5 Tips for Completing Worksheet 1 941x Easily

Completing tax forms can often feel like an overwhelming task, especially for businesses with complex financial activities. However, among the many IRS forms, Form 941x stands out as it deals with adjustments to employment taxes. While the form might seem daunting at first, it becomes manageable with the right strategies. Here are five tips to make the process of filling out Worksheet 1 of Form 941x as smooth as possible:

Understand the Purpose of Form 941x

Before diving into the specifics of Worksheet 1, it’s crucial to understand why you’re filing Form 941x:

- It’s used for correcting errors in previously filed Forms 941.

- Worksheet 1 helps calculate the underreported or overreported employment taxes.

💡 Note: Form 941x is not for amending Forms 944 or other IRS forms related to employment taxes.

Organize Your Records

The key to successfully completing any tax form, including Worksheet 1 of Form 941x, is meticulous organization:

- Collect all payroll records for the period you are amending.

- Ensure you have details of each employee’s wages and benefits.

- Gather any other documents like previously filed 941 forms, state records, or accounting reports.

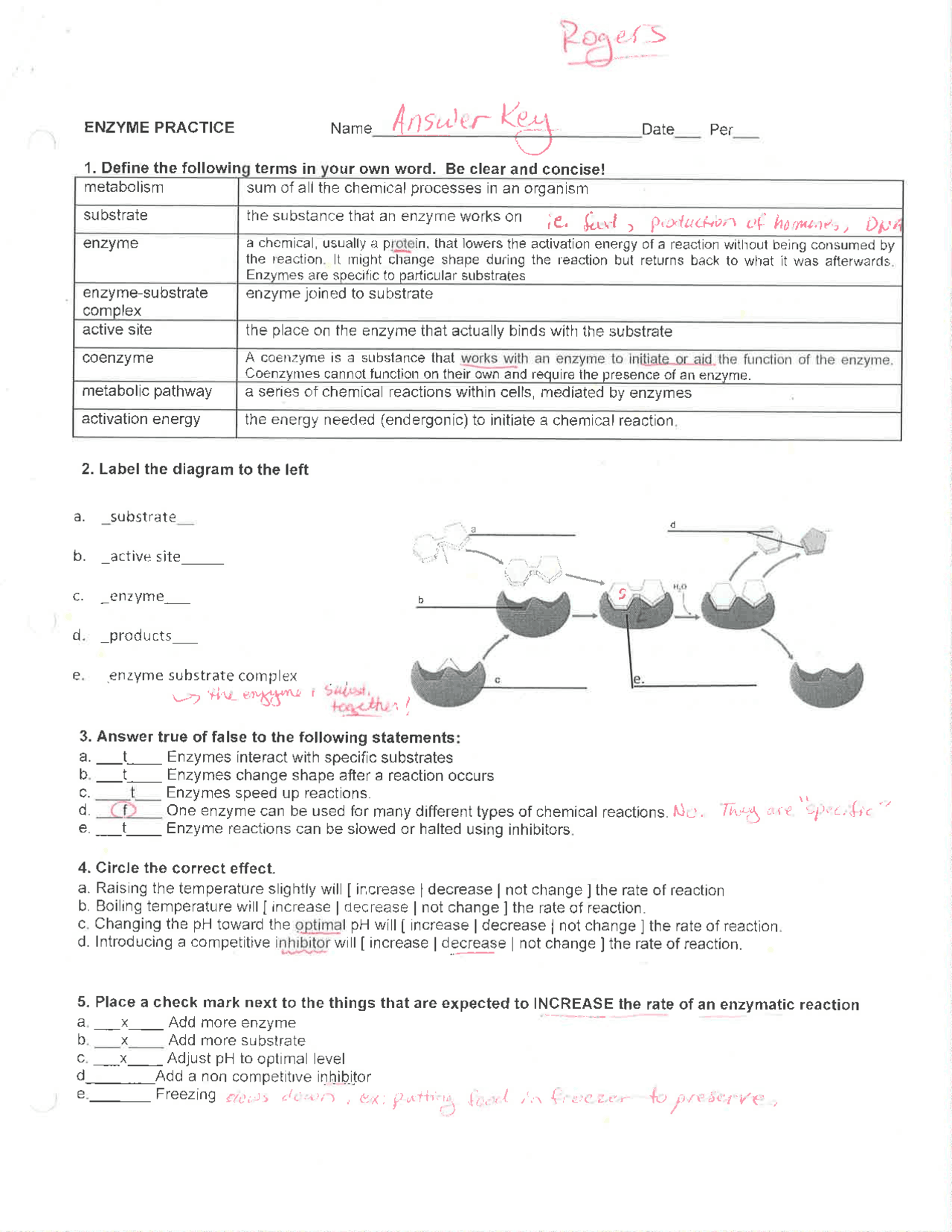

Fill Out the Form Step by Step

Completing Worksheet 1 can be broken down into manageable steps:

