7 Tax Deductions Every Realtor Needs to Know

In the world of real estate, success doesn't come without its share of hard work, dedication, and a keen eye for detail. Not only do you need to have a strong grasp on the market, but you also need to be equally savvy when it comes to managing your finances, especially regarding tax deductions. As a realtor, maximizing your deductions can significantly impact your net income. Here, we delve into seven key tax deductions that every realtor should be aware of to ensure you're not leaving money on the table come tax season.

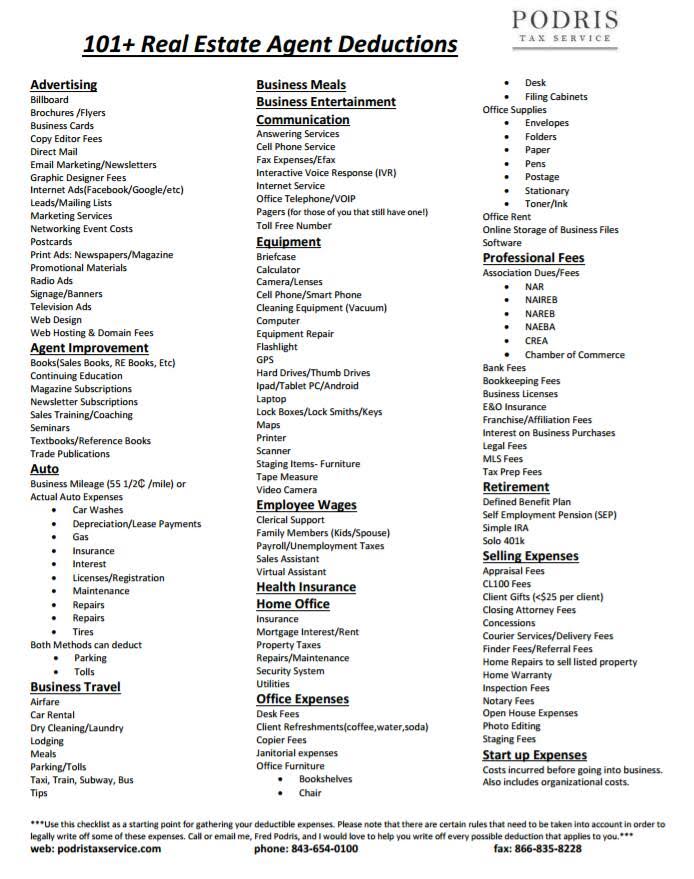

1. Home Office Deduction

One of the most substantial deductions available to realtors is the home office deduction. If you use part of your home regularly and exclusively for business activities, you could deduct a portion of your housing expenses such as:

- Mortgage interest or rent

- Utilities

- Homeowners insurance

- Repairs and maintenance directly related to the office area

🏡 Note: The space must be used exclusively for business purposes to qualify for this deduction. If you use your home office to also store personal items, you might not be eligible.

2. Vehicle Expenses

Realtors often find themselves on the road, showing properties, attending meetings, or networking events. Therefore, vehicle expenses constitute a significant deduction:

- Mileage rates

- Lease payments or depreciation

- Gas, oil, repairs, maintenance, insurance, and registration fees

Keep meticulous records of your travel logs to substantiate these deductions. You can either use the standard mileage rate or actual expenses, whichever is more beneficial for your situation.

3. Marketing and Advertising Costs

Real estate is all about visibility and making the right impression. Costs related to marketing and advertising are fully deductible:

- Business cards

- Signage

- Online advertising

- Print advertising in magazines or newspapers

4. Professional Fees and Licenses

To keep your real estate license active and up to date, you might incur various fees:

- License renewal fees

- Professional association dues

- Continuing education courses

These fees can add up, but the good news is that they are all deductible.

5. Travel Expenses

When your job takes you away from your tax home, travel expenses can be deducted. This includes:

- Hotel accommodations

- Flights or other transportation costs

- Meals (while on business travel, limited to 50% of the cost)

Keeping detailed travel itineraries and receipts is crucial to claiming these expenses.

6. Insurance Premiums

Insurance costs for your business are deductible. This can include:

- Health insurance for yourself and your employees

- Errors and omissions insurance

- Property insurance for your office or business equipment

7. Retirement Plans and Health Savings Accounts (HSA)

Realtors can benefit from significant tax advantages by contributing to retirement plans or HSAs:

- IRA, SEP-IRA, or Solo 401(k) contributions are deductible, reducing your taxable income

- Contributions to an HSA can be deducted, providing triple tax advantages (deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses)

Being diligent about understanding and applying these tax deductions can greatly influence your financial health. As a realtor, your ability to claim these deductions correctly can make the difference between a good year and a great one.

Can I deduct my mobile phone bill?

+

Yes, if you use your mobile phone primarily for business, you can deduct a portion of the cost. Keep a log of your business usage versus personal usage to substantiate the deduction.

Are client gifts tax-deductible?

+

Yes, gifts given to clients for business purposes are deductible up to $25 per client per year. Remember to keep records of these expenses.

How long should I keep my records for tax purposes?

+

It’s recommended to keep your records for at least three years from the date you file your return, but due to potential audits or changes in tax law, keeping them longer is advisable.