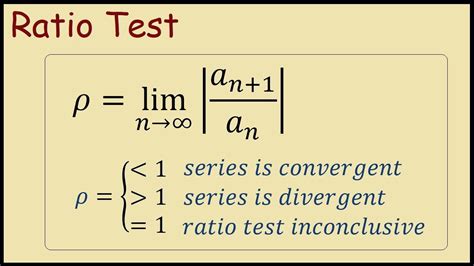

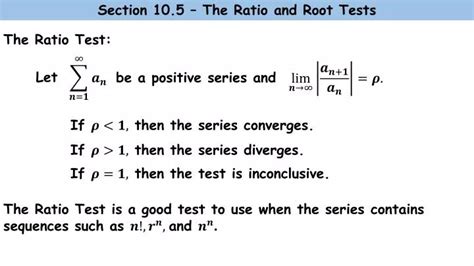

5 Ratio Test Conditions

Understanding the 5 Ratio Test Conditions

The 5 Ratio Test Conditions are a set of criteria used to evaluate the creditworthiness of a borrower. These conditions are crucial in determining whether a borrower can repay a loan. In this article, we will delve into the details of the 5 Ratio Test Conditions, exploring each condition and its significance in the lending process.

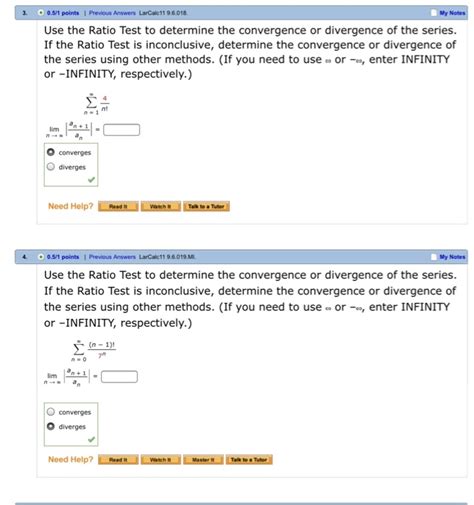

Condition 1: Debt-to-Income Ratio

The debt-to-income ratio is a critical factor in determining a borrower’s creditworthiness. This ratio calculates the percentage of a borrower’s monthly gross income that goes towards paying debts. Lenders typically prefer a debt-to-income ratio of 36% or less. A higher ratio may indicate that a borrower is over-extending themselves and may struggle to repay the loan.

Condition 2: Credit Score

A borrower’s credit score is a three-digit number that represents their credit history. Credit scores range from 300 to 850, with higher scores indicating better credit. Lenders use credit scores to evaluate the likelihood of a borrower repaying a loan. A good credit score can help borrowers qualify for better loan terms, including lower interest rates.

Condition 3: Loan-to-Value Ratio

The loan-to-value ratio calculates the percentage of a loan amount compared to the value of the collateral. For example, if a borrower is applying for a 100,000 loan</i> to purchase a <i>150,000 property, the loan-to-value ratio would be 66.67%. Lenders typically prefer a loan-to-value ratio of 80% or less, as this indicates that the borrower has a significant stake in the property.

Condition 4: Debt Service Ratio

The debt service ratio calculates the percentage of a borrower’s monthly gross income that goes towards paying debts, including the proposed loan. This ratio helps lenders evaluate whether a borrower can afford the loan payments. A debt service ratio of 43% or less is generally considered acceptable.

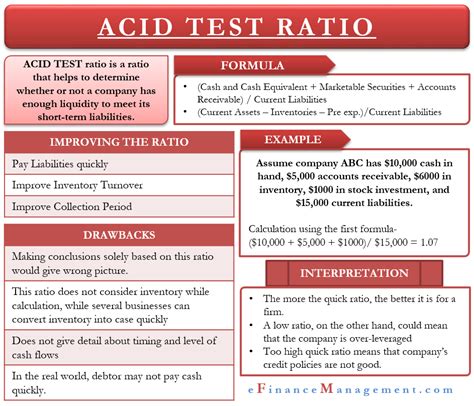

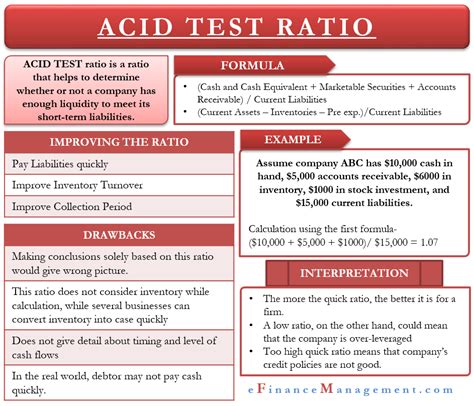

Condition 5: Cash Flow Ratio

The cash flow ratio calculates a borrower’s ability to generate cash to service their debts. This ratio is particularly important for self-employed borrowers or those with irregular income. A cash flow ratio of 1.25 or higher indicates that a borrower has sufficient cash flow to service their debts.

📝 Note: These conditions may vary depending on the lender and the type of loan. Borrowers should review the specific requirements with their lender to ensure they meet the necessary criteria.

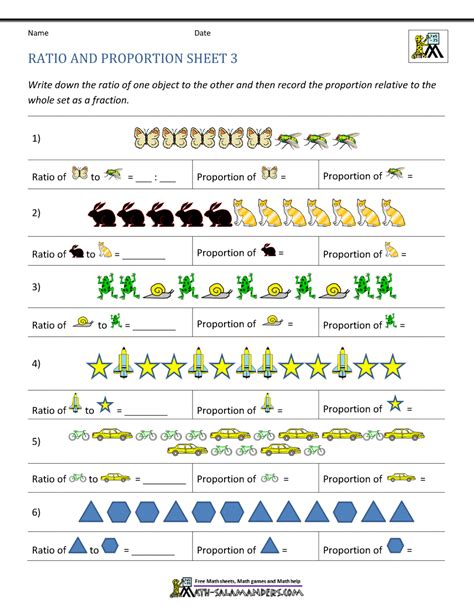

To illustrate the 5 Ratio Test Conditions, consider the following example:

| Condition | Calculation | Acceptable Ratio |

|---|---|---|

| Debt-to-Income Ratio | Monthly debts / Monthly gross income | 36% or less |

| Credit Score | Credit score | 700 or higher |

| Loan-to-Value Ratio | Loan amount / Property value | 80% or less |

| Debt Service Ratio | Monthly debts / Monthly gross income | 43% or less |

| Cash Flow Ratio | Cash flow / Debt service | 1.25 or higher |

In summary, the 5 Ratio Test Conditions are essential in evaluating a borrower’s creditworthiness. By understanding these conditions, borrowers can better prepare themselves for the loan application process and increase their chances of securing a loan with favorable terms. Ultimately, meeting these conditions demonstrates a borrower’s ability to manage their debt and repay the loan, making them a more attractive candidate for lenders.

What is the debt-to-income ratio, and why is it important?

+

The debt-to-income ratio calculates the percentage of a borrower’s monthly gross income that goes towards paying debts. This ratio is important because it helps lenders evaluate whether a borrower can afford the loan payments.

How does credit score affect the loan application process?

+

A good credit score can help borrowers qualify for better loan terms, including lower interest rates. A poor credit score, on the other hand, may lead to higher interest rates or loan rejection.

What is the loan-to-value ratio, and why is it significant?

+

The loan-to-value ratio calculates the percentage of a loan amount compared to the value of the collateral. This ratio is significant because it helps lenders evaluate the risk of lending and determine the loan amount.