5 Ways to Maximize Your Paycheck: Math Worksheet

Getting the most out of your paycheck isn't just about how much you earn; it's also about understanding your financial inflow and outflow. Here, we'll explore how you can use a math worksheet to analyze, plan, and ultimately maximize your earnings in a way that aligns with your lifestyle and financial goals.

1. Understand Your Net Pay

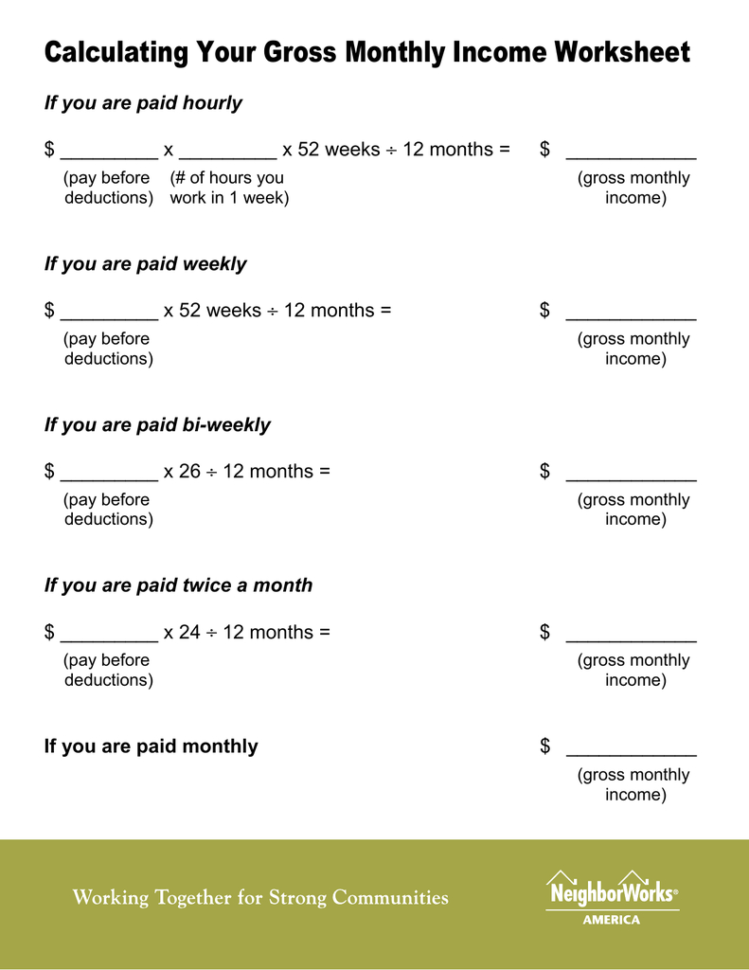

The journey to maximizing your paycheck begins with a deep understanding of what you actually take home after taxes, social security contributions, and any other deductions.

- List your gross salary – This is the starting point before any deductions.

- Calculate all mandatory deductions such as federal and state taxes, Medicare, and Social Security.

- Consider benefits costs if applicable, like health insurance premiums or retirement contributions.

- Subtract these amounts from your gross to get your net pay.

💡 Note: Understanding net pay is crucial because this is the actual amount available for spending or saving. Misinterpreting your net pay can lead to financial mismanagement.

2. Create a Budget Worksheet

With your net pay in mind, creating a budget allows you to allocate funds effectively:

| Category | Percentage of Net Pay |

|---|---|

| Housing | 30% |

| Transportation | 15% |

| Food | 12% |

| Savings and Debt Repayment | 20% |

| Entertainment and Hobbies | 10% |

| Utilities | 5% |

| Personal Care | 3% |

| Charity | 2% |

| Miscellaneous | 3% |

Using this worksheet, you can adjust the percentages based on your income level and spending habits, ensuring you have a clear picture of where your money goes.

3. Implement the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework:

- 50% of your income goes to needs like rent or mortgage, utilities, and groceries.

- 30% is allocated for wants – dining out, entertainment, non-essential purchases.

- 20% is reserved for savings and debt repayment.

This rule, when applied to your worksheet, can provide a framework that's both flexible and disciplined.

4. Track Your Expenses

To maximize your paycheck, you must be vigilant about tracking where every dollar goes:

- Use an app or a traditional ledger to record every expense.

- Update your budget worksheet with real-time data for better financial oversight.

- Regularly review to spot trends or areas where adjustments are needed.

![]()

By tracking your expenses, you're not just managing your money; you're empowering yourself to make informed decisions about your financial future.

5. Optimize Your Income

Lastly, maximizing your paycheck isn't just about spending less but also earning more. Here's how:

- Invest in Yourself: Skills training or education can lead to higher-paying jobs.

- Side Hustles: Utilize your skills or hobbies for additional income.

- Negotiate Salary: Be prepared to discuss your worth during salary reviews.

- Passive Income: Invest in assets that generate income with minimal effort, like rental properties or stock dividends.

By implementing these strategies into your math worksheet, you'll not only understand your finances better but also create opportunities for growth.

To wrap up, maximizing your paycheck involves a combination of understanding your net pay, budgeting, adhering to a savings rule, meticulous expense tracking, and exploring income optimization. By following these five steps and using a math worksheet, you can turn what might seem like basic arithmetic into a powerful tool for financial empowerment. Remember, the goal isn't just to manage money but to use it as a stepping stone to achieve your financial dreams.

How often should I update my budget worksheet?

+

It’s best to update your budget worksheet monthly or whenever there’s a significant change in your income or expenses.

What if I don’t make enough to cover the 50/30/20 rule?

+

The rule is flexible. Adjust the percentages to fit your income, focusing more on reducing expenses if necessary to meet your financial goals.

Is tracking every small expense really necessary?

+

Yes, because small expenses can add up over time, and tracking them can reveal hidden spending patterns or areas for saving.

How can I negotiate a higher salary?

+

Research market rates, prepare a list of your achievements, and practice the negotiation conversation. Timing is key, often when you’ve had a performance review or upon receiving a job offer.

What if I can’t find a side hustle?

+

Look for opportunities within your current skill set or explore learning new skills online. Also, consider less traditional income sources like participating in surveys or selling unused items.