5 Steps to Your Rich Life: Ramit Sethi Worksheet

Embarking on a journey towards financial independence can seem like a daunting task. However, with the right guidance, tools, and mindset, achieving your rich life is not just a dream but an attainable reality. One such guide is the comprehensive worksheet by Ramit Sethi, renowned financial coach and author of "I Will Teach You to Be Rich." This worksheet isn't just about numbers; it's about aligning your financial goals with your life aspirations, offering a structured pathway to manage, save, and invest your money.

Step 1: Defining Your Rich Life

The first step in Ramit Sethi’s worksheet is to define what a rich life means to you. It’s not merely about accumulating wealth, but about understanding how money can enhance your quality of life. Here’s how to get started:

- Visualize Your Ideal Life: What does your perfect day look like? What do you want to achieve or experience in the next year, five years, or ten?

- Financial Priorities: List down your must-haves, your savings, investments, and guilt-free spending.

- Identify Your Values: How do you want to spend your money? Is it on travel, experiences, comfort, or philanthropy?

Example:

Imagine your ideal week could involve:

| Activity | Cost Estimation |

|---|---|

| 2-Day Weekend Getaway | 500</td> </tr> <tr> <td>Dinner at a Fine Dining Restaurant</td> <td>150 |

| Monthly Spa Day | 100</td> </tr> <tr> <td>Savings for Retirement</td> <td>300 |

Through this exercise, you begin to envision your life, not just as a series of numbers in an account, but as a series of enriching experiences.

💡 Note: Your rich life isn't fixed. It evolves as your circumstances, preferences, and aspirations change.

Step 2: Setting Financial Goals

After establishing what a rich life looks like for you, the next step is to concretize your financial goals. Here’s how:

- Short-Term Goals: These could include saving for a vacation, buying new furniture, or starting an emergency fund.

- Medium-Term Goals: Goals like buying a car, investing in a home, or education for children fit here.

- Long-Term Goals: Retirement, legacy investments, or creating a financial safety net for your family.

- Assign each goal a monetary value and a deadline.

Tracking Your Goals:

Once you’ve identified your goals, track your progress. Here’s a sample table to help:

| Goal | Target Amount | Current Savings | Deadline |

|---|---|---|---|

| Emergency Fund | 10,000</td> <td>3,000 | 1 Year | |

| Vacation | 4,500</td> <td>2,000 | 6 Months | |

| Retirement | 1 Million</td> <td>50,000 | 30 Years |

Assigning a monetary value and a deadline to each goal provides a tangible pathway to achieving them.

