MN Wage Calculator Tool

Introduction to MN Wage Calculator Tool

The MN Wage Calculator Tool is a valuable resource for employees and employers in Minnesota to calculate wages, deductions, and other related factors. This tool helps ensure compliance with Minnesota’s labor laws and regulations. In this article, we will delve into the details of the MN Wage Calculator Tool, its features, and how it can be used to benefit both employees and employers.

Features of the MN Wage Calculator Tool

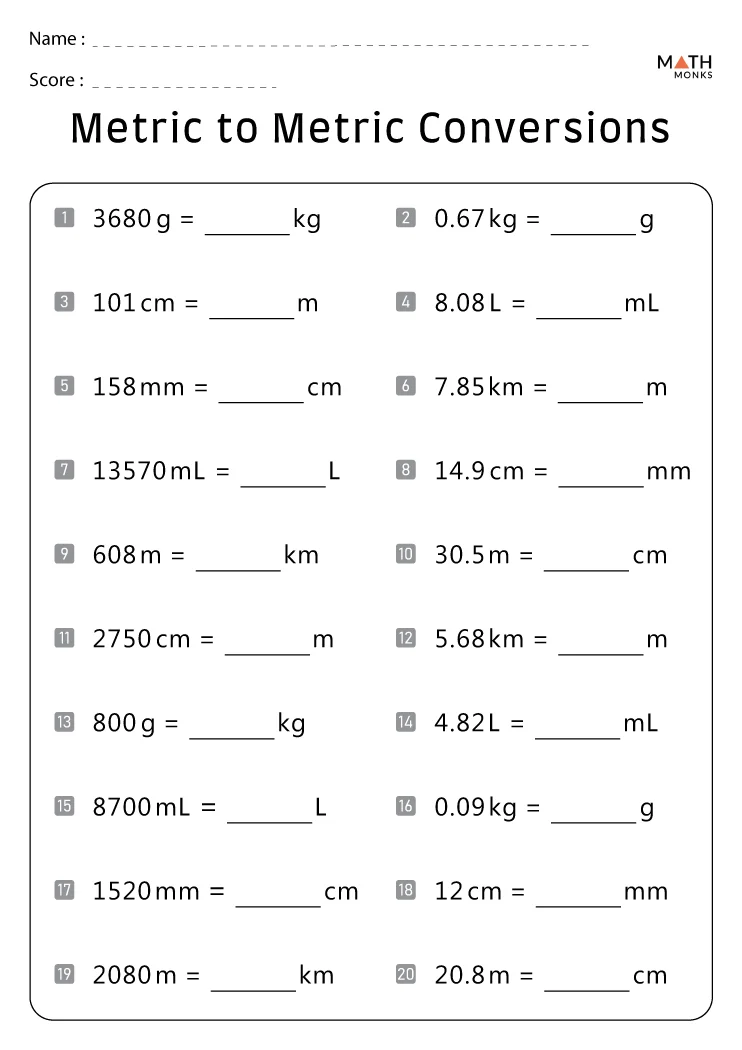

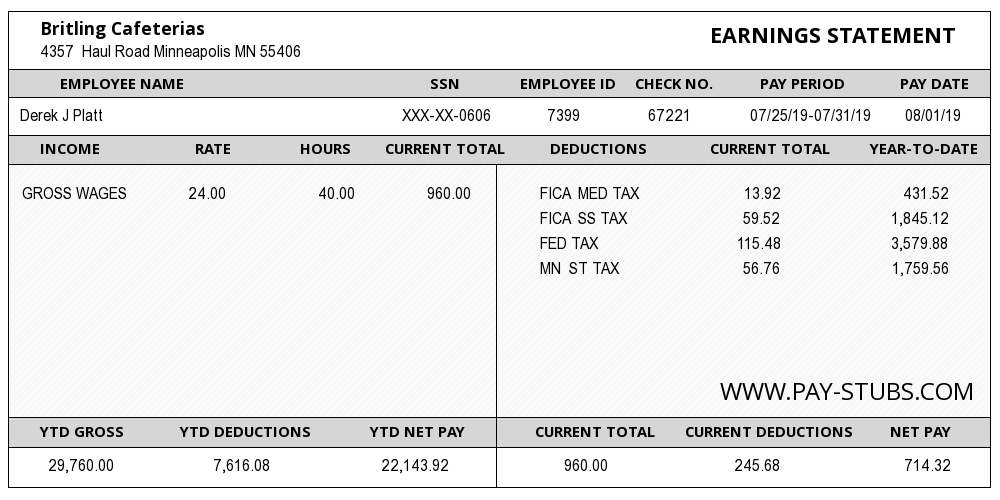

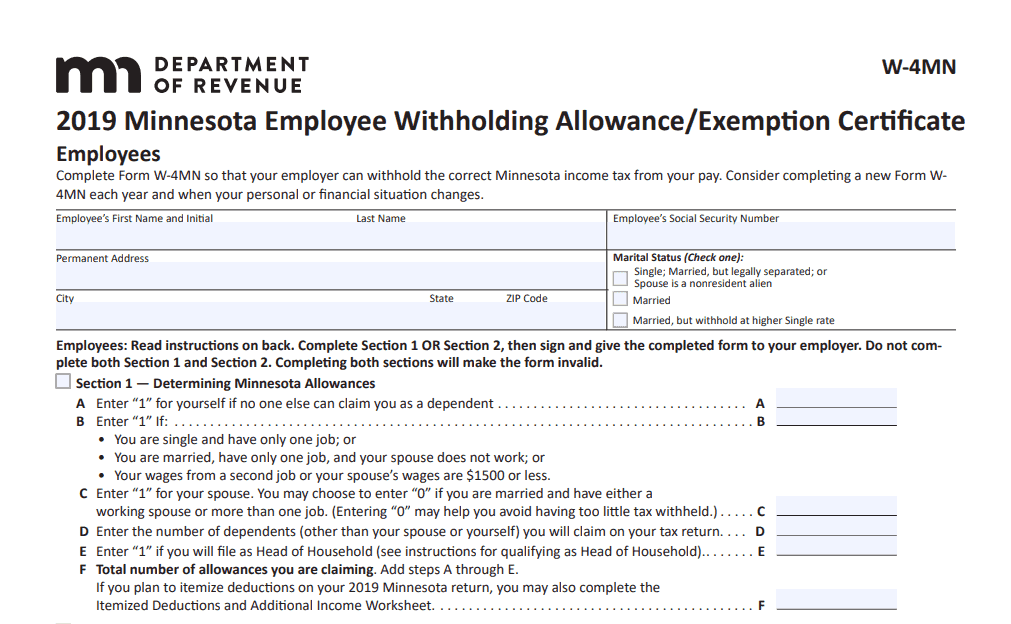

The MN Wage Calculator Tool offers a range of features that make it an essential tool for calculating wages and deductions. Some of the key features include: * Gross Pay Calculator: This feature allows users to calculate gross pay based on the number of hours worked, pay rate, and other factors. * Net Pay Calculator: This feature calculates the take-home pay after deductions such as taxes, health insurance, and other benefits. * Overtime Pay Calculator: This feature helps calculate overtime pay based on the number of hours worked and the pay rate. * Deductions Calculator: This feature allows users to calculate deductions such as taxes, health insurance, and other benefits.

Benefits of the MN Wage Calculator Tool

The MN Wage Calculator Tool offers numerous benefits to both employees and employers. Some of the key benefits include: * Accurate Calculations: The tool provides accurate calculations, reducing the risk of errors and disputes. * Compliance with Labor Laws: The tool helps ensure compliance with Minnesota’s labor laws and regulations, reducing the risk of penalties and fines. * Time-Saving: The tool saves time and effort, allowing users to quickly and easily calculate wages and deductions. * Increased Transparency: The tool provides increased transparency, allowing employees to understand their pay and deductions.

How to Use the MN Wage Calculator Tool

Using the MN Wage Calculator Tool is straightforward. Here are the steps to follow: * Enter Employee Information: Enter the employee’s name, pay rate, and number of hours worked. * Select Deductions: Select the deductions to be made, such as taxes, health insurance, and other benefits. * Calculate Wages: Calculate the gross pay, net pay, and overtime pay using the tool’s features. * Review and Verify: Review and verify the calculations to ensure accuracy and compliance with labor laws.

