Military

Maryland Tax Estimator Tool

Introduction to Tax Estimation

When it comes to managing your finances, understanding your tax obligations is crucial. This is especially true for residents of Maryland, where taxes can significantly impact your disposable income. To help individuals and businesses navigate the complexities of taxation, the Maryland tax estimator tool has been developed. This tool provides an accurate estimation of your tax liability, allowing you to plan your finances more effectively. In this article, we will delve into the details of the Maryland tax estimator tool, its benefits, and how it can be used to your advantage.

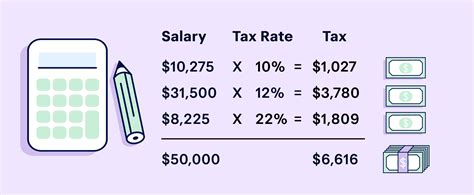

Understanding the Maryland Tax System

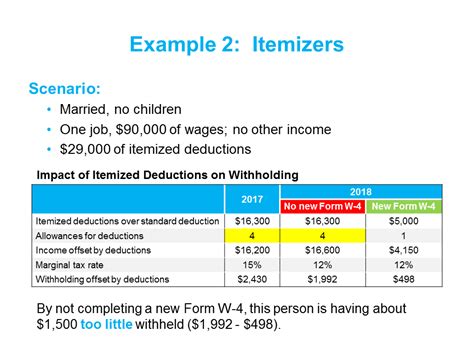

Before we explore the estimator tool, it’s essential to have a basic understanding of the Maryland tax system. Maryland has a progressive income tax system, with rates ranging from 4.75% to 5.75%. The tax rates apply to different brackets of income, and the rate you pay depends on your taxable income. Additionally, Maryland has a sales tax rate of 6%, which applies to most goods and services. Local jurisdictions may also impose their own taxes, which can increase the overall tax burden.

Benefits of the Maryland Tax Estimator Tool

The Maryland tax estimator tool offers several benefits to individuals and businesses. Some of the key advantages include: * Accuracy: The tool provides an accurate estimation of your tax liability, helping you avoid any surprises when you file your tax return. * Convenience: The tool is easy to use and can be accessed online, allowing you to estimate your taxes from the comfort of your own home. * Time-saving: The tool saves you time and effort, as you don’t need to manually calculate your taxes or consult with a tax professional. * Planning: The tool helps you plan your finances more effectively, as you can estimate your tax liability and make informed decisions about your income and expenses.

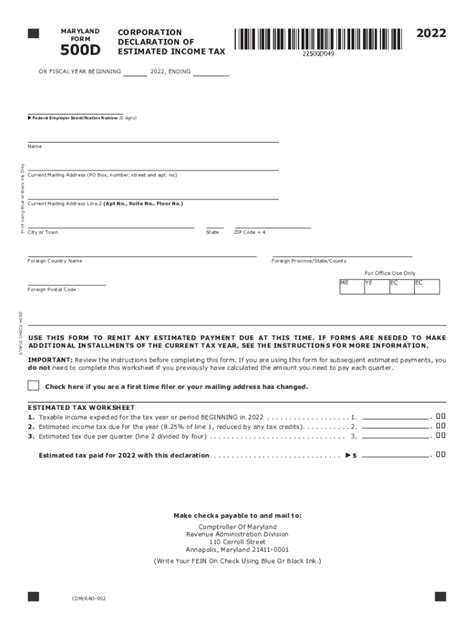

How to Use the Maryland Tax Estimator Tool

Using the Maryland tax estimator tool is a straightforward process. Here are the steps you need to follow: * Gather your income information: You will need to provide your income details, including your gross income, deductions, and exemptions. * Select your filing status: You will need to select your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). * Enter your dependents: You will need to enter the number of dependents you claim, as this can impact your tax liability. * Calculate your taxes: Once you have entered the required information, the tool will calculate your estimated tax liability.

📝 Note: The Maryland tax estimator tool is for estimation purposes only and should not be used as a substitute for professional tax advice.

Tax Credits and Deductions

In addition to the estimator tool, it’s essential to understand the various tax credits and deductions available in Maryland. Some of the key credits and deductions include: * Earned Income Tax Credit (EITC): A refundable credit for low-to-moderate income working individuals and families. * Child Tax Credit: A non-refundable credit for families with qualifying children. * Mortgage Interest Deduction: A deduction for mortgage interest paid on a primary residence. * Charitable Donations Deduction: A deduction for charitable donations made to qualified organizations.

Conclusion and Next Steps

In conclusion, the Maryland tax estimator tool is a valuable resource for individuals and businesses looking to estimate their tax liability. By understanding the tax system, using the estimator tool, and taking advantage of tax credits and deductions, you can minimize your tax burden and maximize your disposable income. To get started, simply access the Maryland tax estimator tool online and follow the prompts to estimate your taxes. Remember to consult with a tax professional if you have any questions or concerns about your tax liability.

What is the Maryland tax estimator tool?

+

The Maryland tax estimator tool is an online resource that helps individuals and businesses estimate their tax liability.

How do I use the Maryland tax estimator tool?

+

To use the tool, simply access it online and follow the prompts to enter your income information, select your filing status, and calculate your estimated tax liability.

What tax credits and deductions are available in Maryland?

+

Maryland offers various tax credits and deductions, including the Earned Income Tax Credit (EITC), Child Tax Credit, Mortgage Interest Deduction, and Charitable Donations Deduction.