5 Smart Moves for 401k and Roth IRA Funding

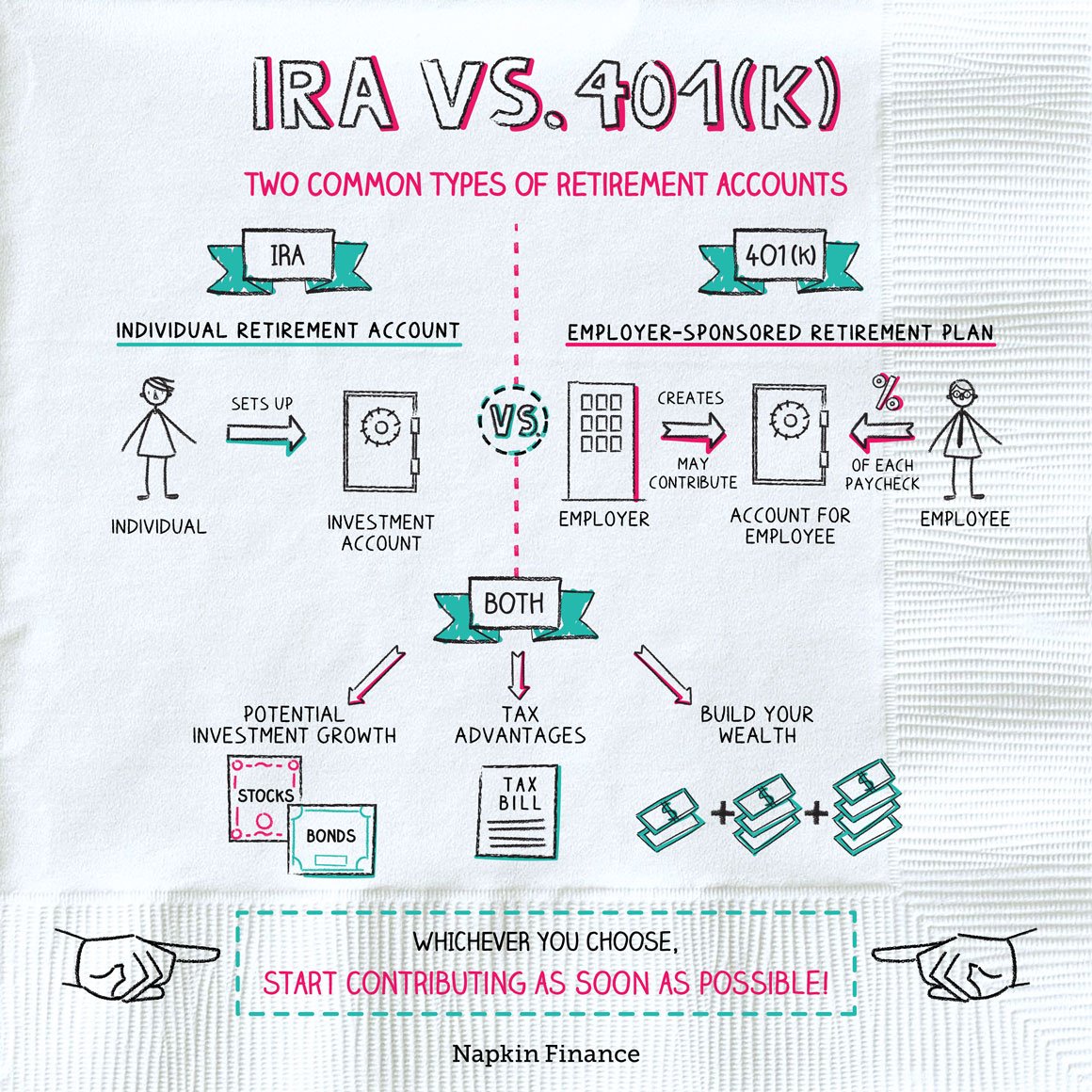

Retirement might seem like a distant concept for many, but it's an important aspect of financial planning that requires immediate attention. Funding your retirement through mechanisms like a 401(k) and Roth IRA offers tax advantages, investment growth, and potential for a comfortable future. Here are five smart strategies to maximize your contributions and benefits from these retirement accounts.

