3 Ways to Maximize Entertainment Expense Deductions

When it comes to business operations, many entrepreneurs overlook the potential tax benefits of entertainment expenses. Entertainment deductions can be a significant way to reduce your taxable income if you manage them correctly. This article will explore three effective strategies to maximize your entertainment expense deductions while staying within the IRS's legal boundaries.

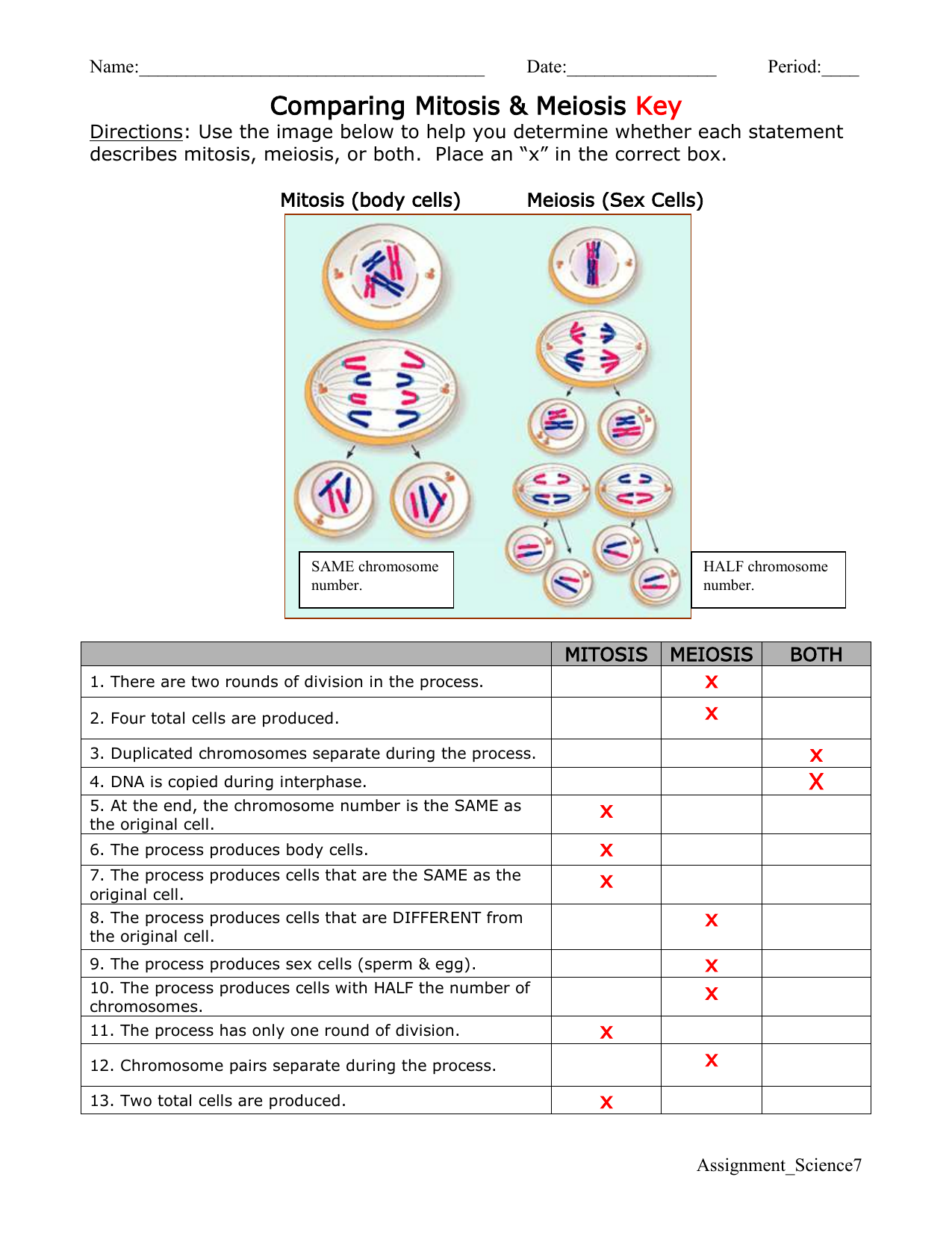

Understand What Qualifies as Entertainment Expenses

Before diving into deduction strategies, it's crucial to understand what constitutes an entertainment expense:

- Business meals: Meetings where food or beverages are provided, and business is discussed.

- Entertainment events: Tickets for sports, theatre, or music performances when associated with business purposes.

- Client appreciation events: Events or outings designed to entertain or build client relationships.

- Conferences and seminars: Attendance at educational and networking events.

🎉 Note: Keep in mind that not all entertainment expenses qualify for a full deduction. For instance, only 50% of business meal expenses are deductible.

Strategy 1: Direct Business Connection

Ensure every entertainment expense is directly linked to your business. Here's how you can maximize deductions with a direct business connection:

- Clear Business Purpose: Document the business purpose of each expense. This includes client meetings, discussing potential deals, or networking with industry leaders. Maintain records of attendees, date, and the nature of the business discussed.

