Investment Comparison Guide: Find the Best Option Easily

In today’s dynamic investment landscape, finding the best option to grow your wealth can feel like navigating a maze. Whether you’re saving for retirement, looking to increase your financial security, or seeking to create additional income streams, understanding the various investment vehicles is crucial. This comprehensive guide will walk you through some of the most popular investment options, comparing their risk profiles, expected returns, and suitability for different investor profiles.

Understanding Different Investment Types

Before diving into specific investments, it’s essential to understand the general categories:

Stocks: Owning shares of a company gives you equity in it. Stocks are known for potentially high returns but come with significant risks due to market volatility.

Bonds: Investing in bonds means you’re lending money to an entity (government or corporate) which pays you back with interest over time. They are generally safer than stocks but offer lower returns.

Real Estate: Real estate can provide both rental income and capital appreciation. It requires substantial initial investment but can be less liquid.

Mutual Funds: These funds pool money from investors to invest in a diversified portfolio of assets. They’re managed by professionals, reducing the need for individual stock selection.

ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on exchanges like stocks, offering flexibility and often lower fees.

Cryptocurrencies: Digital or virtual currencies that use cryptography for security. They are highly speculative and volatile.

Comparative Analysis of Investment Options

1. Stocks

Potential Returns: High, especially with growth stocks.

Risk: High due to market and company-specific risks.

Liquidity: Generally very liquid.

Investment Time Horizon: Long-term.

Suitability: Best for investors with a higher risk tolerance looking for growth over many years.

🔍 Note: Investing in individual stocks requires research and often comes with higher costs due to trading fees.

2. Bonds

Potential Returns: Moderate to low; depends on the issuer’s credit rating.

Risk: Varies; government bonds are low risk, corporate bonds can be riskier.

Liquidity: Moderate to low, depending on the bond type.

Investment Time Horizon: Medium to long-term.

Suitability: Ideal for conservative investors or those looking to balance a riskier portfolio.

Real Estate

Potential Returns: Appreciation of property value plus rental income.

Risk: Market risk, leverage risk, property management issues.

Liquidity: Low; selling property takes time.

Investment Time Horizon: Long-term.

Suitability: Suitable for investors who want a tangible asset and are willing to manage or delegate property management.

Mutual Funds

Potential Returns: Depends on the fund’s strategy but generally provides balanced returns.

Risk: Moderate; depends on the asset allocation.

Liquidity: High, though there might be redemption fees.

Investment Time Horizon: Varies, typically medium to long-term.

Suitability: Great for investors looking for diversified exposure without managing individual stocks.

ETFs

Potential Returns: Similar to mutual funds but with the added benefit of trading like stocks.

Risk: Varies based on what the ETF is tracking.

Liquidity: High, can be bought or sold at any time during market hours.

Investment Time Horizon: Can be short-term to long-term.

Suitability: Ideal for investors who want the diversification of mutual funds with the trading flexibility of stocks.

Cryptocurrencies

Potential Returns: Very high but extremely volatile.

Risk: Extremely high due to regulatory changes, market sentiment, and technological risks.

Liquidity: High, although it can vary by specific cryptocurrency.

Investment Time Horizon: Short to medium-term, due to volatility.

Suitability: For those with a high risk appetite, understanding of blockchain technology, and potentially looking to diversify into digital assets.