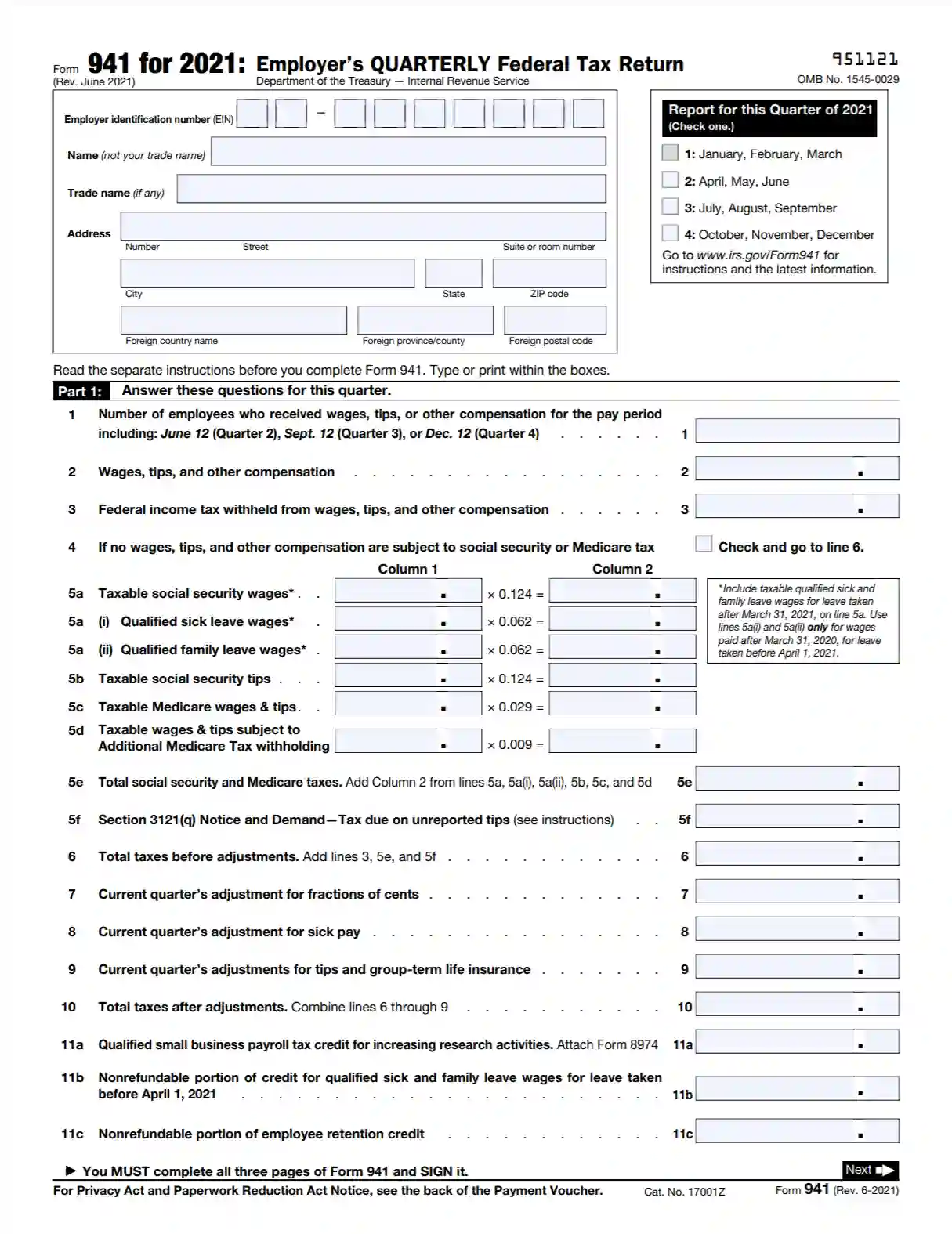

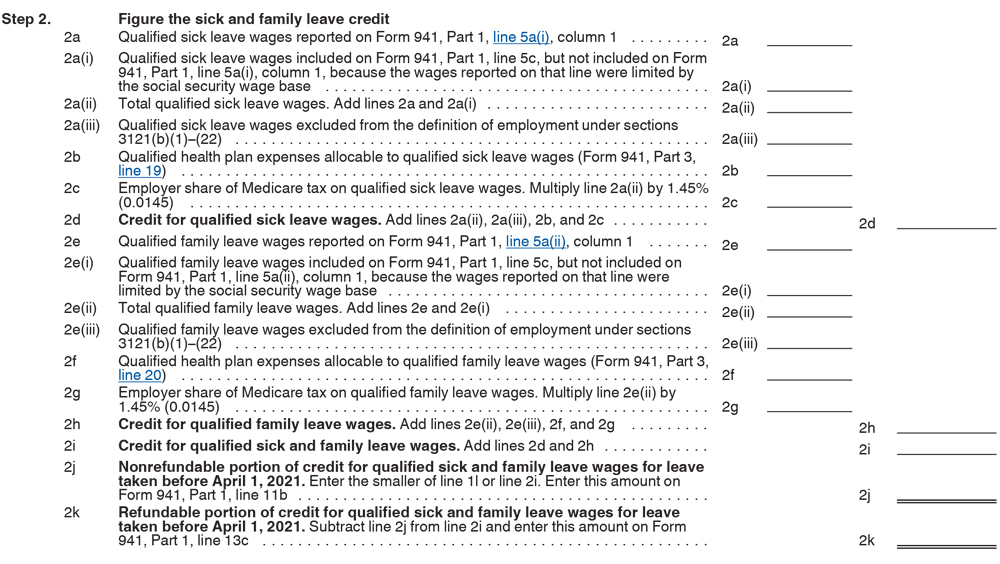

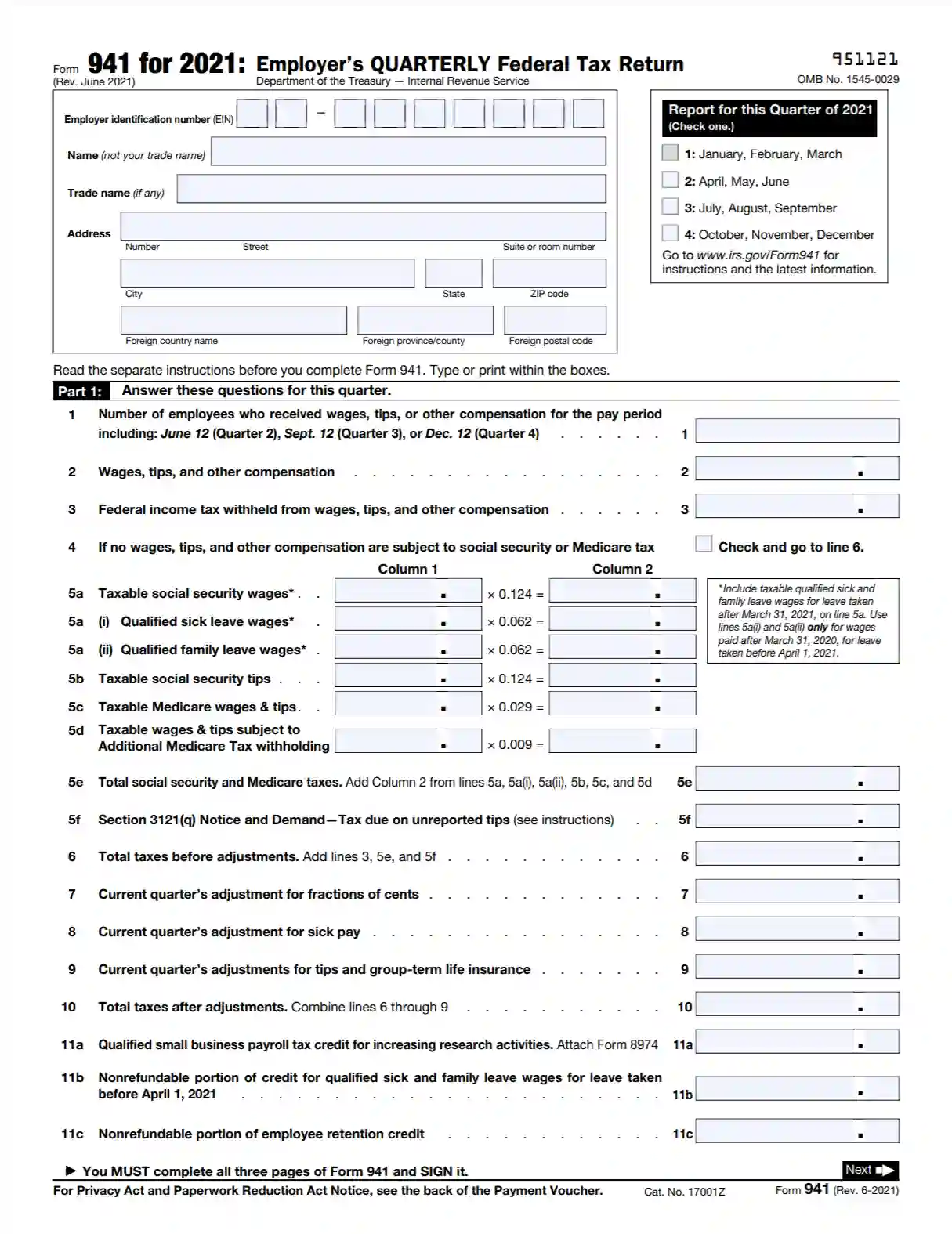

- Enter Correct Wages and Taxable Amounts: Input the correct wages paid to employees, including any tips, and calculate the taxable Social Security and Medicare wages.

- Calculate and Adjust Taxes: Use the worksheet to find out the correct amounts of Social Security, Medicare, and Additional Medicare Tax.

- Follow IRS Instructions: There are specific IRS instructions for each line, which should be followed to the letter to avoid errors.

Use Online Tax Software or an Accountant

While some businesses handle their taxes in-house, others benefit greatly from external help:

- Online Tax Software: Many reputable software platforms offer templates for Form 941x, which guide you through the process with automatic calculations.

