5 Kansas Payroll Tips

Understanding Kansas Payroll: An Overview

When it comes to managing payroll in Kansas, there are several factors to consider to ensure compliance with state and federal regulations. From calculating payroll taxes to understanding labor laws, the process can be complex and time-consuming. In this article, we will provide 5 Kansas payroll tips to help businesses navigate the process with ease.

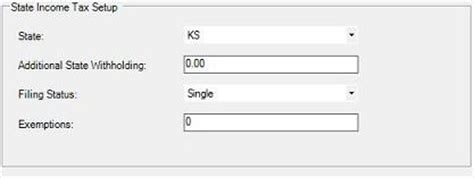

Tip 1: Calculate Payroll Taxes Accurately

Calculating payroll taxes is a crucial step in the payroll process. In Kansas, employers are required to withhold state income taxes from employee wages. The state income tax rate in Kansas ranges from 3.1% to 5.2%, depending on the employee’s income level. Employers must also withhold federal income taxes and pay Social Security and Medicare taxes. To calculate payroll taxes accurately, employers can use the following formula: - Calculate the employee’s gross income - Determine the employee’s tax filing status and number of allowances - Calculate the state and federal income tax withholdings - Calculate the Social Security and Medicare tax withholdings

Tip 2: Comply with Labor Laws

Kansas labor laws require employers to pay employees at least minimum wage, which is currently $7.25 per hour. Employers must also comply with overtime laws, which require paying employees 1.5 times their regular rate for hours worked over 40 in a workweek. Additionally, employers must provide employees with unpaid breaks and meal periods, as required by law.

Tip 3: Understand Payroll Scheduling

Payroll scheduling is an important aspect of managing payroll in Kansas. Employers must decide on a payroll schedule that works best for their business, whether it’s bi-weekly, semi-monthly, or monthly. The payroll schedule will determine when employees are paid and when payroll taxes are due. Employers must also consider payroll deadlines, such as the deadline for filing payroll tax returns and making tax payments.

Tip 4: Keep Accurate Payroll Records

Keeping accurate payroll records is essential for complying with state and federal regulations. Employers must maintain records of employee wages, taxes, and benefits, as well as payroll tax returns and payments. The following are some key payroll records that employers must keep: * Employee wages and hours worked * Payroll tax returns and payments * Employee benefits, such as health insurance and retirement plans * Worker’s compensation records

Tip 5: Consider Outsourcing Payroll

Outsourcing payroll can be a cost-effective and efficient way to manage payroll in Kansas. By outsourcing payroll, employers can avoid the time-consuming and complex process of calculating payroll taxes and complying with labor laws. Additionally, outsourcing payroll can help reduce the risk of payroll errors and penalties. When considering outsourcing payroll, employers should look for a reputable payroll provider that offers accurate and reliable payroll services.

📝 Note: Employers must ensure that their payroll provider is compliant with state and federal regulations, including the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA).

In summary, managing payroll in Kansas requires attention to detail and compliance with state and federal regulations. By following these 5 Kansas payroll tips, employers can ensure accurate and efficient payroll processing, reduce the risk of payroll errors and penalties, and maintain compliance with labor laws and regulations. Whether you’re a small business or a large corporation, understanding Kansas payroll is crucial for success. By outsourcing payroll or using payroll software, employers can simplify the payroll process and focus on growing their business. Ultimately, managing payroll in Kansas requires a combination of knowledge, planning, and execution, and by following these tips, employers can ensure a smooth and efficient payroll process.

What is the minimum wage in Kansas?

+

The minimum wage in Kansas is $7.25 per hour.

What are the payroll tax rates in Kansas?

+

The state income tax rate in Kansas ranges from 3.1% to 5.2%, depending on the employee’s income level.

Can employers outsource payroll in Kansas?

+

Yes, employers can outsource payroll in Kansas to a reputable payroll provider.