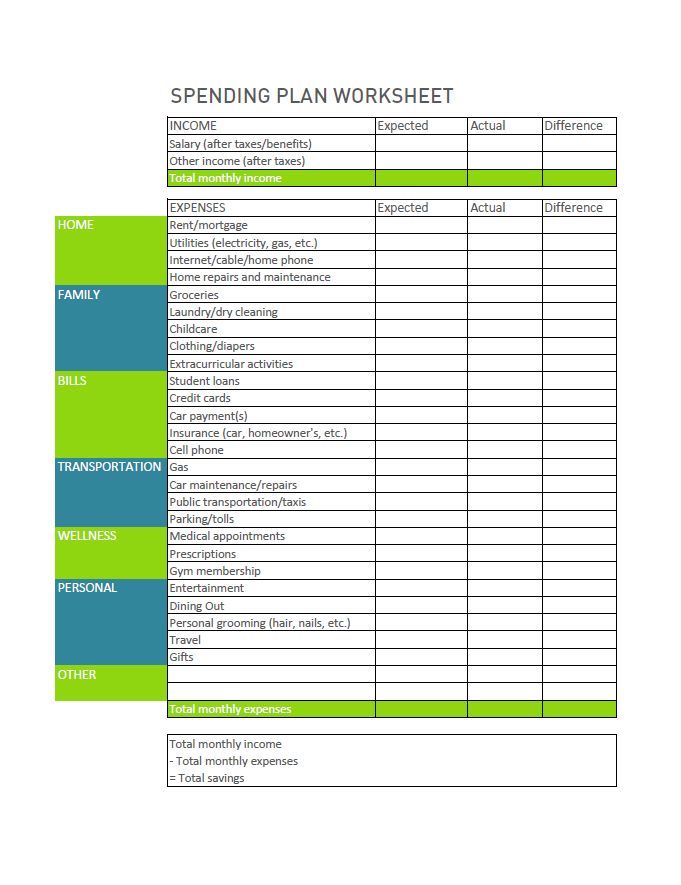

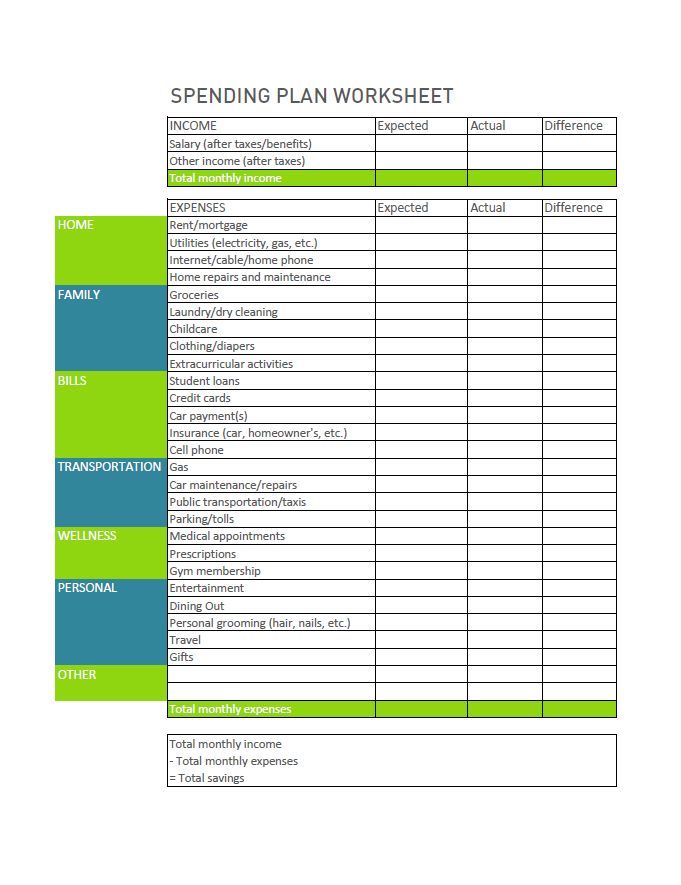

Step 3: Understanding Your Income and Expenses

Now that you’ve set your sights on your financial goals, understanding where your money comes from and goes is crucial. Here’s how to map it out:

- Income: List all your income sources, from salary to side gigs.

- Fixed Expenses: Regular payments like rent, utilities, insurance.

- Variable Expenses: These fluctuate, like groceries, dining out, or entertainment.

- Subtract your total expenses from your income to see your discretionary income.

Example Income and Expense Breakdown:

| Category | Monthly Amount |

|---|---|

| Income | 5,000</td> </tr> <tr> <td colspan="2"><b>Fixed Expenses:</b></td> </tr> <tr> <td>Rent/Mortgage</td> <td>1,500 |

| Utilities | 250</td> </tr> <tr> <td>Insurance</td> <td>200 |

| Loan Payments | 300</td> </tr> <tr> <td colspan="2"><b>Variable Expenses:</b></td> </tr> <tr> <td>Groceries</td> <td>400 |

| Eating Out | 150</td> </tr> <tr> <td>Entertainment</td> <td>100 |

| Transportation | 100</td> </tr> <tr> <td>Discretionary Income</td> <td>2,000 |

🔍 Note: Monitoring your expenses isn’t about restricting yourself; it's about understanding and optimizing your spending habits.

