5 Ways Fix Funding

Introduction to Funding Challenges

In the world of business and entrepreneurship, one of the most significant hurdles that individuals and companies face is securing adequate funding. Whether you’re launching a startup, expanding an existing operation, or simply trying to keep your business afloat during tough economic times, having access to sufficient capital is crucial. However, the process of obtaining funding can be complex, time-consuming, and often daunting. This is where understanding the various ways to fix funding issues becomes essential.

Understanding Funding Challenges

Before diving into solutions, it’s vital to grasp the nature of funding challenges. These can range from lack of personal savings, insufficient credit history, to inability to attract investors. Each of these challenges requires a unique approach, and there’s no one-size-fits-all solution. However, by assessing your financial situation, building a strong business plan, and exploring various funding options, you can significantly improve your chances of securing the funds you need.

5 Ways to Fix Funding Issues

Here are five strategies that can help address funding challenges:

Bootstrap Your Business: Bootstrapping involves using your own savings or revenue from early customers to fund your business. This approach allows you to maintain control and avoid debt, but it can limit your growth potential. Key considerations include:

- Starting small and scaling up gradually.

- Being extremely frugal with your expenses.

- Focusing on generating revenue as quickly as possible.

Crowdfunding: Platforms like Kickstarter, Indiegogo, and GoFundMe have made it possible to raise funds from a large number of people, typically in exchange for rewards or equity. Success in crowdfunding depends on:

- Having a compelling project or product.

- Creating an engaging campaign.

- Promoting your campaign effectively through social media and other channels.

Seek Venture Capital or Angel Investors: These investors provide capital in exchange for equity in your business. They can offer valuable guidance and networking opportunities but require a solid business plan and significant growth potential. Key steps include:

- Researching potential investors and understanding their interests.

- Preparing a persuasive pitch and detailed business plan.

- Negotiating terms that align with your vision and goals.

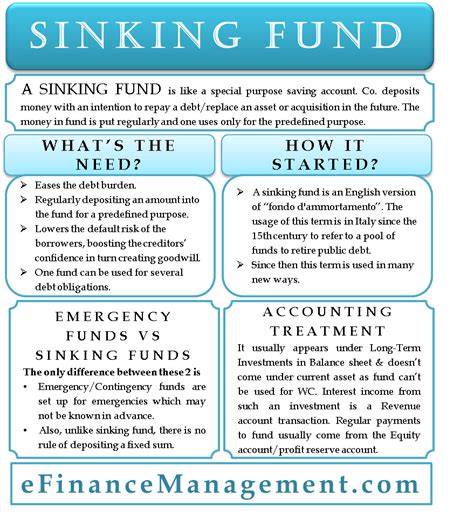

Apply for Small Business Loans: Traditional loans from banks or alternative lenders can provide necessary funding, but they often require a good credit score, collateral, or a guarantee. Consider:

- Improving your credit score before applying.

- Exploring government-backed loans for favorable terms.

- Carefully reviewing loan terms to ensure they’re manageable.

Consider Incubators and Accelerators: These programs offer resources, mentorship, and sometimes funding in exchange for equity. They can be highly competitive but provide valuable support for early-stage companies. Look for:

- Programs that align with your business sector or stage.

- Opportunities for networking and learning from experienced mentors.

- Clear understanding of the terms, including equity requirements.

Implementing Funding Solutions

Implementing these strategies requires patience, persistence, and a willingness to adapt. Building a strong network, staying agile, and continuously learning are essential for navigating the funding landscape. Moreover, being open to feedback and willing to pivot your approach when necessary can significantly enhance your chances of success.

Funding and Growth

Securing funding is not a one-time achievement but rather a continuous process, especially for growing businesses. As your company evolves, so do your funding needs. Continuous financial planning, monitoring cash flow, and strategically seeking additional funding when necessary are crucial for sustained growth and success.

💡 Note: Always review the terms and conditions of any funding option carefully to ensure they align with your business goals and financial situation.

In summary, addressing funding challenges requires a combination of strategic planning, adaptability, and a deep understanding of the various funding options available. By leveraging these strategies and maintaining a proactive approach to financial management, businesses can overcome funding hurdles and set themselves up for long-term success.

What are the most common funding challenges faced by startups?

+

The most common funding challenges include lack of personal savings, insufficient credit history, and inability to attract investors. Each of these challenges requires a tailored approach to overcome.

How do I choose the right funding option for my business?

+

Choosing the right funding option depends on your business stage, growth potential, financial situation, and personal preferences. Consider factors like control, debt, potential for growth, and the terms of the funding option.

What role does a business plan play in securing funding?

+

A business plan is crucial as it outlines your business model, market analysis, financial projections, and growth strategy. It serves as a roadmap for your business and is often required by investors and lenders to assess the viability and potential of your business.