Master Your Money with Dave Ramsey Budget Worksheet

Struggling to keep track of your finances? You're not alone. Millions find budgeting a daunting task, but it doesn't have to be. The Dave Ramsey Budget Worksheet can transform your financial landscape, offering a structured path to financial freedom. Whether you're trying to get out of debt, save for your future, or simply manage your daily expenses better, this worksheet is your key to financial discipline and insight.

The Importance of Budgeting

Budgeting is the cornerstone of financial health. It:

- Tracks spending: Knowing where every penny goes helps prevent unnecessary expenditures.

- Controls cash flow: Manages your money inflow and outflow, ensuring you’re not overspending.

- Sets financial goals: Budgets turn dreams into achievable targets by mapping out how much money you need and when.

- Reduces stress: A budget alleviates the worry about money by providing clarity and control.

Why Choose Dave Ramsey’s Approach?

Dave Ramsey’s budgeting method has a proven track record:

- Zero-Based Budgeting: Every dollar has a purpose, with no money left unassigned.

- Baby Steps: A systematic plan to achieve financial stability and wealth.

- Psychological Commitment: Encourages behavioral changes by providing tangible financial steps.

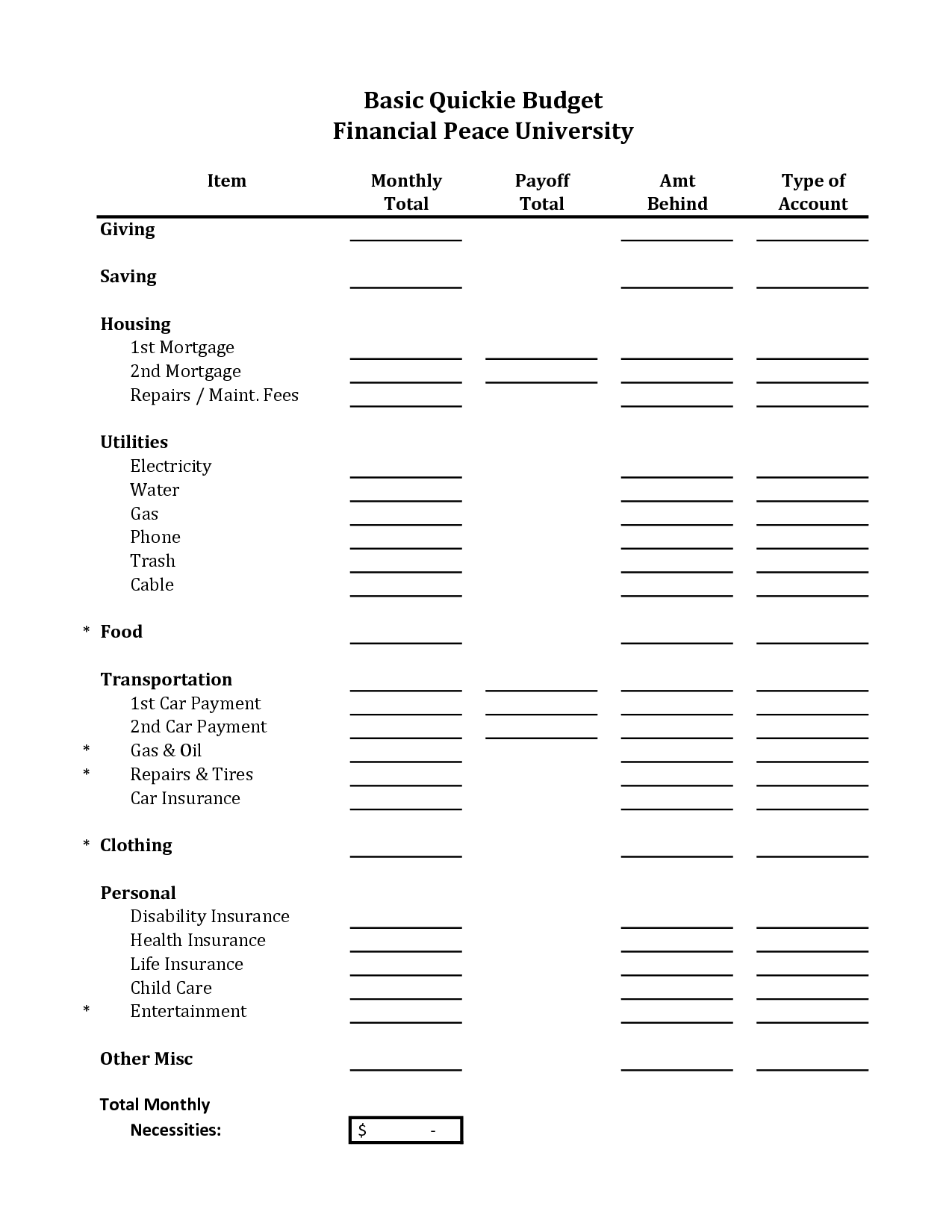

Understanding Dave Ramsey’s Budget Worksheet

The Dave Ramsey Budget Worksheet, also known as the EveryDollar app, facilitates:

- Income input: Log all sources of income, including regular pay, side gigs, or any additional income.

- Expense allocation: Assign each dollar to expenses like housing, utilities, groceries, savings, debt payments, and discretionary spending.

- Tracking actual spending: Compare actual expenses against the budgeted amount to see where adjustments are needed.

🔑 Note: The worksheet also helps in categorizing expenses into needs vs. wants, which aids in prioritizing spending.

How to Use the Dave Ramsey Budget Worksheet

Follow these steps to implement the budgeting method effectively:

- Download or access the budget worksheet - Available online or as an app.

- Calculate your total monthly income - Include all regular and irregular income sources.

- List your expenses:

- Fixed expenses (unchanging each month): Rent/mortgage, utilities, insurance, etc.

- Variable expenses: Food, entertainment, clothing, etc.

- Savings and investments: Emergency fund, retirement, or college fund.

- Debt payments: Loans, credit cards, etc.

- Charitable giving: Donations or contributions to charities or causes.

- Assign every dollar a purpose - Ensure every dollar from your income is accounted for in your budget.

