5 Budget Tips from Gail Vaz-Oxlade

In today's world, where financial stability is more crucial than ever, gaining wisdom from seasoned experts like Gail Vaz-Oxlade can be immensely beneficial. Renowned for her no-nonsense approach to money management, Gail offers straightforward advice that helps individuals take control of their finances. Here are five budget tips inspired by Gail Vaz-Oxlade's methods to help you optimize your financial health:

1. Understand Your Expenses

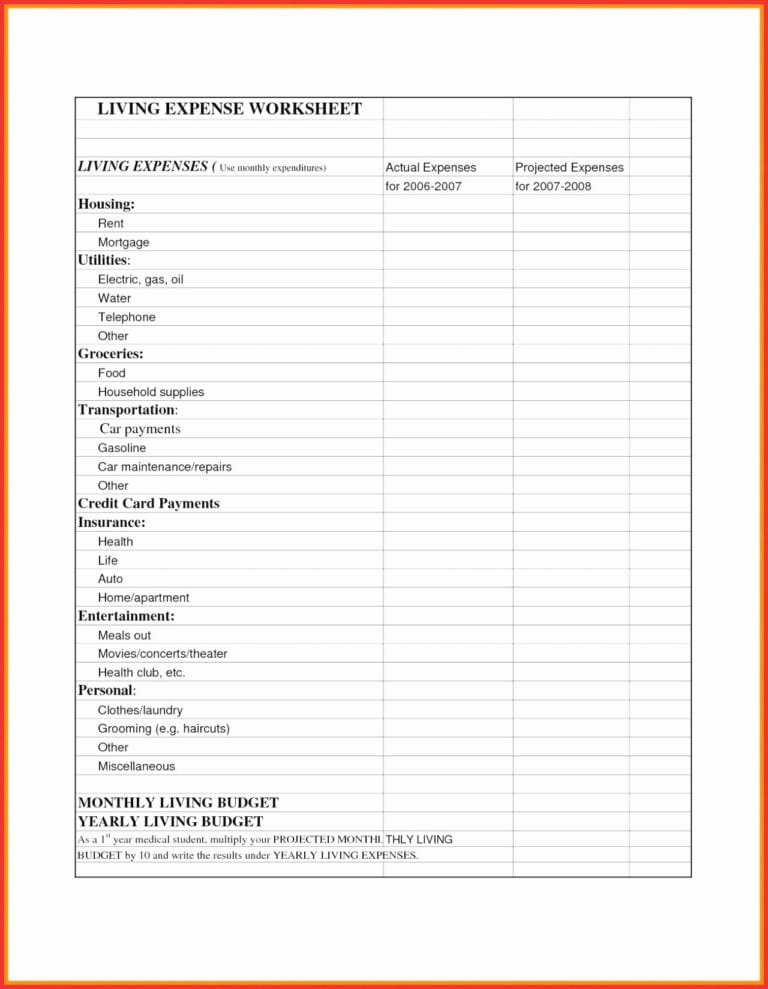

Before you can manage your money effectively, you need a clear picture of where your money goes. Tracking your expenses is the first step towards mindful spending. Here’s how:

- List your expenses: Write down everything you spend money on over a month.

- Categorize your costs: Divide them into fixed expenses (like rent or mortgage) and variable expenses (such as groceries or entertainment).

- Use budgeting apps or tools: Apps like Mint or YNAB (You Need a Budget) can automate this process for you.

- Analyze your spending patterns: Are there areas where you consistently overspend?

📝 Note: This initial step of tracking can be time-consuming but is crucial for identifying areas to cut back.

2. Create a Realistic Budget

With an understanding of your expenditures, it’s time to create a budget. Here’s how to make it realistic:

- Set clear financial goals: Whether it’s saving for a house, retirement, or simply reducing debt, know what you’re working towards.

- Allocate your income: Use the 50/30/20 rule - 50% on needs, 30% on wants, and 20% for savings or debt repayment.

- Adjust for Reality: If your budget doesn’t reflect your actual spending, tweak it until it does.

Below is a sample budget to guide you:

| Category | Amount Allocated |

|---|---|

| Rent/Mortgage | 30% of Income |

| Groceries | 15% of Income |

| Utilities | 10% of Income |

| Savings | 20% of Income |

| Entertainment | 10% of Income |

| Other Expenses | 15% of Income |

3. Cut Unnecessary Costs

Gail is a firm believer in eliminating unnecessary expenses. Here’s how to do that:

- Review your subscriptions: Are you really using that gym membership or streaming service?

- Bulk buying wisely: Buying in bulk can save money, but only for items you use regularly.

- Cook at Home: Eating out is one of the biggest culprits of overspending.

- DIY where possible: From home repairs to beauty treatments, doing it yourself can cut costs significantly.

4. Manage Debt Wisely

Debt can be a major roadblock to financial freedom. Gail suggests the following steps:

- Prioritize high-interest debts: Use the snowball or avalanche method to tackle credit card debt first.

- Avoid new debt: Use cash or debit instead of credit cards when possible.

- Consolidate if necessary: If you have multiple debts, consider consolidating them for easier management and possibly lower interest rates.

🔄 Note: Remember, managing debt is not just about paying it off but also preventing it from accumulating again.

5. Save for Emergencies and Beyond

Having savings can shield you from financial shocks. Here’s how to save effectively:

- Set up an emergency fund: Aim for 3-6 months of living expenses as a buffer.

- Automate your savings: Set up automatic transfers to your savings account.

- Explore high-yield options: Savings accounts with higher interest rates can grow your money faster.

By following these tips, not only do you ensure you’re prepared for emergencies, but you also set the stage for future financial growth.

To wrap up, Gail Vaz-Oxlade's approach to budgeting is rooted in practicality, self-awareness, and discipline. Her tips guide individuals towards not just managing their money, but mastering it. Through understanding your spending, creating a realistic budget, cutting down on unnecessary expenses, managing debt, and saving systematically, you can achieve financial independence. This methodical approach ensures that you are not only prepared for the present but also for the future.

What if I can’t stick to my budget?

+

If you find it challenging to adhere to your budget, consider revising it to make it more flexible or realistic. Sometimes, tracking expenses for a longer period helps in understanding your actual spending patterns, allowing for a more tailored budget.

How can I motivate myself to save more?

+

Set specific, achievable goals. Visualize what your savings can do for you, whether it’s a vacation, a new home, or retirement. Automating your savings and watching it grow can also be incredibly motivating.

Should I pay off debt before saving?

+

While it’s wise to pay off high-interest debt first, having a small emergency fund is also crucial to prevent falling into more debt in case of unexpected expenses. Balance both, but prioritize the debt with the highest interest rate.

How can I handle unexpected expenses while budgeting?

+

Create an emergency category in your budget or set aside a portion of your income each month for unexpected costs. This fund can prevent dipping into your savings or using high-interest credit options.