- Establish an Ordinary and Necessary Expense: The expense should be common in your business and a necessary cost of conducting business. For example, taking a potential client to a sports event to discuss a contract negotiation.

- Proximity of Discussion: Ideally, business should be conducted before, during, or immediately following the entertainment event. This establishes the expense's direct connection to business activities.

Strategy 2: Planning and Documentation

Meticulous planning and documentation are key to ensuring your entertainment expenses are deductible:

- Pre-Event Planning: Outline your business objectives for each event. This helps in justifying the expenditure during an audit.

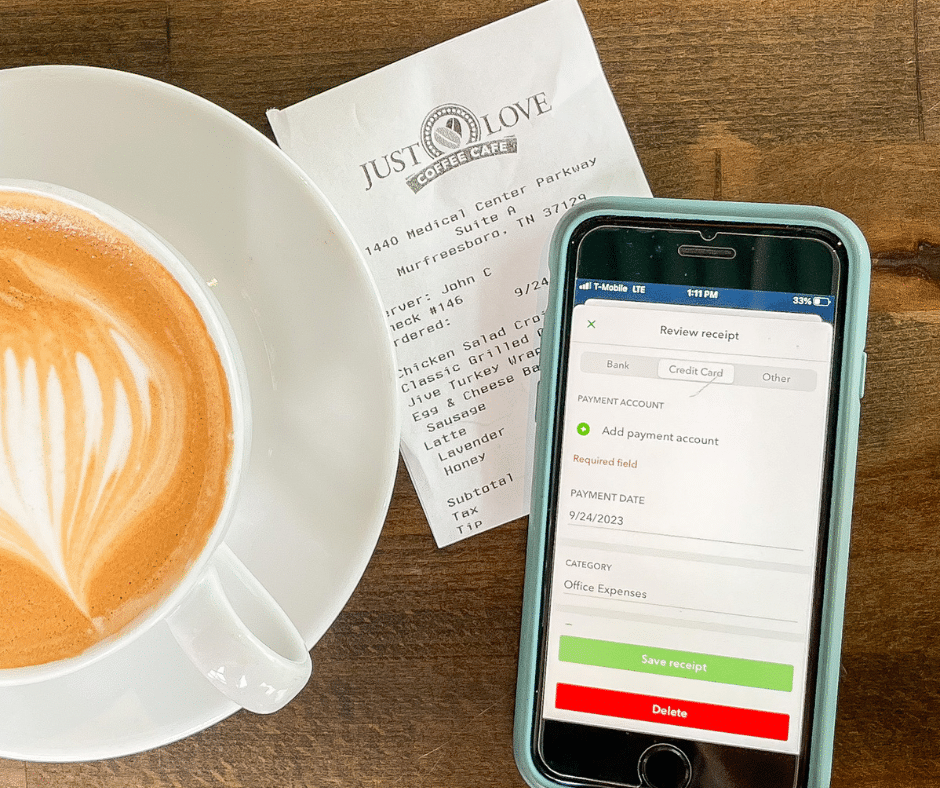

- Real-Time Documentation: Record expenses at the time of the event. This includes receipts, event tickets, names of attendees, and details of the business discussed.

- Deduction Limits: Be aware of IRS limits for entertainment deductions. For instance, as of 2022, the IRS has temporarily allowed a 100% deduction for business meals, but this is subject to change, so keep updated.

💡 Note: While 100% deduction of business meals was allowed temporarily, always check the current IRS guidelines to avoid overclaiming deductions.

Strategy 3: Explore Less Traditional Entertainment

Consider less conventional entertainment methods that can also qualify for deductions:

- Virtual Events: With the rise in virtual meetings, online events, webinars, and virtual team-building activities are now recognized as deductible entertainment expenses.

- Charity Events: Hosting or attending events to benefit charities where business discussions occur can be claimed as entertainment expenses.

- Golf or Sporting Outings: Business conducted during these events qualifies, but ensure there is a clear business purpose beyond the mere act of playing or watching the sport.

To summarize, maximizing your entertainment expense deductions requires a deep understanding of what qualifies, meticulous planning, proper documentation, and occasionally thinking outside the box for entertainment options. Remember, while the IRS provides allowances for deductions, the key is to ensure these expenses serve a direct business purpose, are ordinary and necessary, and are well-documented. Over time, these small savings can add up, allowing you to reinvest in your business, pursue growth opportunities, or simply improve your bottom line.

Can I deduct entertainment expenses for employee-only events?

+

Entertainment expenses for employee-only events like team-building activities or company retreats are generally deductible, provided they are ordinary and necessary for business operations.

Do I need to keep all receipts for entertainment expenses?

+

Yes, retaining all receipts and documentation is crucial. It provides substantiation in case of an IRS audit. Include who attended, the date, purpose, and amount spent.

What if my entertainment involves both business and personal enjoyment?

+

If your entertainment activity includes both business and personal elements, you should apportion the expenses. Only the portion directly related to business can be deducted. For instance, if you took a client to a show and spent an additional evening with family, only the client-related expenses could be claimed.