5 Steps to Fill Out Social Security Benefits Worksheet

In the realm of retirement planning, understanding and correctly filling out the Social Security Benefits Worksheet can be a pivotal step towards securing your financial future. This worksheet helps estimate your monthly benefits from the Social Security Administration (SSA) upon retirement. In this comprehensive guide, we'll walk you through five crucial steps to complete this worksheet accurately, ensuring that you can optimize your benefits and avoid common pitfalls.

The Importance of Understanding Social Security Benefits

Before diving into the steps, it's important to grasp why the Social Security Benefits Worksheet is significant:

- Retirement Planning: Accurate estimations help plan your retirement income.

- Informed Decisions: Knowing your benefits helps in making informed decisions about when to retire.

- Optimizing Benefits: Understanding how factors like work history, age at retirement, and other income affect your benefits.

Step 1: Collect Your Work History

The foundation of your Social Security benefits calculation lies in your work history. Here’s how to compile it:

- Retrieve Old Tax Records: Look through your old tax returns or contact the IRS for records if you've misplaced them.

- Check Social Security Statements: Review your annual Social Security Statement sent by SSA for an overview of your earnings history.

- Verify Your Employment Records: Ensure all your employment records are accurate with SSA.

📘 Note: Your Social Security benefits are based on your 35 highest-earning years, adjusted for inflation. If you've worked less than 35 years, zeros will be added for each year below the 35-year threshold, potentially lowering your benefit.

Step 2: Determine Your Primary Insurance Amount (PIA)

The Primary Insurance Amount (PIA) is your basic monthly benefit at full retirement age (FRA). To calculate this:

- Identify your Average Indexed Monthly Earnings (AIME) from your work history.

- Apply the SSA's formula to determine your PIA based on AIME. Here is the simplified version:

| AIME Percentage | Benefit Factor |

|---|---|

| 0-20% of AIME | 90% |

| Next 30% of AIME | 32% |

| Any amount above 50% of AIME | 15% |

The resulting PIA gives you the foundation for further adjustments.

Step 3: Adjust Your Benefits for Early or Delayed Retirement

Your retirement age significantly impacts your monthly benefits:

- Early Retirement: If you retire before your FRA, your benefits are reduced by a specific percentage for each month you receive benefits before reaching your FRA.

- Delayed Retirement: For each year you delay retirement past your FRA up to age 70, your benefits increase by approximately 8% per year.

Step 4: Factor in Spousal and Survivor Benefits

If applicable, consider spousal or survivor benefits in your worksheet:

- Spousal Benefits: If married, your spouse can receive up to 50% of your PIA if they have not worked or have lower earnings.

- Survivor Benefits: After the death of one spouse, the survivor may be eligible for 100% of the deceased's benefit if it’s higher than their own.

📌 Note: Choosing to start taking spousal benefits early can reduce the survivor benefits later. Planning with this in mind is crucial.

