Fiscal Policy Worksheet Answer Key Revealed

Understanding Fiscal Policy: A Detailed Worksheet Answer Key

Fiscal policy plays a crucial role in the economic health of a nation, acting as the government’s economic tool for managing public spending and taxation to influence the economy. This blog post aims to break down the fiscal policy worksheet by providing an answer key, clarifying complex economic concepts in a simple, digestible format.

What is Fiscal Policy?

Fiscal policy involves changes in government spending and tax policies to promote economic stability. Here’s how it works:

- Expansionary Fiscal Policy - Designed to stimulate the economy by increasing government spending or reducing taxes, leading to increased demand.

- Contractionary Fiscal Policy - Aims to cool down an overheating economy by decreasing government spending or increasing taxes, thereby reducing demand.

💡 Note: Understanding the cyclical nature of fiscal policy is vital for economic analysts and policymakers alike.

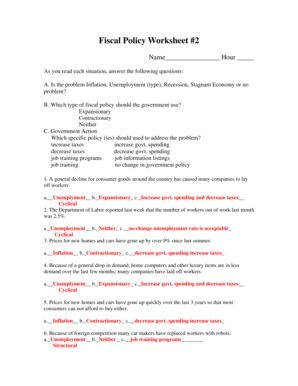

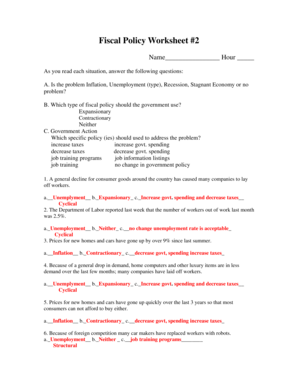

Answer Key to Common Fiscal Policy Worksheet Questions

Let’s dive into the key components of fiscal policy through answers to common worksheet questions:

1. Define Expansionary Fiscal Policy

Expansionary fiscal policy refers to actions by the government to increase aggregate demand and stimulate economic growth. It includes:

- Increasing government spending

- Cutting taxes

- Both to boost consumer and business confidence

2. Explain Contractionary Fiscal Policy

When the economy is growing too quickly, causing inflation or economic imbalances, contractionary fiscal policy steps in:

- Reducing government expenditure

- Imposing higher taxes

- to decrease aggregate demand

⚠️ Note: Inappropriate use of contractionary policy can lead to recessions, so timing is crucial.

3. Discuss the Automatic Stabilizers in Fiscal Policy

Automatic stabilizers are mechanisms within fiscal policy that naturally stabilize economic activity:

- Progressive Taxation

- Unemployment Benefits

- which automatically adjust without explicit government intervention.

4. How Do Budget Deficits and Surpluses Work?

A fiscal deficit occurs when:

| Fiscal Situation | Description |

|---|---|

| Deficit | When government spending exceeds its revenue. The gap must be filled by borrowing. |

| Surplus | When government revenues exceed spending, allowing for debt reduction or saving. |

Key Considerations in Implementing Fiscal Policy

When designing and implementing fiscal policy, several factors must be considered:

- Economic Environment - Understanding the current economic cycle is fundamental to choosing the right policy approach.

- Political Will - Fiscal policy can be politically charged, making the implementation a challenge.

- Long-term vs. Short-term Effects - Policymakers often have to balance immediate needs with future sustainability.

The Impact of Fiscal Policy on the Economy

Fiscal policy impacts various sectors of the economy:

- Aggregate Demand: Changes in taxation and government spending directly influence consumer spending and investment.

- Income Distribution: Progressive taxation and welfare policies can redistribute income, affecting inequality.

- Interest Rates: Large deficits can lead to higher interest rates if borrowing increases significantly.

- Investment: Government investment can crowd out private sector investment or stimulate it, depending on policy choices.

📌 Note: The effectiveness of fiscal policy is also influenced by its coordination with monetary policy.

Practical Applications of Fiscal Policy

Let’s explore practical examples:

- Stimulus Packages - During economic downturns, governments often implement stimulus packages to boost demand.

- Tax Incentives - To encourage business investment or consumer spending, governments might offer tax breaks or incentives.

- Infrastructure Investment - A common expansionary approach where government invests in projects to create jobs and improve economic infrastructure.

The key to fiscal policy’s success lies in its timely application and the balance between short-term stimulus and long-term fiscal responsibility. It’s an intricate balance that requires careful analysis and foresight.

Summing up, fiscal policy is a vital tool for economic management, influencing growth, employment, and inflation. It involves intricate decision-making, where understanding the nuances of economic theory, practical application, and political context is paramount. This blog post has outlined the key aspects of fiscal policy through a worksheet answer key, providing insights into how governments can shape the economy for the betterment of all.

What is the difference between fiscal and monetary policy?

+

Fiscal policy involves changes in government spending and taxation, while monetary policy concerns the management of the money supply and interest rates by the central bank.

Can fiscal policy alone lead to full employment?

+

Fiscal policy can stimulate demand and increase employment but cannot guarantee full employment alone; it often needs to be supported by monetary policy and other economic factors.

How does public debt affect fiscal policy?

+

High public debt can limit the government’s ability to implement expansionary fiscal policy due to the need to service existing debt, potentially leading to higher interest rates or necessitating tax increases or spending cuts.

What are the limitations of fiscal policy?

+

Limitations include time lags in implementation, political constraints, and potential for creating large deficits which could lead to future tax increases or spending cuts.