- Hire a Professional: If your business’s tax situation is complex or if you’re not confident in your ability to fill out the form correctly, consider hiring a tax professional or accountant.

💡 Note: Ensure any software or accountant you choose is well-versed in IRS tax laws.

Review, Review, Review

Accuracy is key when it comes to tax filings:

- Double-check all numbers against your records.

- Review the completed Form 941x and Worksheet 1 for any mathematical errors or miscalculations.

- Verify that all the necessary lines and forms are filled out.

The IRS penalizes mistakes, so taking time to review your work is time well spent.

By following these tips, the task of completing Worksheet 1 of Form 941x can be transformed from a source of stress into a manageable process. Remember, the goal is not just to comply with IRS regulations but also to ensure your business is not underpaying or overpaying taxes, maintaining financial health and regulatory compliance.

What is the penalty for filing Form 941x incorrectly?

+

The IRS can impose penalties for errors on Form 941x. This includes penalties for not depositing or paying enough taxes, as well as failure to file on time or accurately. These penalties can add up to 10% of the underreported tax or $255 per occurrence, whichever is larger.

Can I file Form 941x electronically?

+

Yes, IRS e-filing options exist for Form 941x through authorized e-file providers. However, not all businesses or individuals can e-file Form 941x directly through the IRS’s website, so check with your e-filing provider or tax professional for specifics.

How far back can I file Form 941x?

+

Generally, you can file Form 941x within three years from the date you filed the original return or two years from the date you paid the tax, whichever is later. However, there are exceptions and specific time limits for certain kinds of claims, so it’s best to consult IRS guidelines or a tax professional for precise details.