Georgia Salary Calculator

Understanding the Georgia Salary Calculator

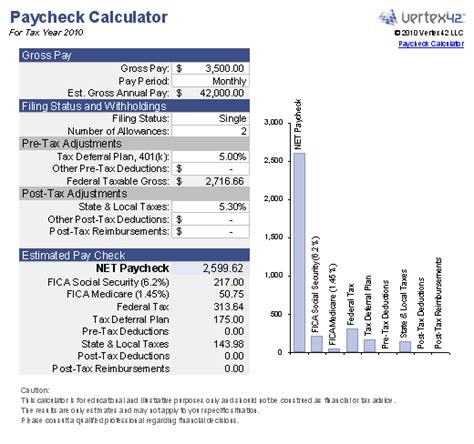

The Georgia salary calculator is a tool designed to help individuals estimate their net salary after deductions, based on their gross income. It takes into account various factors such as income tax, social security contributions, and other deductions to provide an accurate estimate of take-home pay. This calculator is particularly useful for those who are considering a job offer in Georgia or are looking to understand how their salary will be affected by taxes and other deductions.

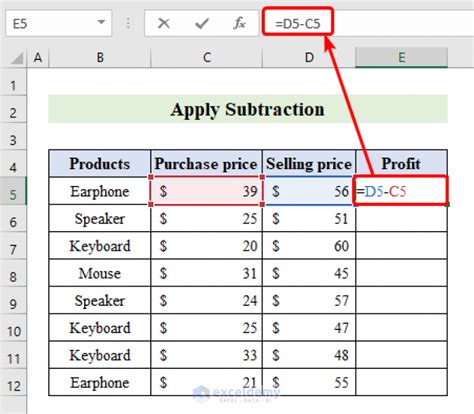

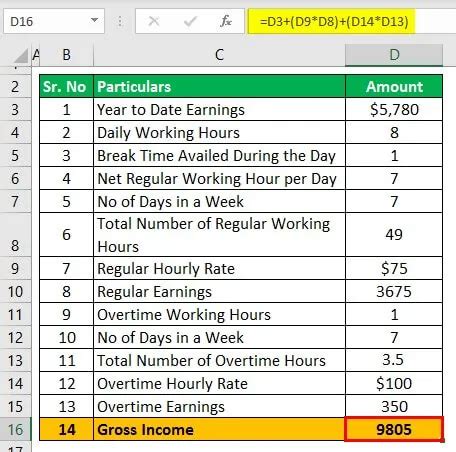

How the Georgia Salary Calculator Works

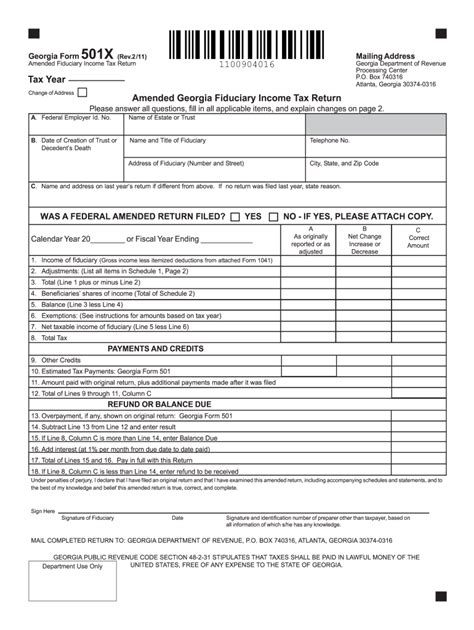

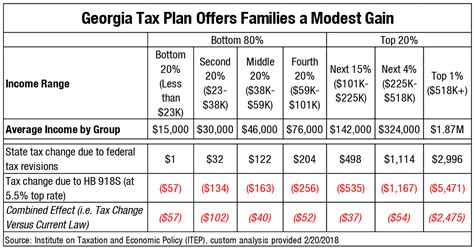

To use the Georgia salary calculator, individuals need to input their gross income, which is the total amount of money they earn before any deductions are made. The calculator then applies the relevant tax rates and deductions to estimate the net salary. The key factors that are taken into account include: * Federal income tax: This is the tax levied by the federal government on an individual’s income. * State income tax: Georgia has a state income tax, which ranges from 1% to 5.75%, depending on the individual’s income level. * Social security contributions: These are mandatory contributions made by employees and employers to fund social security programs. * Other deductions: These may include health insurance premiums, retirement plan contributions, and other benefits.

Benefits of Using the Georgia Salary Calculator

Using the Georgia salary calculator can provide several benefits, including: * Accurate estimates: The calculator provides an accurate estimate of take-home pay, helping individuals to budget and plan their finances effectively. * Informed decision-making: By understanding how their salary will be affected by taxes and other deductions, individuals can make informed decisions about job offers and salary negotiations. * Financial planning: The calculator can help individuals to plan their finances, including saving for retirement, paying off debt, and achieving other financial goals.

Key Considerations When Using the Georgia Salary Calculator

When using the Georgia salary calculator, there are several key considerations to keep in mind: * Tax rates and laws: Tax rates and laws are subject to change, so it’s essential to ensure that the calculator is up-to-date and reflects the current tax environment. * Individual circumstances: The calculator provides a general estimate, and individual circumstances may affect the accuracy of the estimate. For example, individuals with dependents or those who are self-employed may need to take into account additional factors. * Other benefits and deductions: The calculator may not take into account all benefits and deductions, such as health insurance premiums or retirement plan contributions, so individuals should factor these in when estimating their take-home pay.

| Gross Income | Federal Income Tax | State Income Tax | Net Salary |

|---|---|---|---|

| $50,000 | $8,000 | $2,000 | $40,000 |

| $75,000 | $15,000 | $3,750 | $56,250 |

| $100,000 | $20,000 | $5,000 | $75,000 |

📝 Note: The table above provides a simplified example of how the Georgia salary calculator works and is not intended to reflect actual tax rates or calculations.

In summary, the Georgia salary calculator is a useful tool for individuals who want to estimate their net salary after deductions. By taking into account various factors such as income tax, social security contributions, and other deductions, the calculator provides an accurate estimate of take-home pay. However, it’s essential to keep in mind the key considerations, including tax rates and laws, individual circumstances, and other benefits and deductions.

What is the Georgia salary calculator?

+

The Georgia salary calculator is a tool designed to help individuals estimate their net salary after deductions, based on their gross income.

How does the Georgia salary calculator work?

+

The calculator takes into account various factors such as income tax, social security contributions, and other deductions to provide an accurate estimate of take-home pay.

What are the benefits of using the Georgia salary calculator?

+

The benefits of using the Georgia salary calculator include accurate estimates, informed decision-making, and financial planning.

Related Terms:

- Hourly paycheck calculator Georgia

- Georgia income tax calculator

- Weekly salary calculator ga

- Free salary calculator ga

- Salary calculator ga hourly

- Take home pay calculator