-

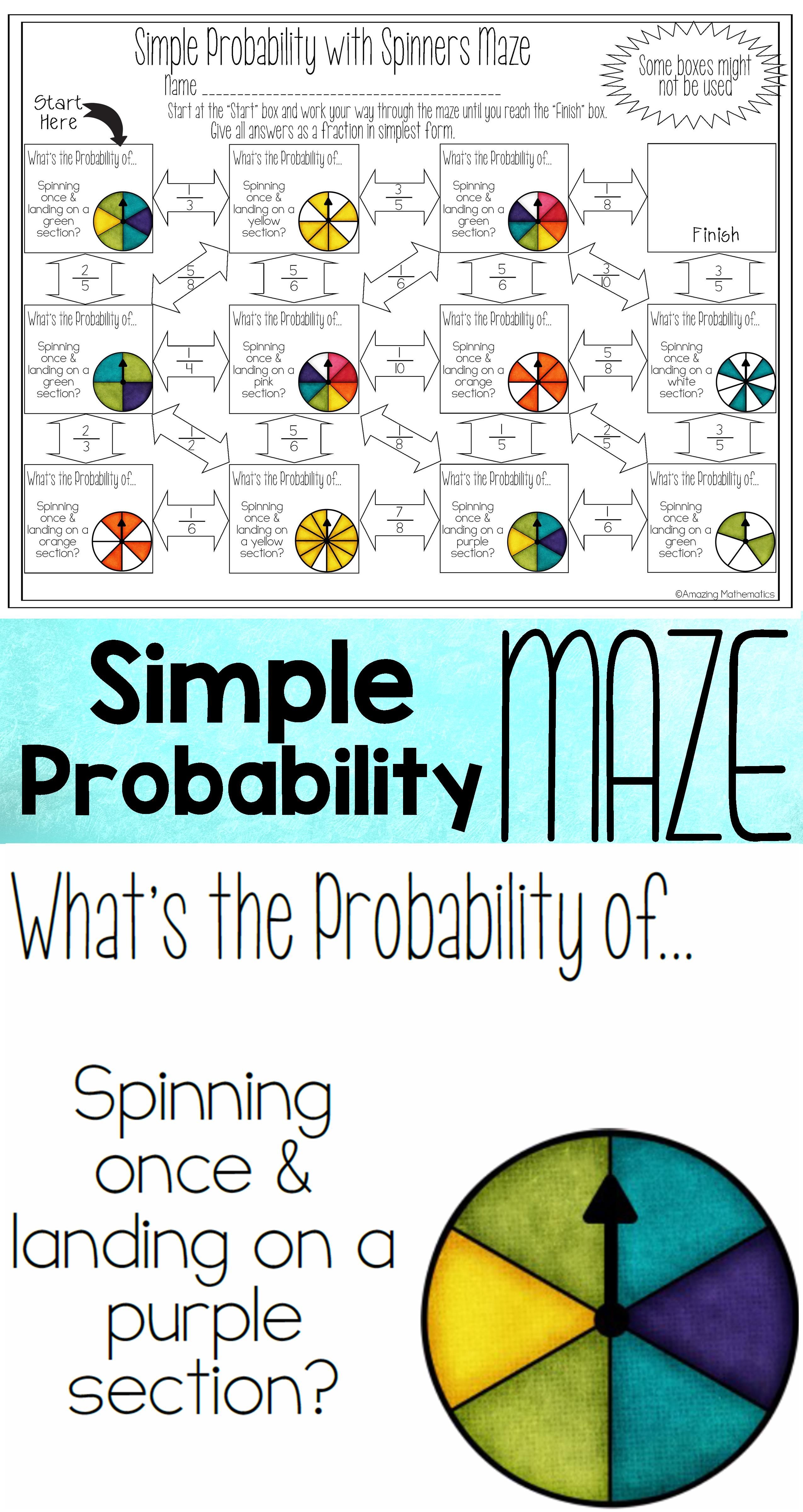

Unlock the Secrets of Theoretical Probability with Worksheets

This worksheet provides exercises and examples to help students understand and apply concepts of theoretical probability in various scenarios.

Read More » -

Investment Comparison Guide: Find the Best Option Easily

A worksheet designed to help compare different investment options, providing a structured analysis for better decision-making.