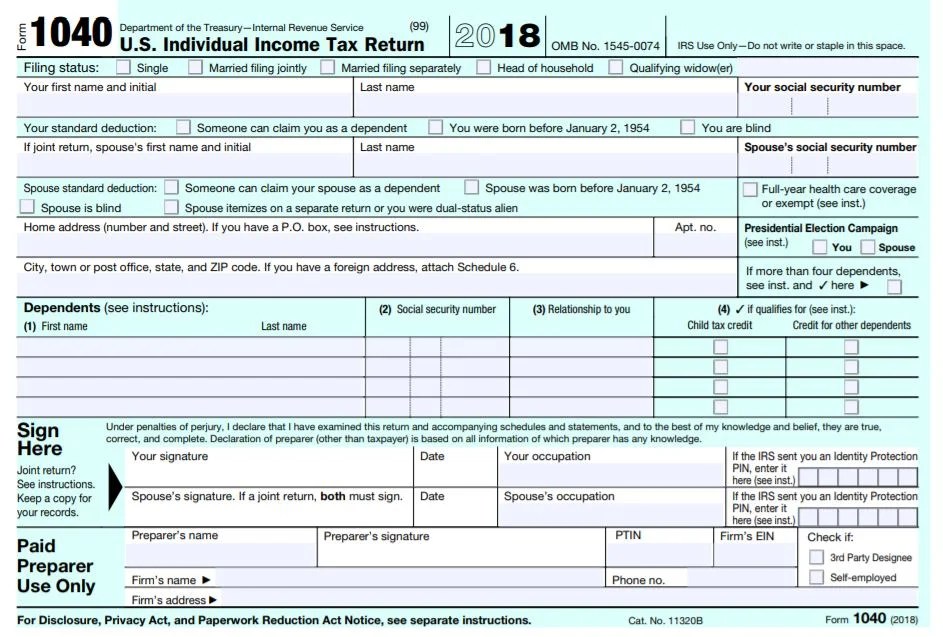

Step 4: Creating a Financial Plan

With a clear picture of your financial situation, it’s time to formulate a financial plan that leads towards your rich life:

- Automation: Automate savings, investments, and bill payments to avoid lapses.

- Reduce Costs: Look for savings in your fixed and variable expenses.

- Invest: Allocate your discretionary income into investments that align with your risk profile and financial goals.

- Increase Income: Explore additional income streams to bolster your financial health.

Financial Plan Examples:

- Savings: Automate monthly transfers of 500 to an emergency fund and another 300 to a vacation fund.

- Investing: Open an investment account, set up automatic contributions, and choose low-cost, diversified funds.

- Expense Reduction: Cut down entertainment costs by hosting movie nights at home instead of going to theaters.

- Income: Start freelancing on weekends, which could add 500-1,000 to your monthly income.

Having a plan is crucial, but equally important is being flexible enough to adapt the plan as your life changes.

Step 5: Review and Adjust

The final step in Ramit Sethi’s worksheet is to review and adjust your plan periodically. Here’s what this entails:

- Monthly Review: Assess your progress towards your goals, your income, and expenses.

- Quarterly Analysis: Dive deeper into your financial plan, looking for opportunities to optimize.

- Annual Check: Reflect on your aspirations, goals, and financial strategy for the next year.

Adjusting Your Plan:

Here are some adjustments you might make:

- Increase your automatic savings or investment contributions as your income grows.

- Reallocate funds towards goals that have become more pressing.

- Evaluate your spending habits to ensure they’re still aligned with your values and goals.

✅ Note: The journey to financial independence isn’t linear. Flexibility and adaptability are key to success.

Following these steps in Ramit Sethi’s worksheet brings not just financial clarity but also a sense of purpose and control over your money. Your rich life isn’t defined solely by numbers; it’s about living on your terms, making choices that enhance your well-being, and having the financial freedom to do so. Remember, the path to wealth is as much about knowing yourself as it is about managing your finances. By aligning your financial decisions with your life goals, you're paving a path to your rich life, one that’s both fulfilling and secure.

What if I can’t afford to start saving for all my goals?

+

Start small. Saving even a small amount regularly is better than not starting at all. You can adjust your goals and contributions as your financial situation improves.

How often should I review my financial goals?

+

At a minimum, review your goals monthly to ensure you’re on track. Quarterly reviews can be more in-depth, while an annual review provides a strategic overview.

Can I achieve a rich life even if my income is modest?

+

Absolutely. A rich life isn’t defined by the size of your income but by how you manage and utilize it. Efficient budgeting, wise investments, and focusing on what truly makes you happy can lead to a fulfilling rich life.