-

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

Maximize Your Savings with Qualified Dividends Tax Guide

This worksheet helps determine the tax on qualified dividends and long-term capital gains, providing a method to calculate taxes separately from other income, ensuring accurate tax liability.

Read More » -

5 Smart Moves for 401k and Roth IRA Funding

A practical guide offering step-by-step instructions and considerations for funding both 401(k)s and Roth IRAs, including contribution limits, tax benefits, and strategic planning tips for optimizing retirement savings.

Read More » -

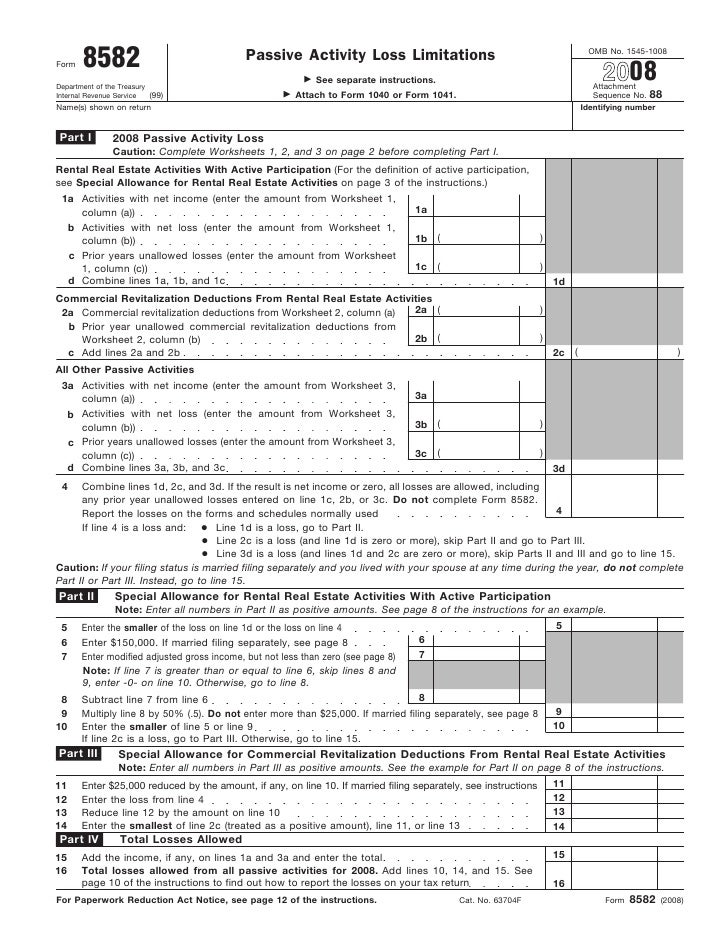

5 Tips to Complete Form 8582 Worksheet Easily

A guide detailing how to complete Form 8582, which is used by individuals, estates, and trusts to calculate the amount of passive activity losses they can claim against income.

Read More »