- Monitor and adjust - Track your spending throughout the month and adjust your budget if necessary.

🌟 Note: Use the 'sinking fund' section of the worksheet to save for known future expenses like car maintenance, holidays, or gifts.

Tips for Effective Budgeting

Here are some best practices to ensure you stay on track:

- Be honest: Include all sources of income and every expenditure.

- Set realistic goals: Start small if budgeting is new to you; grow your financial discipline over time.

- Plan for the unexpected: Include an “emergency fund” in your budget.

- Use cash: Physical money can help you visualize your spending more easily.

- Regular review: Make budgeting a weekly or bi-weekly routine to keep financial progress on course.

📚 Note: For couples or families, communicate the budget to ensure everyone is on the same financial page.

Overcoming Common Budgeting Challenges

Many face similar issues when starting out:

- Unexpected expenses - Address these by having a buffer in your emergency fund.

- Unrealistic budgeting - Gradually tighten your budget instead of setting unattainable goals initially.

- Emotional spending - Recognize triggers and create a buffer for discretionary spending.

- Lack of follow-through - Set reminders or automate some processes to maintain consistency.

🔔 Note: Remember, the goal is not to cut out all fun but to control the frequency and scale of these expenses.

Conclusion

Budgeting might seem overwhelming at first, but with tools like Dave Ramsey’s Budget Worksheet, it becomes a manageable, empowering activity. As you allocate every dollar, your financial path becomes clear, and you’ll find yourself not just managing money, but mastering it. Through consistent application and adjustment, you’ll see your debt decrease, savings increase, and overall financial health improve. The worksheet is not just a tool but a guide to your financial journey, helping you to prioritize your financial future.

What if I have inconsistent income?

+

Use your average monthly income to set a baseline. Adjust your expenses accordingly each month, and consider the lowest month’s income as your budget baseline to ensure you always have a safety net.

Can I use the Dave Ramsey Budget Worksheet for long-term savings goals?

+

Yes, by including sinking funds for specific goals in your monthly budget, you can allocate money towards future expenses or long-term goals like buying a house or retirement.

How does Dave Ramsey’s method differ from other budgeting methods?

+

Ramsey’s method uses zero-based budgeting, where every dollar is assigned a purpose, and emphasizes psychological commitment through his ‘Baby Steps’ program for debt management and wealth building.