-

Maximize Tax Savings with Qualified Dividends Guide

This article explains how to use the Qualified Dividends and Capital Gain Tax Worksheet to accurately calculate taxes on qualified dividends and long-term capital gains, assisting individuals in determining their tax obligations efficiently.

Read More » -

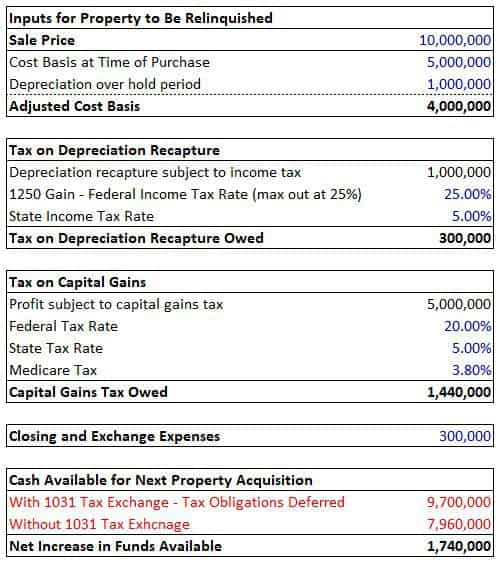

1031 Exchange: Simplified Worksheet for Tax Savings Calculation

Simplify your 1031 exchange process with this detailed calculation worksheet, designed to ensure compliance and optimize your tax benefits.

Read More » -

Maximize Your Tax Benefits with Worksheet 1 in Pub. 596

Explanation of how to use Worksheet 1 from IRS Publication 596 to determine eligibility for the Earned Income Credit.

Read More » -

Maximize Savings with Our 1031 Exchange Excel Worksheet

A step-by-step guide to using an Excel worksheet for managing and calculating 1031 Exchange transactions, aiding in tax deferral strategies.

Read More » -

Maximize Your Savings with Qualified Dividends Tax Guide

This worksheet helps determine the tax on qualified dividends and long-term capital gains, providing a method to calculate taxes separately from other income, ensuring accurate tax liability.

Read More »