Military

Pennsylvania Tax Calculator Tool

Introduction to Pennsylvania Tax Calculator Tool

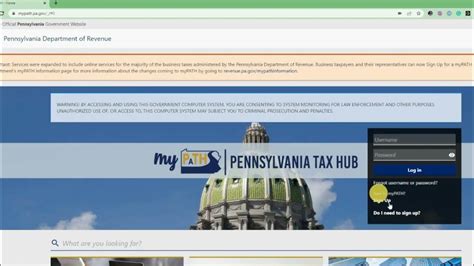

The Pennsylvania tax calculator tool is a valuable resource for individuals and businesses looking to calculate their tax liabilities in the state of Pennsylvania. With its user-friendly interface and accurate calculations, this tool can help individuals and businesses navigate the complex world of taxation. In this article, we will explore the features and benefits of the Pennsylvania tax calculator tool, as well as provide a step-by-step guide on how to use it.

Features of the Pennsylvania Tax Calculator Tool

The Pennsylvania tax calculator tool offers a range of features that make it an essential resource for taxpayers. Some of the key features include: * Tax liability calculation: The tool calculates the user’s tax liability based on their income, deductions, and credits. * Support for multiple filing statuses: The tool supports multiple filing statuses, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). * Handling of deductions and credits: The tool allows users to claim deductions and credits, such as the standard deduction, itemized deductions, and tax credits like the Earned Income Tax Credit (EITC). * Accuracy and reliability: The tool is regularly updated to reflect changes in tax laws and regulations, ensuring accurate and reliable calculations.

Benefits of Using the Pennsylvania Tax Calculator Tool

Using the Pennsylvania tax calculator tool can provide several benefits, including: * Simplified tax calculations: The tool simplifies the tax calculation process, reducing the risk of errors and saving time. * Increased accuracy: The tool ensures accurate calculations, reducing the risk of overpaying or underpaying taxes. * Improved tax planning: The tool allows users to explore different tax scenarios, making it easier to plan and make informed decisions about their taxes. * Convenience: The tool is available online, making it accessible from anywhere with an internet connection.

Step-by-Step Guide to Using the Pennsylvania Tax Calculator Tool

To use the Pennsylvania tax calculator tool, follow these steps: * Gather necessary information: Collect all necessary information, including income, deductions, and credits. * Select filing status: Choose the correct filing status from the available options. * Enter income and deductions: Enter income and deductions, including wages, interest, dividends, and capital gains. * Claim credits: Claim eligible tax credits, such as the EITC or child tax credit. * Review and calculate: Review the information entered and calculate the tax liability.

💡 Note: It is essential to ensure the accuracy of the information entered, as incorrect data can lead to incorrect calculations.

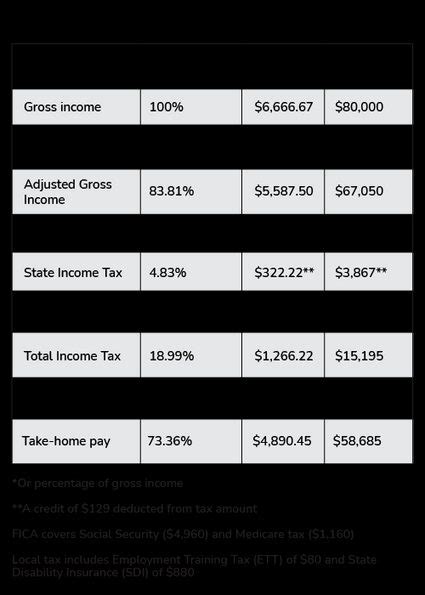

Tax Rates and Brackets in Pennsylvania

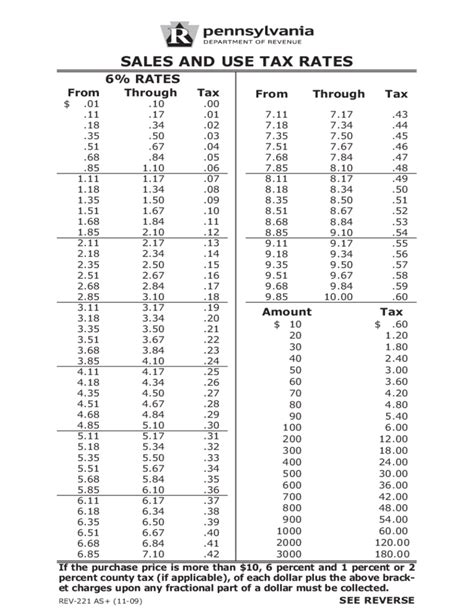

Pennsylvania has a flat state income tax rate of 3.07%. However, local taxes may apply, ranging from 0.5% to 2.5%. The following table outlines the tax rates and brackets in Pennsylvania:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 8,500 | 3.07% |

| 8,501 - 12,000 | 3.07% |

| $12,001 and above | 3.07% |

Local Taxes in Pennsylvania

In addition to the state income tax, local taxes may apply in Pennsylvania. These taxes are typically levied by municipalities, school districts, or counties. The rates and brackets for local taxes vary depending on the location. Some examples of local taxes in Pennsylvania include: * Philadelphia: 3.92% (city tax) * Pittsburgh: 3.0% (city tax) * Allegheny County: 2.0% (county tax)

Conclusion and Final Thoughts

In conclusion, the Pennsylvania tax calculator tool is a valuable resource for individuals and businesses looking to calculate their tax liabilities in the state of Pennsylvania. By following the step-by-step guide and understanding the features and benefits of the tool, users can ensure accurate and reliable calculations. Additionally, being aware of the tax rates and brackets, as well as local taxes, can help individuals and businesses make informed decisions about their taxes.

What is the state income tax rate in Pennsylvania?

+

The state income tax rate in Pennsylvania is 3.07%.

How do I use the Pennsylvania tax calculator tool?

+

To use the Pennsylvania tax calculator tool, follow the step-by-step guide outlined in the article, which includes gathering necessary information, selecting filing status, entering income and deductions, claiming credits, and reviewing and calculating the tax liability.

Are local taxes applied in Pennsylvania?

+