NYS PTET Worksheet Simplified: Your Tax Planning Guide

Navigating the complexities of New York State's Pass-Through Entity Tax (PTET) can be a daunting task for many taxpayers. This guide aims to simplify this process by providing a comprehensive walkthrough of the PTET worksheet, which is essential for effective tax planning and compliance. Whether you're a small business owner or managing finances for a larger entity, understanding PTET can yield significant tax benefits.

What is PTET?

PTET, or Pass-Through Entity Tax, allows pass-through entities like partnerships, S corporations, and LLCs taxed as partnerships or S corporations, to elect to pay an entity-level tax on the income instead of having the partners or shareholders pay the income tax on their individual tax returns. This became particularly advantageous due to the federal tax law changes limiting state and local tax deductions to $10,000 annually.

Why Elect PTET?

- Federal Deduction: This election allows a federal deduction for state income taxes paid at the entity level.

- Increased Tax Deductions: High-income individuals can overcome the SALT cap limitation.

- State Tax Credits: Partners and shareholders receive credits against their personal income taxes for the tax paid by the entity.

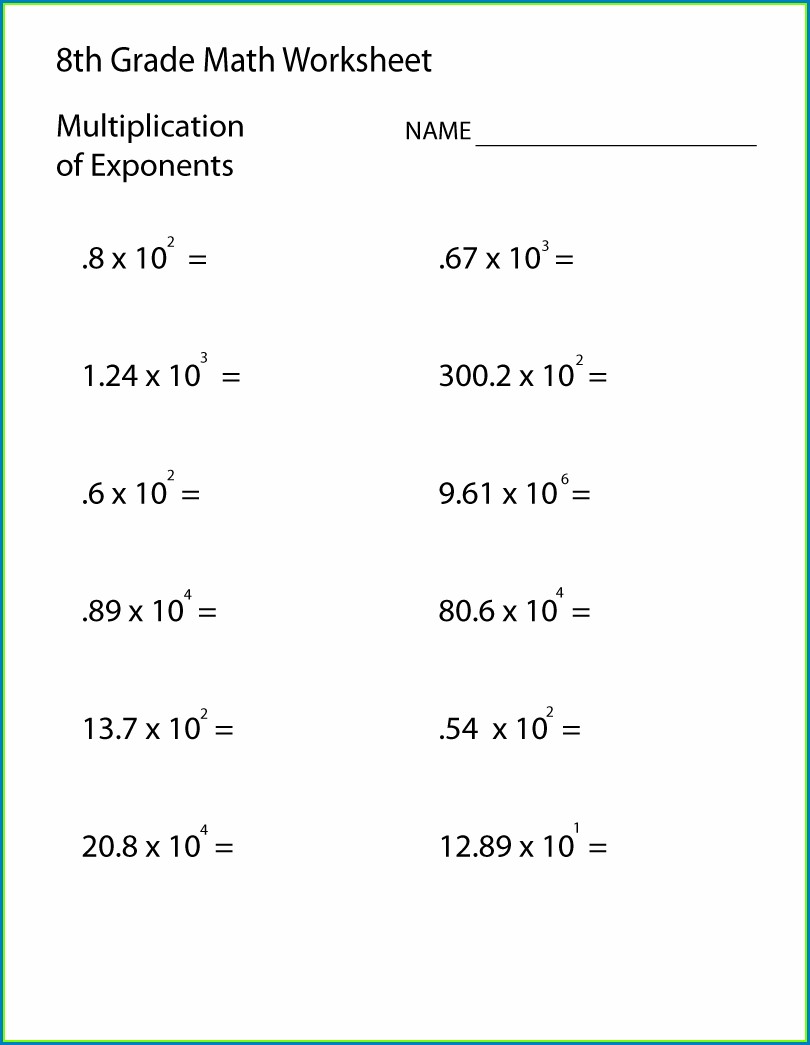

Completing the PTET Worksheet

The NYS PTET worksheet helps calculate the tax owed when opting into PTET. Here are the key steps:

1. Identify Eligible Income

The first step is determining what income qualifies for PTET. This includes:

- Ordinary business income/loss.

- Separately stated income or loss (e.g., interest, dividends).

- Any other income or gain items reportable on federal Schedule K-1.

2. Calculate the Taxable Amount

Use the following formula:

Taxable Amount = Eligible Income * (1 - NOLS - Credits)

Where:

- NOLS = Net Operating Losses (if applicable)

- Credits = Any allowable state tax credits

3. Apply the Tax Rate

New York currently applies a flat rate of 8.82% to the calculated taxable amount for PTET.

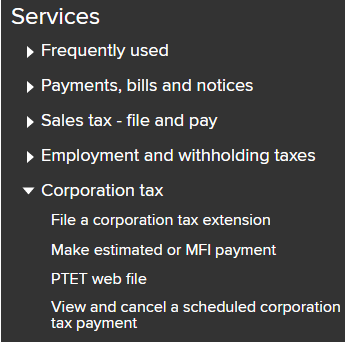

4. Credits to Partners or Shareholders

The total PTET paid by the entity provides a pro-rata credit to each partner or shareholder, reducing their personal income tax liability in New York.