Read More » -

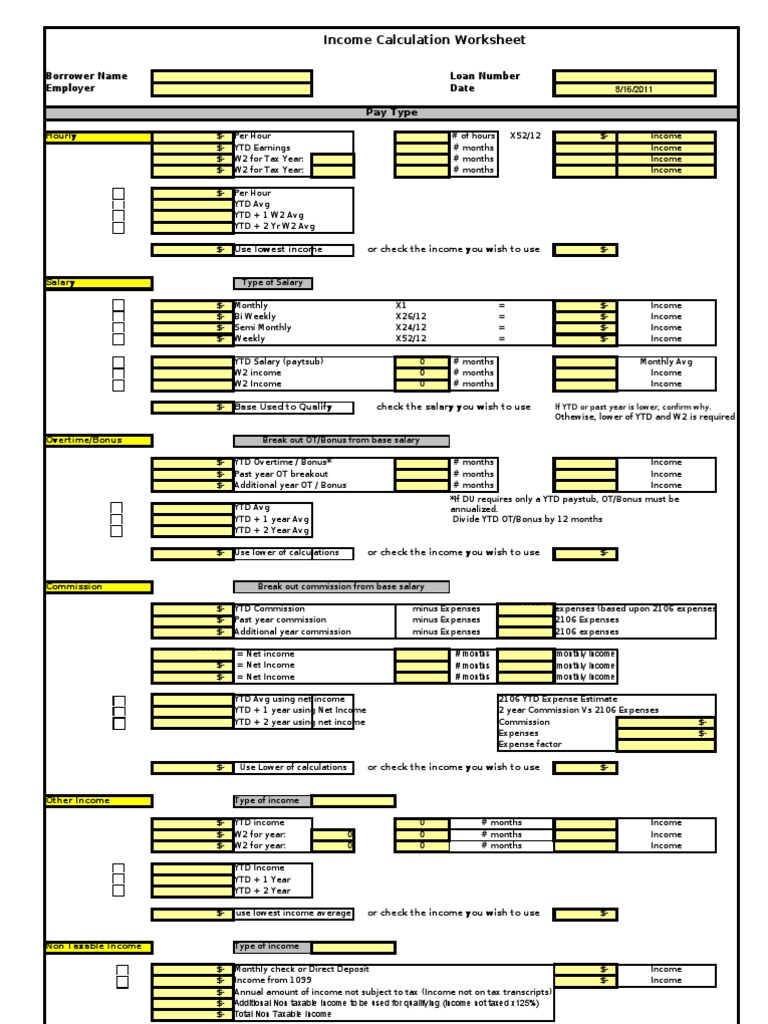

5 Ways to Maximize Your Magic Income Calculator

The Mgic Income Calculator Worksheet provides a detailed guide for calculating income for mortgage insurance eligibility, helping potential homeowners determine their borrowing capacity.

Read More » -

5 Ways to Excel at Shifting Demand Worksheet Answers

This worksheet provides answers to help students understand how demand shifts in economics due to various factors like price changes, income variations, and consumer preferences.

Read More » -

5 Ways to Master Unit Rates With Fractions Worksheet

Practice calculating unit rates involving fractions with this educational worksheet.

Read More » -

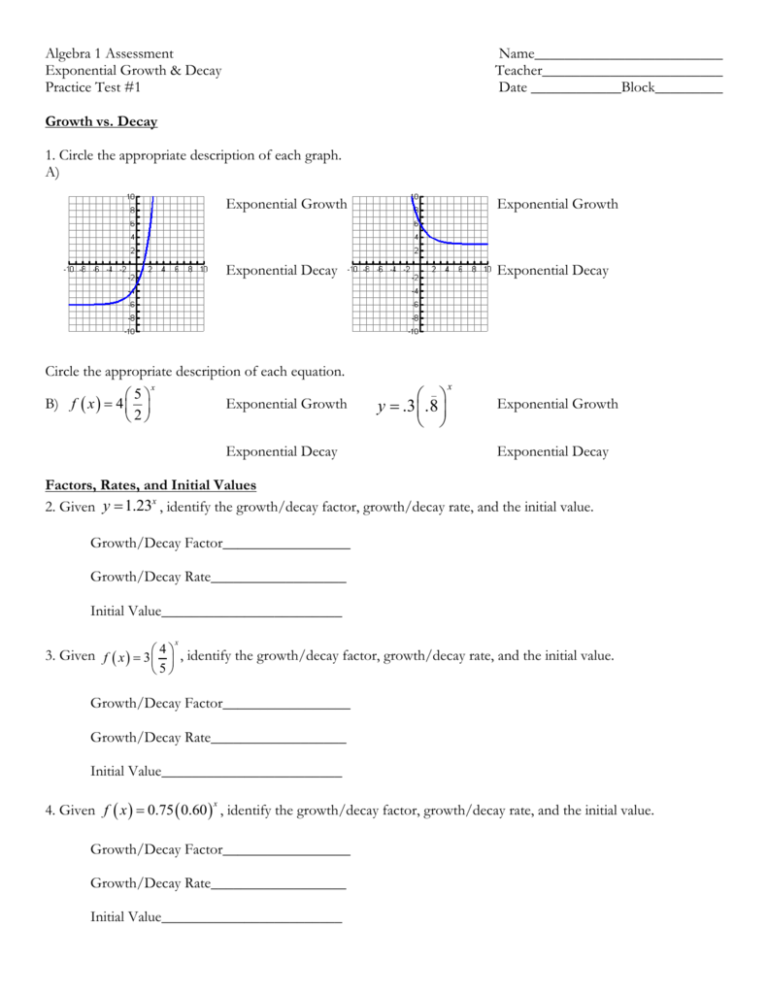

Exponential Regression: Mastering Data Analysis with Ease

This worksheet provides practice problems and examples to understand and apply exponential regression techniques in data analysis.

Read More » -

5 Easy Worksheets for Mastering Compound and Simple Interest

Worksheet with exercises to calculate and compare compound versus simple interest over time.

Read More » -

S&P 500 Worksheet Answer Key: Your Ultimate Guide

Discover the S&P 500 worksheet answer key, providing insights into stock market performance calculations and interpretations, aiding in financial education.

Read More » -

Maximize Your Savings with IRS Credit Limit Worksheet A

IRS Credit Limit Worksheet helps taxpayers calculate their Earned Income Credit, assisting in determining the maximum allowable credit.

Read More » -

5 Essential Tips for Reading Your Pay Stub

This worksheet provides answers to common questions about interpreting details found on a pay stub, assisting employees in understanding their earnings, deductions, and net pay.

Read More »