Mastering Adjusting Entries in Worksheets: Key Tips

The world of accounting has numerous facets, but understanding adjusting entries in worksheets can be one of the most intricate and essential parts for any finance professional. These entries are made to align the revenues and expenses to the periods in which they are incurred, which directly impacts the accuracy of financial reporting. Here’s a comprehensive guide to mastering adjusting entries in accounting worksheets.

Why Adjusting Entries Matter

Adjusting entries are crucial for:

- Accuracy: Ensuring that income statements reflect the correct revenues and expenses.

- Matching Principle: Pairing revenues with the expenses incurred to generate them within the same accounting period.

- Accrual Accounting: Properly accounting for revenues and expenses even when cash transactions don’t occur.

Types of Adjusting Entries

Here are the main types of adjusting entries you need to know:

- Accruals: Revenue or expenses recognized before cash changes hands.

- Deferrals: Revenue or expenses recognized after cash changes hands.

- Depreciation: Allocating the cost of a fixed asset over its useful life.

- Prepayments: Expenses paid in advance, like insurance or rent.

- Estimated Items: Adjustments for items like bad debts or inventory adjustments.

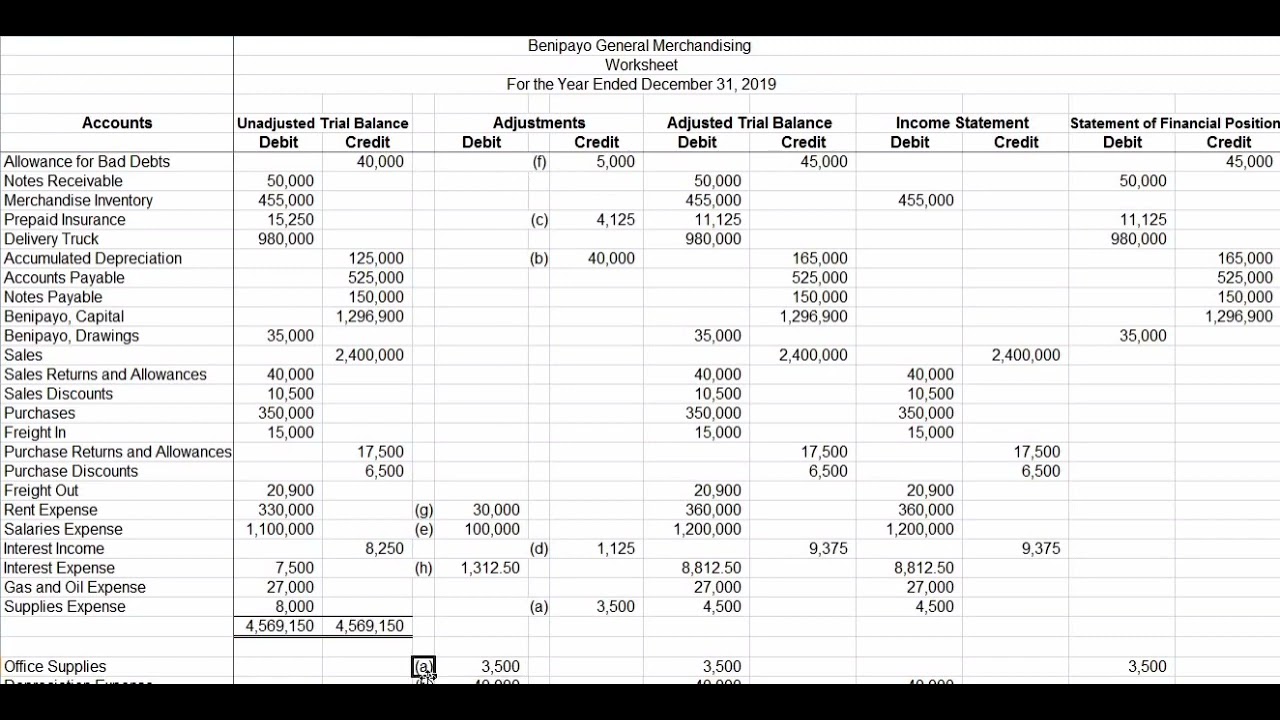

Steps to Making Adjusting Entries

Here is a step-by-step process for making adjusting entries:

- Identify: Determine what adjustments are needed based on your accounts and business activities.

- Record: Enter these adjustments into the worksheet.

- Verify: Check the entries to ensure accuracy in alignment with accounting principles.

- Adjust: Post the entries in your trial balance.

- Close: Transfer the temporary accounts to the income summary or retained earnings.

- Double-Entry System: For each debit, there should be a corresponding credit.

- Reconciliation: Regularly reconcile your accounts to ensure entries are correct.

- Time: Ensure that adjustments are made at the right time to reflect the correct accounting period.

Common Adjusting Entries

Let’s look at some common scenarios requiring adjustments:

| Scenario | Type of Entry | Adjusting Entry Example |

|---|---|---|

| Revenue Earned but Not Yet Recorded | Accrued Revenue | Debit Accounts Receivable, Credit Service Revenue |

| Expenses Incurred but Not Paid | Accrued Expenses | Debit Expense, Credit Accounts Payable |

| Prepaid Expenses Expiring | Deferred Expense | Debit Insurance Expense, Credit Prepaid Insurance |

✏️ Note: Always ensure that your adjusting entries balance the equation of Assets = Liabilities + Equity.

Key Considerations for Accuracy

Conclusion

Mastering adjusting entries in worksheets involves a blend of understanding the accounting principles, recognizing the events that trigger adjustments, and accurately recording these adjustments. By ensuring that your entries are timely, accurate, and reflect the true financial position of your company, you can produce reliable financial statements. Adjusting entries are not just about correcting errors but about painting a realistic picture of the company’s financial health, thereby facilitating informed decision-making.

What is the difference between accrued and deferred adjustments?

+

Accrued adjustments recognize revenue or expenses before cash transactions occur, while deferred adjustments delay the recognition of revenue or expenses until after the cash transaction has happened.

How often should I make adjusting entries?

+

Adjusting entries should be made at the end of each accounting period, which is usually monthly, quarterly, or annually depending on the business’s reporting cycle.

What happens if I miss an adjusting entry?

+

Missing an adjusting entry can lead to inaccurate financial statements, which might result in misinformed decision-making, potential legal issues, and could affect tax reporting.