🔍 Note: Ensure accurate apportionment of credits to each partner or shareholder based on their ownership percentage.

Key Considerations

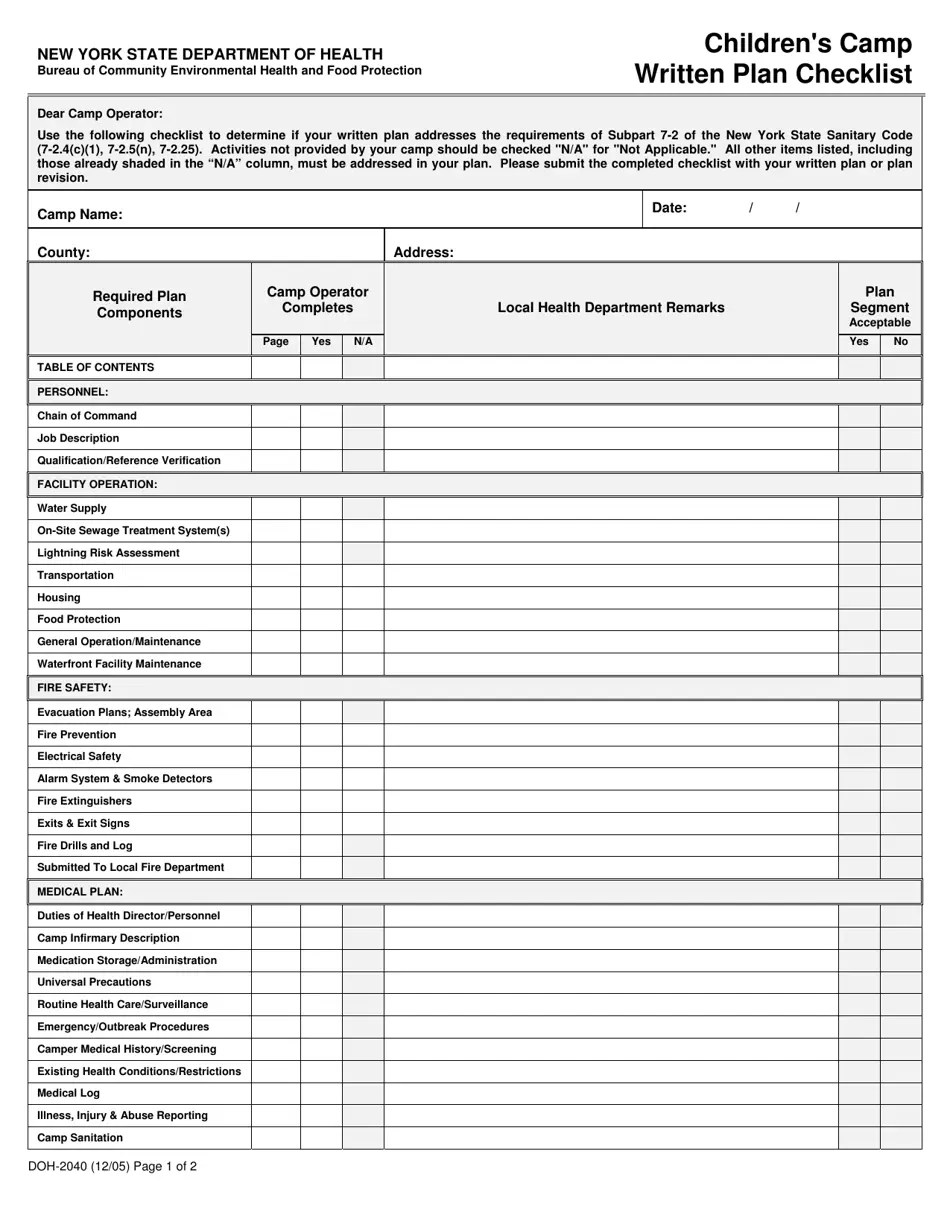

- Amendments: You can amend your PTET election by the extended due date of the return. Be cautious as the decision impacts all members.

- Withholding: Entities might need to make estimated tax payments for PTET. Not meeting these obligations can result in penalties and interest.

- Non-resident Partners: Out-of-state partners can claim PTET credits in their resident states, but special rules apply.

📘 Note: Not all entities might benefit from PTET. Review your specific situation with a tax professional.

In summary, the NYS PTET offers strategic tax planning opportunities for pass-through entities. By electing to pay PTET, you can optimize tax savings for the partners or shareholders. Understanding the intricacies of the PTET worksheet is crucial for accurate tax calculations, ensuring compliance, and leveraging the full benefits of this tax strategy. Remember, the success of your tax planning depends on careful analysis of your unique circumstances and consultation with tax professionals to ensure that you make the most informed decision.

Who is eligible to elect PTET?

+

Partnerships, S corporations, LLCs taxed as partnerships or S corporations, and estate or trust beneficiaries can elect PTET.

What happens if we miss the deadline to elect PTET?

+

If the election deadline is missed, the entity cannot retroactively claim PTET for that year. However, you might file an amended return if eligible.

How are PTET credits applied to non-resident partners?

+

Non-resident partners can generally use PTET credits to offset their tax liability in their resident states, provided those states honor PTET credits.