3 Essential Tips for Completing Form 2210 Worksheet

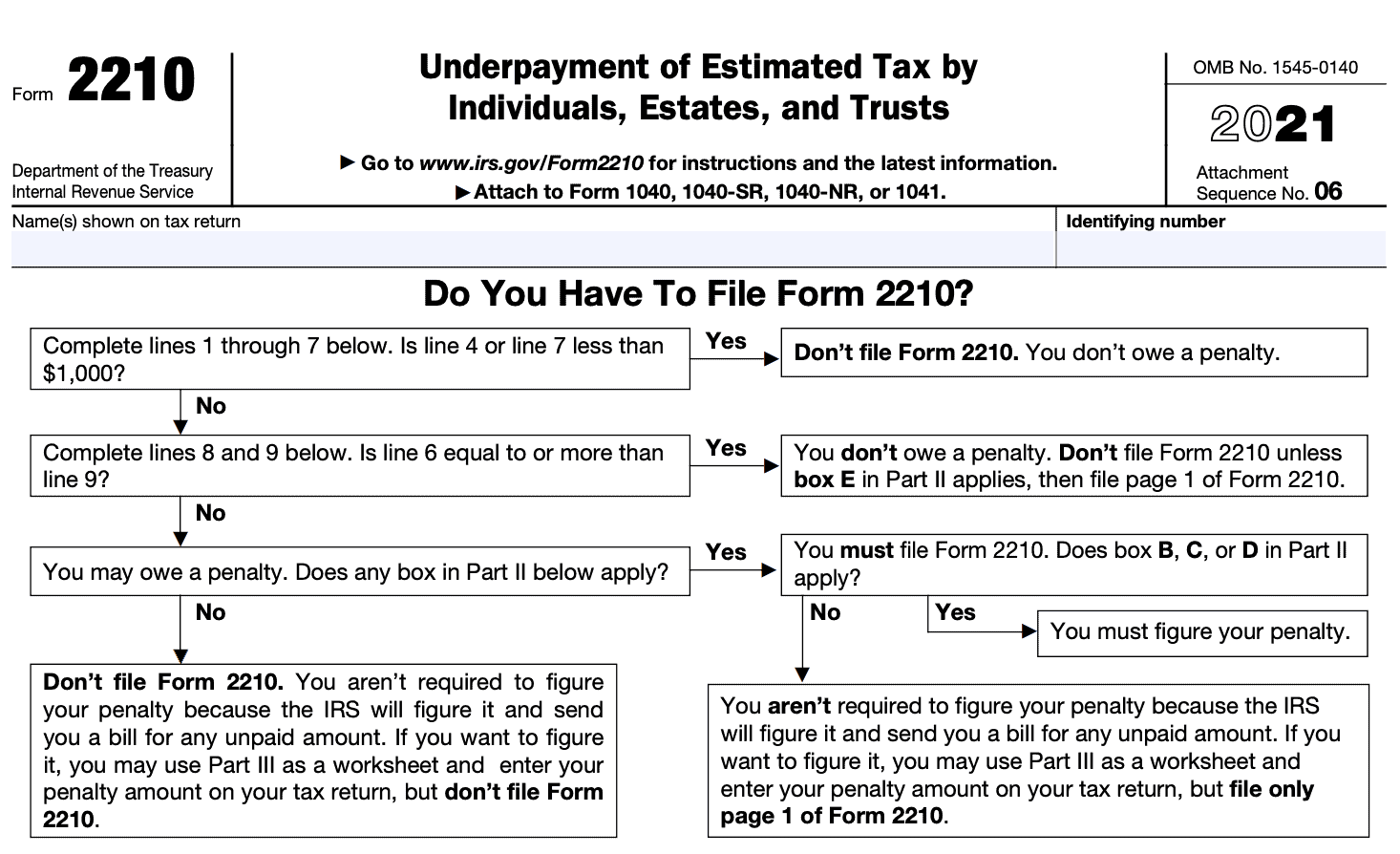

In the complex world of tax preparation, navigating through the myriad of forms can be overwhelming. Among these, Form 2210, which deals with underpayment of estimated tax, often confuses taxpayers. To help you master this process, here are three essential tips for completing Form 2210 Worksheet.

Understand the Purpose of Form 2210

Before you dive into the worksheet, understanding what Form 2210 is intended for is crucial:

- Form 2210 helps calculate any penalty for underpayment of estimated tax by individuals, estates, or trusts.

- It determines if you owe a penalty for not paying enough tax during the year through withholding or estimated tax payments.

- Knowing this, you can better prepare for the worksheet sections that might affect your tax payments.

🔍 Note: An exception applies if you paid at least 90% of the tax due for the current year or 100% of the tax shown on your prior year’s return.

Gather All Necessary Documentation

Completing Form 2210 without the right documents can lead to errors or omissions. Here’s what you need:

- Last Year’s Tax Return: This provides a baseline for your prior year’s tax liability.

- Current Year’s Income Records: Includes all W-2s, 1099s, and any other income-related documents.

- Previous Quarterly Estimated Tax Payments: Essential for calculating the required annual payment amount.

| Document | Purpose |

|---|---|

| Form 1040 | Calculates total tax liability |

| W-2s and 1099s | Records your income for the year |

| Estimated Tax Vouchers | Shows your payments made to the IRS |

💡 Note: Keep copies of all documents for records or potential IRS audits.

Accurately Fill Out the Worksheet

The Form 2210 Worksheet requires precision. Here are some steps to ensure you do it correctly:

- Calculate Required Annual Payment: This involves computing 90% of your current year’s tax or 100% of the prior year’s tax (or 110% if your AGI is above $150,000).

- Enter Payments: List all your estimated tax payments for the year in the respective quarters.

- Determine if Penalty Applies: Compare your payments against the required annual payment to see if a penalty is due.

- Use the Annualized Income Installment Method: If your income varies significantly throughout the year, this method can minimize or eliminate penalties.

- Complete the Waiver: If you meet certain criteria, you might qualify for a waiver of the underpayment penalty.

📝 Note: The IRS provides instructions with examples in the Form 2210 package. Always refer to these for specific situations.

By following these tips, you can navigate the Form 2210 Worksheet with confidence, minimizing potential penalties and ensuring compliance with tax regulations. Remember, while the form can be daunting, with the right preparation and knowledge, you can manage your estimated tax payments effectively, ensuring you're neither underpaying nor overpaying your taxes throughout the year.

What triggers Form 2210?

+

Form 2210 is triggered when you’ve underpaid your estimated taxes for any given quarter or the entire year, making it necessary to calculate any potential penalty.

Can I avoid the penalty with Form 2210?

+

Yes, you can avoid the penalty by meeting certain criteria, like paying 90% of your tax for the current year or 100% (or 110% for high earners) of your prior year’s tax, or if you qualify for a waiver under specific conditions outlined by the IRS.

What should I do if my income varies throughout the year?

+

If your income is not consistent, use the annualized income installment method to compute the required payments. This approach allows for adjustments based on your income variability.