Premarital Financial Worksheet: Secure Your Future Together

The journey towards a lasting marriage is paved not only with love and commitment but also with practical steps towards a secure financial future. Before you say "I do," tackling the topic of finances can set a strong foundation for your life together. A premarital financial worksheet is a tool that helps couples navigate their financial compatibility and plan effectively. Here's how you can use it to secure your future together:

Understanding Your Financial Situation

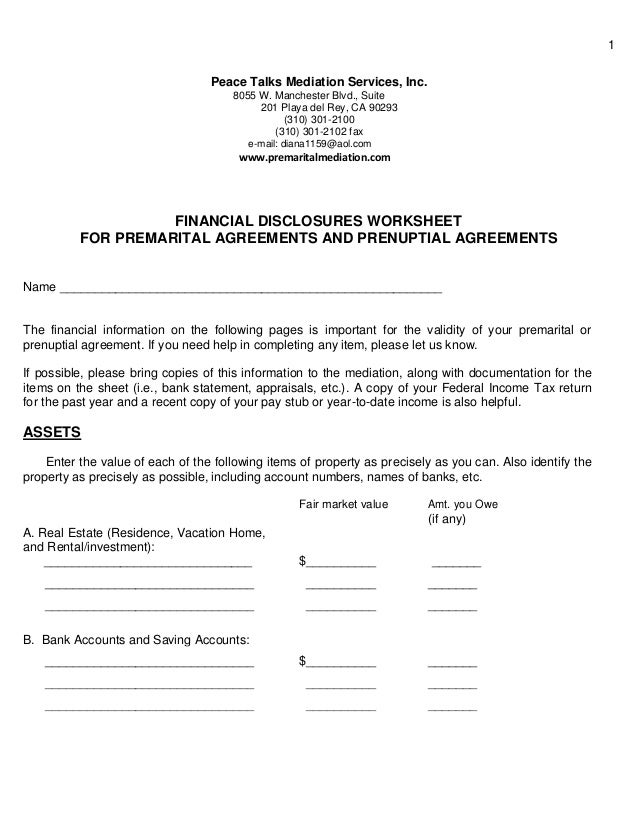

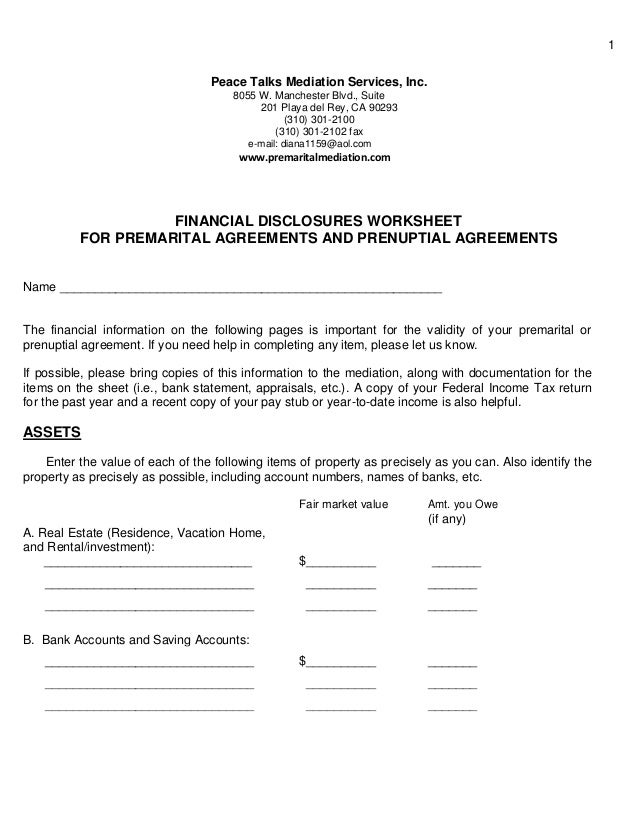

The first step in creating a premarital financial worksheet is to understand your current financial situation as individuals. This includes:

- Your assets (e.g., savings, investments, property)

- Your liabilities (e.g., student loans, credit card debt)

- Your income sources

- Your credit scores

Here’s a simple table to help organize this information:

| Category | Partner 1 | Partner 2 |

|---|---|---|

| Income | ||

| Assets | ||

| Liabilities | ||

| Credit Score |

💡 Note: This worksheet acts as a snapshot of your financial health at the start of your journey together.

Setting Financial Goals Together

After understanding each other’s financial situation, discuss and set common financial goals. These can be:

- Short-term goals (e.g., a honeymoon fund, buying a new car)

- Medium-term goals (e.g., saving for a down payment on a house)

- Long-term goals (e.g., retirement, funding children’s education)

Discussing what you both want out of life financially helps align your visions for the future.