📝 Note: It is essential to review and verify the calculations to ensure accuracy and compliance with labor laws.

Common Mistakes to Avoid

When using the MN Wage Calculator Tool, there are common mistakes to avoid. Some of these mistakes include: * Incorrect Pay Rate: Entering an incorrect pay rate can lead to inaccurate calculations. * Incorrect Number of Hours Worked: Entering an incorrect number of hours worked can lead to inaccurate calculations. * Failure to Select Deductions: Failing to select deductions can lead to inaccurate calculations.

Best Practices for Using the MN Wage Calculator Tool

To get the most out of the MN Wage Calculator Tool, follow these best practices: * Use the Tool Regularly: Use the tool regularly to ensure accurate calculations and compliance with labor laws. * Keep Records: Keep records of calculations and deductions to ensure transparency and accountability. * Review and Update: Review and update the tool regularly to ensure it remains accurate and compliant with labor laws.

| Feature | Description |

|---|---|

| Gross Pay Calculator | Calculates gross pay based on hours worked and pay rate |

| Net Pay Calculator | Calculates take-home pay after deductions |

| Overtime Pay Calculator | Calculates overtime pay based on hours worked and pay rate |

| Deductions Calculator | Calculates deductions such as taxes and health insurance |

In summary, the MN Wage Calculator Tool is a valuable resource for employees and employers in Minnesota. By understanding its features, benefits, and how to use it, users can ensure accurate calculations, compliance with labor laws, and increased transparency. By following best practices and avoiding common mistakes, users can get the most out of the tool and ensure a smooth and efficient payroll process.

What is the MN Wage Calculator Tool?

+

The MN Wage Calculator Tool is a resource for calculating wages, deductions, and other related factors in Minnesota.

How do I use the MN Wage Calculator Tool?

+

To use the tool, enter employee information, select deductions, calculate wages, and review and verify the calculations.

What are the benefits of using the MN Wage Calculator Tool?

+

The benefits of using the tool include accurate calculations, compliance with labor laws, time-saving, and increased transparency.