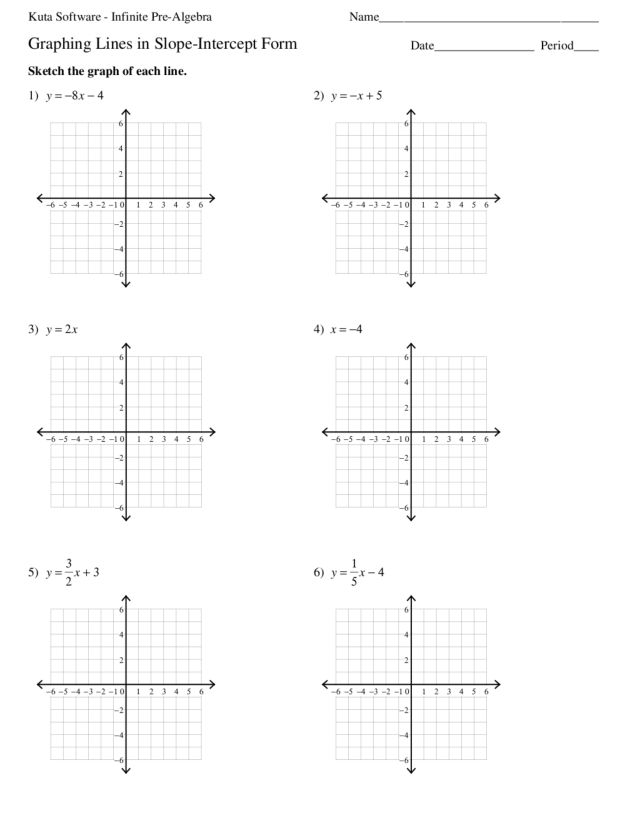

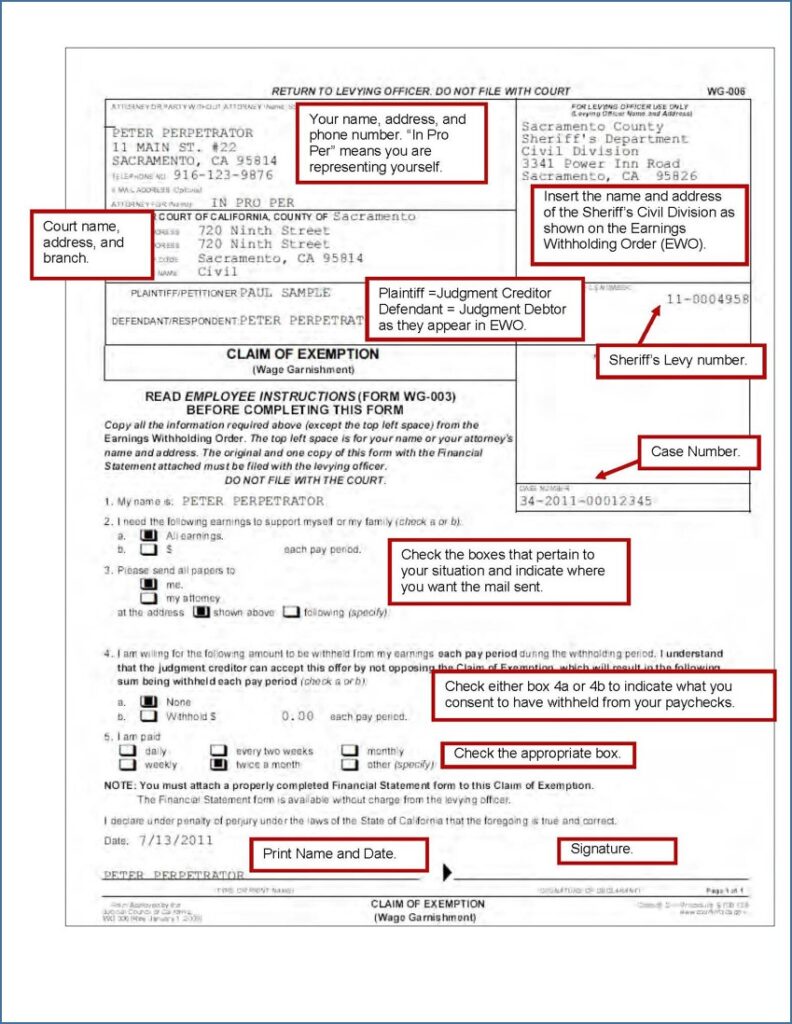

4. Fill Out the Worksheet Correctly

The Garnishment Exemption Worksheet can be complex. Here are some tips for accuracy:

- Use clear, legible handwriting or type the information.

- Read instructions carefully, filling in every section relevant to your situation.

- List all income sources including Social Security, child support, etc., as some are exempt from garnishment.

- Include all expenses to demonstrate your financial need for the exemptions.

- Ensure all numbers and calculations are correct. Mistakes can lead to unnecessary garnishment.

5. Seek Professional Help

If you find the process overwhelming or if you have specific financial or legal issues, seeking help from a:

- Consumer Credit Counseling Service: They can help with budgeting and possibly negotiating payment plans with creditors.

- Attorney: A lawyer specializing in wage garnishment can provide legal advice, represent you in court, or help with exemption calculations.

These professionals can make the process smoother and ensure you receive all entitled exemptions.

In this intricate scenario of wage garnishment, your approach to the Garnishment Exemption Worksheet in Wisconsin is key to managing your finances. Understanding your rights, accurately calculating your exemptions, and seeking professional help when necessary are vital steps in this process. This effort can mean the difference between maintaining your financial stability or facing undue hardship. Remember, you are not alone in this, and resources are available to assist you every step of the way.

What if my income changes?

+

If your income fluctuates or changes, you should re-evaluate your garnishment exemptions and update your Garnishment Exemption Worksheet accordingly. This ensures that your exemptions are based on current financial conditions.

Can I claim more than one exemption?

+

Yes, if you qualify for multiple types of exemptions, such as child support, public benefits, or other legal protections, you can list them on your worksheet. However, ensure each claim is backed by relevant documentation.

What happens if my employer makes a mistake?

+

If your employer garnishes more than the allowed amount due to an error, you have the right to contest this action. Document the error, communicate with your employer, and seek legal advice if necessary to rectify the situation.