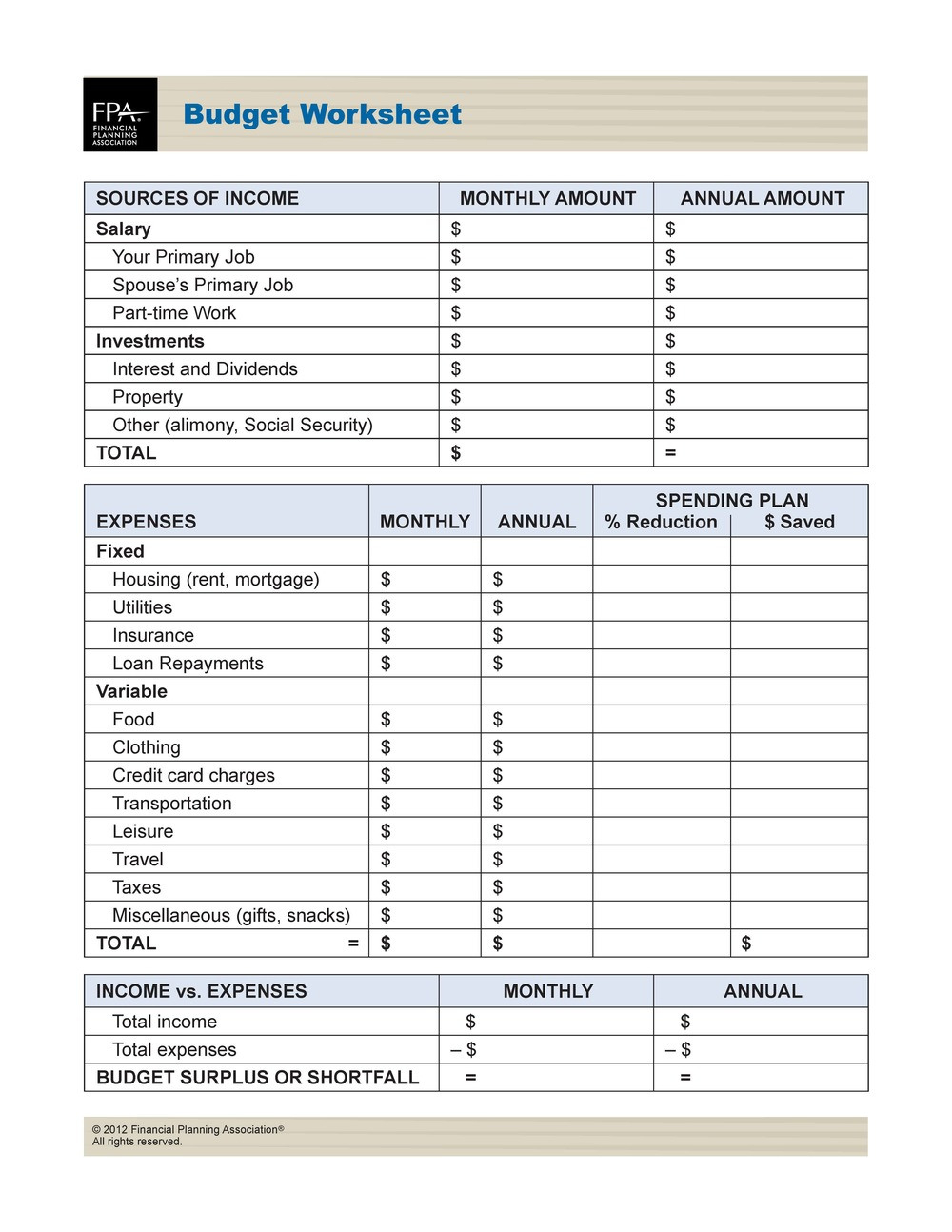

Creating a Budget

A critical component of a premarital financial worksheet is creating a budget that works for both partners. This involves:

- Listing all income

- Tracking monthly expenses

- Allocating money towards joint and personal goals

Here is an example of how you might structure your budget:

| Category | Joint | Personal 1 | Personal 2 |

|---|---|---|---|

| Income | X</td> <td>Y | $Z | |

| Expenses | Housing, utilities, groceries, entertainment, etc. | Clothing, hobbies, personal entertainment, etc. | Same as Personal 1 |

| Savings/Goals | Honeymoon, down payment, etc. | Emergency fund, personal travel, etc. | Same as Personal 1 |

📝 Note: Continually revise your budget to reflect changes in your income or expenses.

Addressing Financial Differences

It’s important to recognize that couples might have different financial habits or philosophies. Here are some steps to address these differences:

- Discuss money attitudes

- Find common ground on saving vs. spending

- Compromise on financial decisions

Joint vs. Separate Accounts

One significant decision is whether to maintain joint accounts, separate accounts, or a mix of both. Consider:

- Joint accounts for shared expenses like rent/mortgage, utilities, and groceries

- Separate accounts for personal expenses, hobbies, or individual financial independence

Planning for the Unexpected

Your worksheet should also include plans for financial emergencies or changes in circumstances:

- Establish an emergency fund

- Discuss life insurance

- Consider prenuptial agreements if necessary

By now, you've laid out a comprehensive plan for financial stability and compatibility. Remember, this worksheet is not just about numbers but about creating a shared vision for your financial future. Keep it updated and review it together regularly to ensure you're both still aligned with your goals and commitments.

Wrapping up, it's clear that a premarital financial worksheet is more than just paperwork; it's a practical approach to merging two financial lives into one. It helps in setting the tone for open communication, trust, and mutual respect regarding money matters. As you move forward, keep these discussions alive, adjusting your plans as life evolves. With a solid financial plan in place, you're not just preparing for a wedding, but building a foundation for a successful, financially secure marriage.

What if one partner is significantly wealthier than the other?

+

Discuss openly about expectations and the impact of wealth disparity on lifestyle, investments, and inheritance. A prenup might be considered for legal protection.

How often should we update our financial worksheet?

+

Regular updates are advised; perhaps quarterly or annually, or whenever there are significant changes in your financial situation.

Is a premarital financial worksheet legally binding?

+

It’s not legally binding, but it can provide a basis for prenup discussions. The decisions made can guide legal agreements or simple contracts between partners.