-

5 Tips to Maximize Your Social Security Tax Benefits

This article explains how to use the Social Security Taxable Benefits Worksheet to determine the taxable portion of your Social Security benefits, assisting readers in understanding their tax obligations and preparing for tax filing.

Read More » -

Maximize Your Refund with California EITC Worksheet

A guide to help California residents determine their eligibility and calculate the potential tax credit they can receive through the state's Earned Income Tax Credit (CalEITC) program.

Read More » -

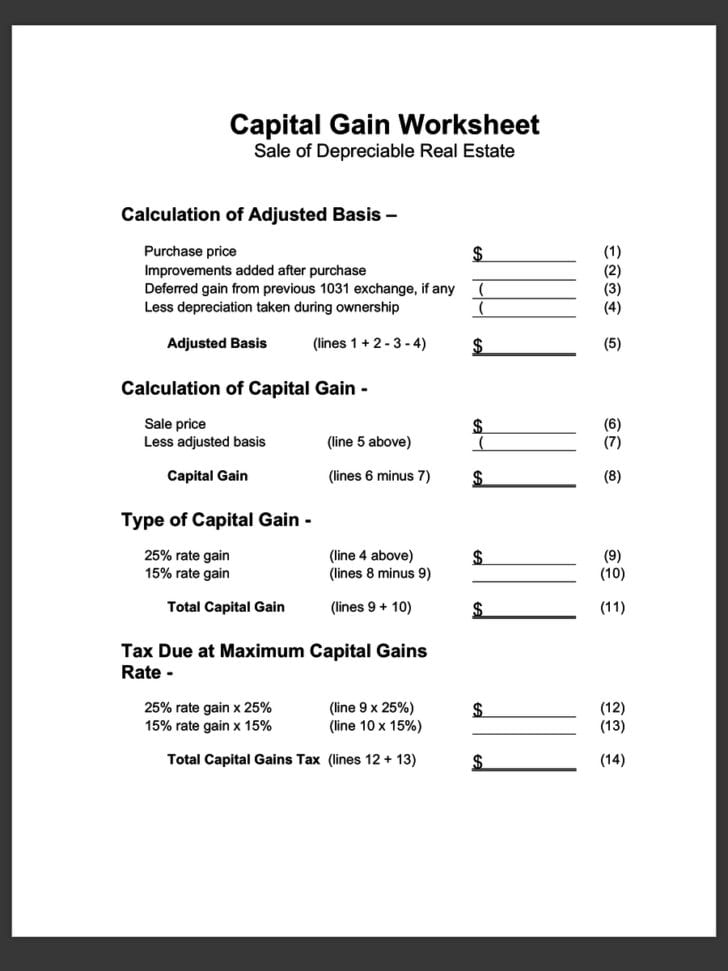

Mastering the 1031 Exchange: Your Essential Worksheet Guide

A guide providing tools and tips for managing Section 1031 tax-deferred exchanges, including a worksheet for calculations.

Read More » -

5 Iowa Social Security Tax Tips for Retirees

This article explains how to use the Iowa Social Security Worksheet to determine if your social security benefits are taxable on your Iowa state income tax return.

Read More » -

5 Essential Tips for Completing Your IT-2104 Worksheet

The IT-2104 form is used by New York State employees to estimate their withholding allowances for state income tax, influencing the amount of tax withheld from their paychecks. Understanding this worksheet helps in determining the correct withholding amount to avoid overpaying or underpaying taxes throughout the year.

Read More »