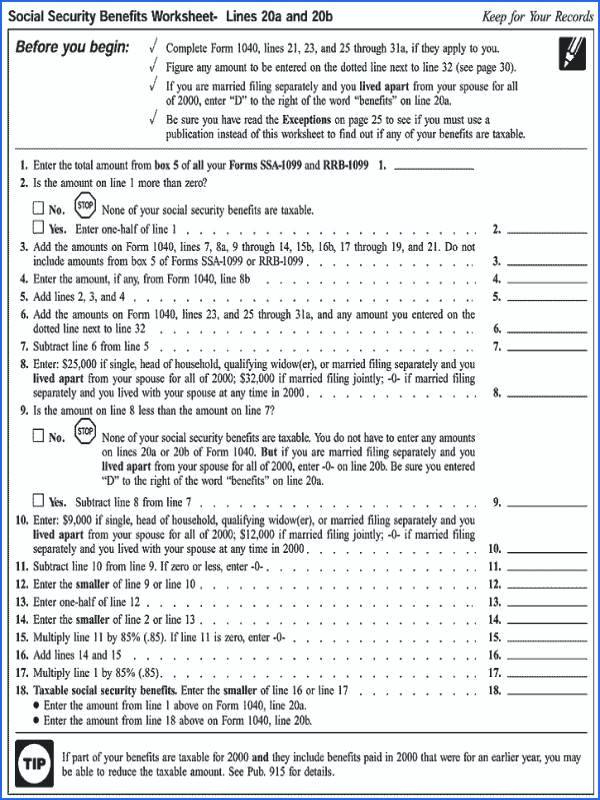

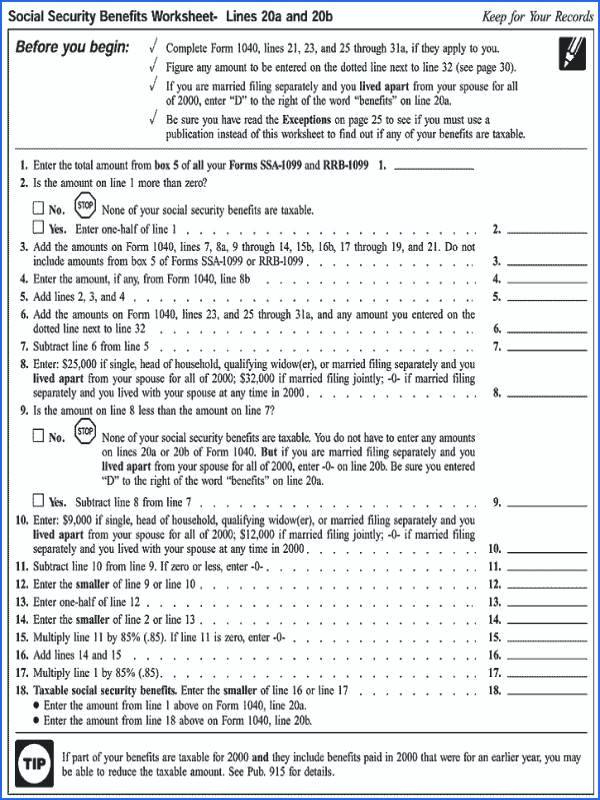

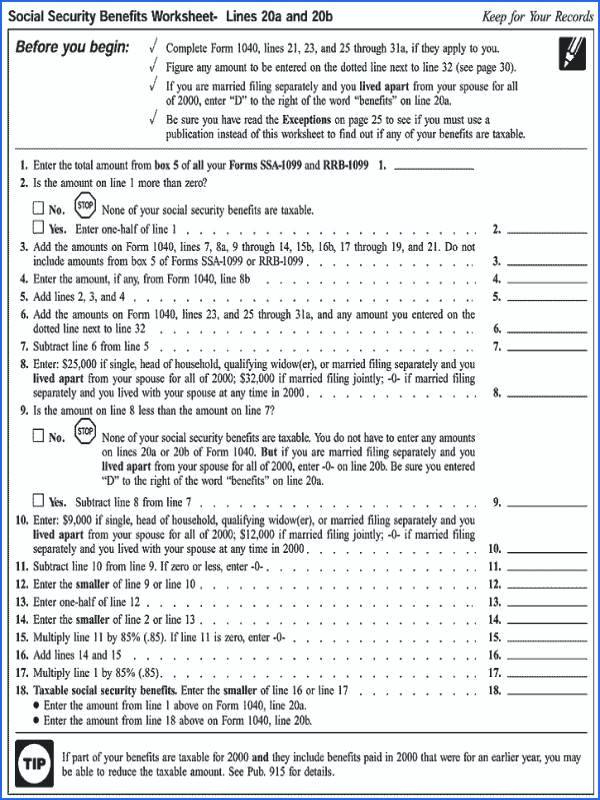

Step 5: Review and Adjust for Other Income and Taxes

Social Security benefits can be subject to federal income taxes:

- Combined Income: Up to 85% of your benefits may be taxable if your "combined income" exceeds certain thresholds.

- Adjust Benefits: Factor in potential tax liabilities when estimating your net benefits.

After calculating the initial figures, review your entire financial landscape to ensure you’ve considered:

- Any pensions or retirement accounts (401(k), IRAs, etc.)

- Part-time work or other income streams

- The potential for cost-of-living adjustments (COLAs) to your benefits

Having gone through these detailed steps, you should now have a clearer picture of your Social Security benefits. This understanding allows you to plan better, whether to continue working, delay retirement, or claim benefits at different points in time. The key is to ensure that the data you provide is accurate, and you understand how different elements like age, work history, and spousal benefits interplay to affect your retirement income.

How do I estimate my Social Security benefits if I am self-employed?

+

If you’re self-employed, you’ll need to ensure you’ve paid into Social Security through self-employment tax. Your benefits are calculated similarly to employees, but your contributions include both the employee and employer portions of Social Security taxes.

What happens if I have less than 35 years of earnings?

+

If you’ve worked less than 35 years, zeros will be factored in for the missing years, potentially reducing your AIME and, consequently, your PIA. Continuing to work past 35 years can replace lower-earning or zero-earning years with higher earnings to increase your benefits.

Can I work and receive Social Security benefits at the same time?

+

Yes, you can work while receiving benefits, but if you’re under your full retirement age, your benefits may be temporarily reduced by 1 for every 2 earned above an annual limit. After reaching your FRA, this limit disappears.