1. Understand Contribution Limits and Make Use of Them

One of the first steps in managing your 401(k) or Roth IRA is to understand the contribution limits for each year:

- In 2023, the maximum employee contribution to a 401(k) is 22,500.</li> <li>If you're 50 or older, you can make an additional catch-up contribution of 7,500, bringing the total to 30,000.</li> <li>For a Roth IRA, the contribution limit is 6,500, with an additional 1,000 catch-up for those over 50, totaling 7,500.

Maximizing these contributions early in your career can significantly increase your retirement nest egg due to compound interest over time.

⚠️ Note: Contribution limits are subject to change annually, so always check the latest IRS guidelines.

2. Take Advantage of Employer Match Programs

Many employers offer a match to your 401(k) contributions, which is essentially free money:

- Typically, an employer will match a percentage of what you contribute, often up to 6% of your salary.

- Not contributing enough to get the full match is like leaving money on the table.

| Your Contribution | Employer Match | Total Contribution |

|---|---|---|

| 5,000</td> <td>2,500 | 7,500</td> </tr> <tr> <td>3,000 | 1,500</td> <td>4,500 |

Make sure you contribute at least enough to receive the full employer match.

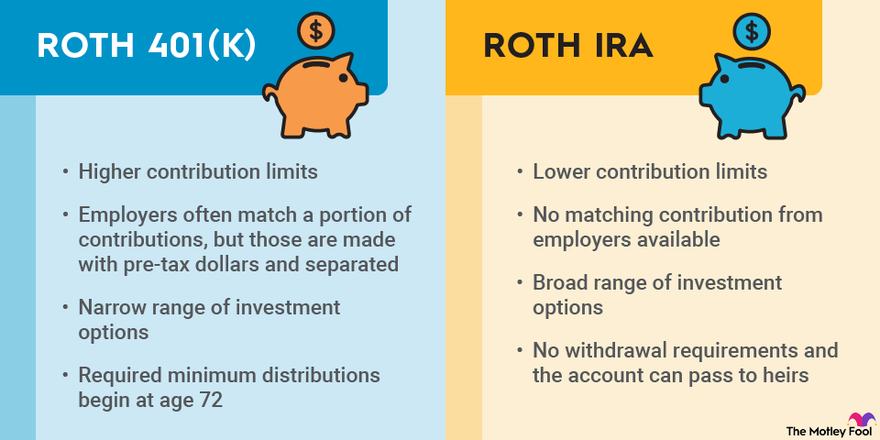

3. Consider a Roth Conversion

If you have a traditional IRA, you might consider converting it to a Roth IRA:

- Converting can provide tax-free withdrawals in retirement if done correctly.

- The tax on the converted amount is paid upfront, allowing for tax-free growth and qualified withdrawals.

However, consider your current tax bracket and future tax expectations before making this decision.

4. Automate Your Savings

Automation is key to disciplined saving:

- Set up automatic contributions from your paycheck or bank account into your 401(k) or Roth IRA.

- This ensures you save regularly without having to think about it, leveraging the power of dollar-cost averaging.

Automating your savings helps you build a habit and takes the decision-making out of the equation.

5. Diversify Your Portfolio

Diversification reduces risk by spreading investments across various assets:

- Within your 401(k) or Roth IRA, consider a mix of stocks, bonds, ETFs, and possibly real estate investment trusts (REITs).

- Reassess your risk tolerance and investment goals periodically.

Remember, not putting all your financial eggs in one basket can lead to a more stable and potentially rewarding retirement.

In summary, maximizing your 401(k) and Roth IRA contributions involves understanding and leveraging annual limits, ensuring you get employer matches, potentially converting to Roth, automating your savings, and diversifying your investment portfolio. By focusing on these strategies, you can work towards a financially secure retirement with less stress and more peace of mind.

What is the difference between a Roth IRA and a traditional IRA?

+

The primary difference lies in tax treatment. Contributions to a Roth IRA are made with after-tax dollars, allowing for tax-free growth and qualified withdrawals in retirement. Conversely, traditional IRAs provide a tax deduction for contributions, with taxes paid on withdrawals.

Can I contribute to both a 401(k) and a Roth IRA?

+

Yes, you can contribute to both, but there are income limits for Roth IRA contributions if you have a workplace retirement plan like a 401(k). The IRS sets these limits annually.

Is it better to invest in a Roth IRA early or later in life?

+

Generally, contributing to a Roth IRA early in your career is advantageous due to the longer period for tax-free growth. However, if you expect to be in a lower tax bracket during retirement, or if tax rates increase, a Roth might also make sense later on.