NC Payroll Calculator Tool

Introduction to North Carolina Payroll Calculator

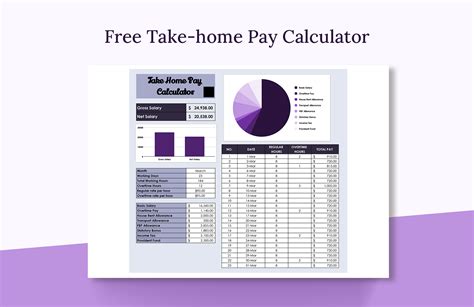

The North Carolina payroll calculator is a valuable tool designed to help employers, employees, and payroll professionals navigate the complexities of payroll calculations in the state of North Carolina. Payroll calculation can be a daunting task, especially considering the various factors that influence it, such as federal and state income taxes, Social Security taxes, Medicare taxes, and other deductions. This tool simplifies the process by providing accurate calculations based on the input of relevant payroll data.

How the NC Payroll Calculator Works

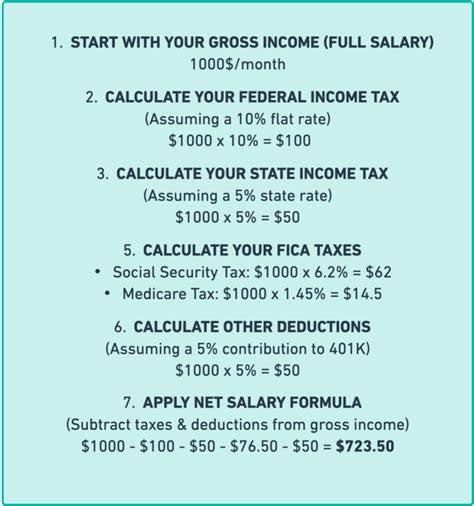

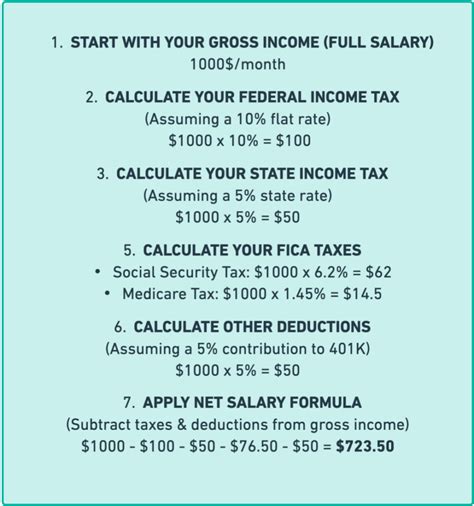

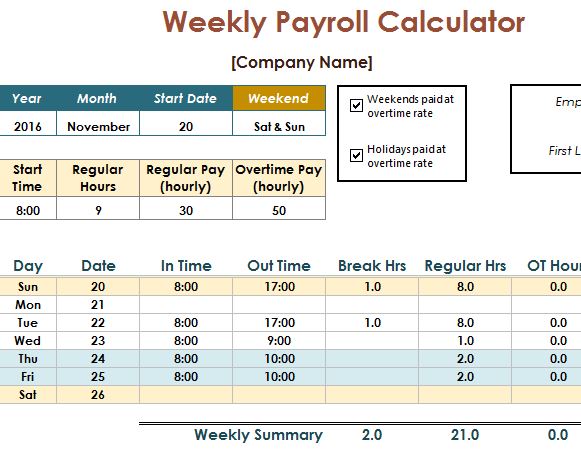

To use the NC payroll calculator, users typically need to input specific details about the employee’s income and the pay period. This may include: - Gross income: The total amount of money earned by the employee before any deductions. - Pay frequency: How often the employee is paid, which could be weekly, biweekly, monthly, etc. - Number of dependents: The number of dependents the employee claims, which affects tax deductions. - Filing status: The employee’s filing status for tax purposes, such as single, married, head of household, etc.

The calculator then applies the relevant tax rates and deductions based on North Carolina’s tax laws and federal tax regulations to arrive at the net income, which is the amount of money the employee actually takes home after all deductions.

Understanding North Carolina Taxes

North Carolina has a progressive income tax system, meaning that higher income levels are taxed at a higher rate. However, the state also offers various tax deductions and credits that can reduce the amount of taxes owed. For instance, there are deductions for charitable contributions, mortgage interest, and property taxes, among others. The NC payroll calculator takes these factors into account to provide a more accurate picture of an employee’s tax liability.

Benefits of Using the NC Payroll Calculator

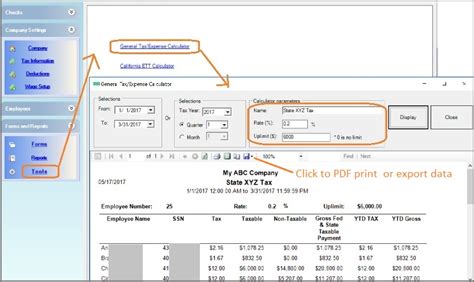

Using a payroll calculator specifically designed for North Carolina offers several benefits: - Accuracy: Ensures that payroll calculations are accurate, reducing the risk of errors that could lead to fines or penalties. - Compliance: Helps employers comply with both federal and North Carolina state tax laws and regulations. - Time-saving: Automates the calculation process, saving time and resources that would be spent on manual calculations or consulting with tax professionals. - Employee Satisfaction: By providing accurate and timely paychecks, employers can enhance employee satisfaction and reduce disputes over pay.

Additional Features and Considerations

Some NC payroll calculators may offer additional features, such as: - Calculations for specific deductions: Such as health insurance premiums, 401(k) contributions, or other voluntary deductions. - Overtime pay calculations: Ensuring that overtime is correctly calculated and taxed according to federal and state laws. - Bonuses and commissions: Handling the taxation of bonuses and commissions, which may have different tax implications than regular income.

When selecting a payroll calculator, it’s essential to consider the specific needs of your business or personal situation. This includes ensuring the calculator is updated with the latest tax rates and laws, as well as being user-friendly and accessible.

📝 Note: It's crucial to regularly update your payroll calculator to reflect changes in tax laws and rates, ensuring compliance and accuracy in your payroll calculations.

Conclusion and Final Thoughts

In summary, the North Carolina payroll calculator is an indispensable tool for anyone involved in payroll processing in the state. By understanding how the calculator works, the benefits it offers, and considering additional features, individuals and businesses can better manage their payroll responsibilities. Whether you’re an employer looking to streamline your payroll process or an employee wanting to understand your paycheck better, leveraging a reliable NC payroll calculator can significantly reduce the complexity and stress associated with payroll calculations.

What is the primary purpose of the NC payroll calculator?

+

The primary purpose of the NC payroll calculator is to simplify and accurately calculate payroll, taking into account North Carolina state taxes and other deductions.

How do I choose the right NC payroll calculator for my needs?

+

To choose the right NC payroll calculator, consider factors such as ease of use, accuracy, compliance with the latest tax laws, and additional features that may be relevant to your specific situation, such as calculations for overtime or bonuses.

Can the NC payroll calculator handle complex payroll scenarios?

+

Yes, many NC payroll calculators are designed to handle complex payroll scenarios, including various deductions, taxes, and pay frequencies. However, the capability can vary depending on the specific calculator or software used.