5 Ways Georgia Pay

Introduction to Georgia Pay

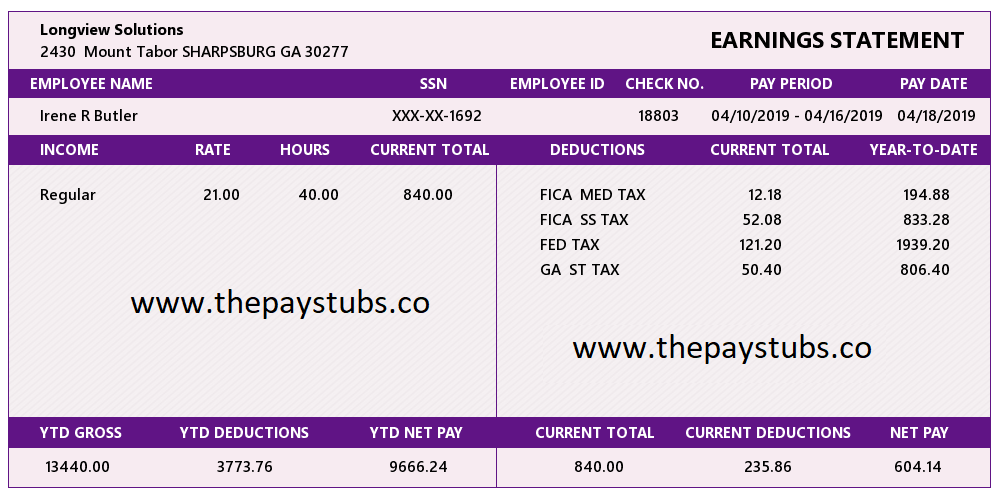

Georgia pay, also known as the pay stub or paycheck stub, is a document that shows the details of an employee’s pay, including their gross pay, deductions, and net pay. It is usually provided by the employer to the employee along with their paycheck. The Georgia pay stub is an important document that helps employees keep track of their income and expenses.

Understanding the Components of a Georgia Pay Stub

A typical Georgia pay stub includes the following components: * Gross pay: The total amount of money earned by the employee before any deductions. * Deductions: The amount of money withheld from the employee’s paycheck for taxes, insurance, and other purposes. * Net pay: The amount of money the employee takes home after all deductions have been made. * Pay period: The period of time for which the employee is being paid. * Pay date: The date on which the employee receives their paycheck.

5 Ways to Obtain a Georgia Pay Stub

There are several ways to obtain a Georgia pay stub, including: * Online payroll portal: Many employers provide an online payroll portal where employees can access their pay stubs and other payroll information. * HR department: Employees can contact their HR department to request a copy of their pay stub. * Payroll provider: Some employers use a payroll provider to manage their payroll, and employees can contact the payroll provider to obtain a copy of their pay stub. * Mail: Employees can request that their pay stub be mailed to them. * In-person pickup: Employees can pick up their pay stub in person from their employer or HR department.

Benefits of Electronic Georgia Pay Stubs

Electronic Georgia pay stubs offer several benefits, including: * Convenience: Employees can access their pay stubs from anywhere with an internet connection. * Environmentally friendly: Electronic pay stubs reduce the need for paper and ink. * Increased security: Electronic pay stubs are less likely to be lost or stolen. * Easy storage: Electronic pay stubs can be easily stored and accessed for future reference.

Georgia Pay Stub Laws

Georgia law requires employers to provide employees with a pay stub that includes certain information, including: * Gross pay * Net pay * Deductions * Pay period * Pay date Employers who fail to provide employees with a pay stub that includes this information may be subject to penalties and fines.

💡 Note: Employers must also keep records of employee pay stubs for a certain period of time, as required by law.

Creating a Georgia Pay Stub

To create a Georgia pay stub, employers will need to gather certain information, including: * Employee name and address * Employee social security number * Gross pay * Deductions * Net pay * Pay period * Pay date Employers can use a template or software to create a Georgia pay stub that includes all of the required information.

| Component | Description |

|---|---|

| Gross pay | The total amount of money earned by the employee before any deductions. |

| Deductions | The amount of money withheld from the employee's paycheck for taxes, insurance, and other purposes. |

| Net pay | The amount of money the employee takes home after all deductions have been made. |

As we come to the end of this discussion on Georgia pay, it’s clear that understanding the components and laws surrounding pay stubs is crucial for both employers and employees. By following the guidelines outlined above, employers can ensure they are providing their employees with accurate and timely pay stubs, while employees can better manage their finances and keep track of their income.

What is a Georgia pay stub?

+

A Georgia pay stub is a document that shows the details of an employee’s pay, including their gross pay, deductions, and net pay.

How do I obtain a Georgia pay stub?

+

There are several ways to obtain a Georgia pay stub, including online payroll portal, HR department, payroll provider, mail, and in-person pickup.

What are the benefits of electronic Georgia pay stubs?

+

Electronic Georgia pay stubs offer several benefits, including convenience, environmentally friendly, increased security, and easy storage.