Investment Options Table

<table>

<tr>

<th>Investment Type</th>

<th>Risk</th>

<th>Potential Returns</th>

<th>Liquidity</th>

<th>Time Horizon</th>

<th>Suitability</th>

</tr>

<tr>

<td>Stocks</td>

<td>High</td>

<td>High</td>

<td>High</td>

<td>Long-term</td>

<td>High Risk Tolerance</td>

</tr>

<tr>

<td>Bonds</td>

<td>Low to Moderate</td>

<td>Moderate to Low</td>

<td>Moderate</td>

<td>Medium to Long-term</td>

<td>Conservative Investors</td>

</tr>

<tr>

<td>Real Estate</td>

<td>Moderate to High</td>

<td>High</td>

<td>Low</td>

<td>Long-term</td>

<td>Willing to Manage</td>

</tr>

<tr>

<td>Mutual Funds</td>

<td>Moderate</td>

<td>Balanced</td>

<td>High</td>

<td>Medium to Long-term</td>

<td>Diversified Investors</td>

</tr>

<tr>

<td>ETFs</td>

<td>Varies</td>

<td>Varies</td>

<td>High</td>

<td>Varies</td>

<td>Flexible Investors</td>

</tr>

<tr>

<td>Cryptocurrencies</td>

<td>Very High</td>

<td>Very High</td>

<td>Varies</td>

<td>Short to Medium-term</td>

<td>High Speculation</td>

</tr>

</table>

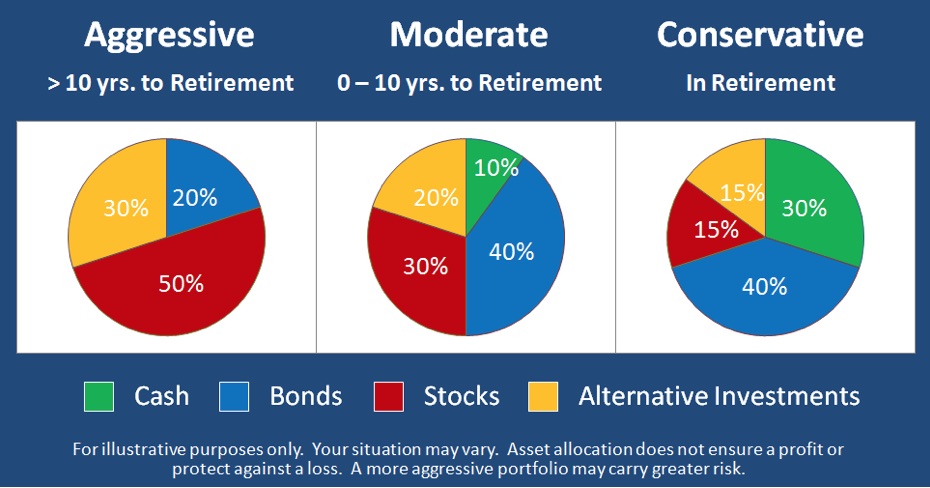

In summary, each investment vehicle carries its own set of risks, returns, and suitability considerations. Stocks might provide high growth opportunities but come with significant risk, while bonds offer stability but with potentially lower returns. Real estate investments can be lucrative but require a longer-term commitment and more active management. Mutual Funds and ETFs offer a way to diversify without the need to pick individual stocks, with ETFs adding trading flexibility. Cryptocurrencies are for those willing to take on extreme risk for potentially extreme rewards.

💡 Note: Always consider your personal financial goals, risk tolerance, and investment horizon when choosing where to invest.

In the end, the best investment option isn’t a one-size-fits-all solution. It’s about aligning your investments with your financial goals, understanding the market conditions, and perhaps most importantly, being comfortable with the level of risk you’re taking on. Diversification across multiple types can mitigate some risks and help balance potential rewards. Remember, no investment guide can predict the future; they merely help you make informed decisions based on historical data and current trends.

FAQs

How do I determine my risk tolerance?

+Your risk tolerance is influenced by your financial goals, investment timeline, financial situation, and your comfort with market fluctuations. Consider using online risk tolerance questionnaires or consult with a financial advisor.

Can I invest in multiple investment types?

+Absolutely! Diversifying your investments across different types can help manage risk while potentially maximizing returns. Many investors maintain a portfolio that includes stocks, bonds, and possibly real estate or other alternative investments.

What should I consider before investing in cryptocurrencies?

+Consider your understanding of blockchain technology, the regulatory environment, your risk tolerance, and whether you’re comfortable with high volatility. Also, never invest more than you can afford to lose.