Florida Payroll Check Calculator

Introduction to Florida Payroll Check Calculator

In the state of Florida, calculating payroll checks can be a complex task, especially when considering the various factors that affect an employee’s take-home pay. The Florida Payroll Check Calculator is a tool designed to simplify this process, providing employers and employees with an accurate calculation of gross pay, deductions, and net pay. This calculator takes into account federal income tax, state income tax, Social Security tax, Medicare tax, and other deductions to provide a comprehensive overview of an employee’s payroll.

How to Use the Florida Payroll Check Calculator

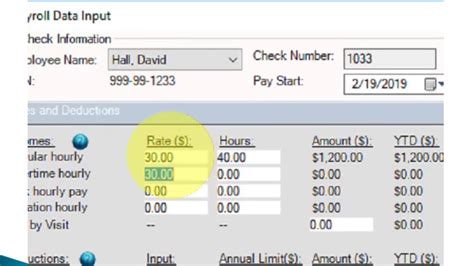

Using the Florida Payroll Check Calculator is a straightforward process that requires some basic information about the employee and their pay. Here are the steps to follow: * Enter the employee’s gross pay, which is their pay before any deductions. * Select the pay frequency, which can be weekly, bi-weekly, monthly, or annually. * Enter the number of dependents the employee claims. * Enter the filing status, which can be single, married, or head of household. * Select the state income tax rate, which is 0% in Florida since the state does not have a state income tax. * Enter any additional deductions, such as health insurance premiums or 401(k) contributions. * Click the calculate button to generate the payroll check calculation.

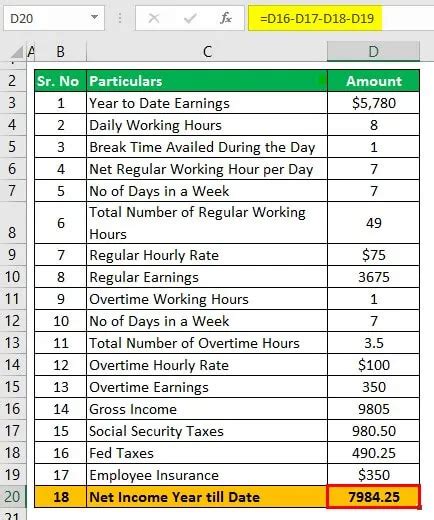

Understanding the Calculation

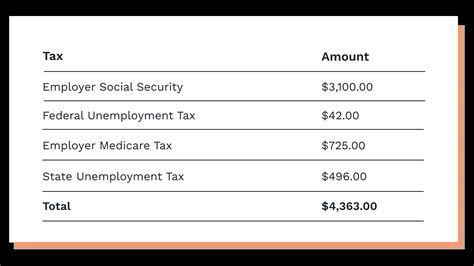

The Florida Payroll Check Calculator provides a detailed breakdown of the employee’s pay, including: * Gross pay: The employee’s pay before any deductions. * Federal income tax: The amount of federal income tax withheld from the employee’s pay. * Social Security tax: The amount of Social Security tax withheld from the employee’s pay. * Medicare tax: The amount of Medicare tax withheld from the employee’s pay. * State income tax: The amount of state income tax withheld from the employee’s pay, which is 0% in Florida. * Net pay: The employee’s take-home pay after all deductions.

📝 Note: The Florida Payroll Check Calculator assumes that the employee is subject to federal income tax, Social Security tax, and Medicare tax. It also assumes that the employee is not subject to state income tax since Florida does not have a state income tax.

Benefits of Using the Florida Payroll Check Calculator

Using the Florida Payroll Check Calculator provides several benefits, including: * Accuracy: The calculator ensures accurate calculations of gross pay, deductions, and net pay. * Simplification: The calculator simplifies the payroll calculation process, reducing the risk of errors. * Time-saving: The calculator saves time and effort, allowing employers and employees to focus on other tasks. * Compliance: The calculator ensures compliance with federal and state tax laws and regulations.

Common Deductions in Florida

Some common deductions in Florida include: * Health insurance premiums: Employees may deduct health insurance premiums from their pay. * 401(k) contributions: Employees may deduct 401(k) contributions from their pay. * Life insurance premiums: Employees may deduct life insurance premiums from their pay. * Disability insurance premiums: Employees may deduct disability insurance premiums from their pay.

| Deduction | Description |

|---|---|

| Health insurance premiums | Employees may deduct health insurance premiums from their pay. |

| 401(k) contributions | Employees may deduct 401(k) contributions from their pay. |

| Life insurance premiums | Employees may deduct life insurance premiums from their pay. |

| Disability insurance premiums | Employees may deduct disability insurance premiums from their pay. |

In summary, the Florida Payroll Check Calculator is a valuable tool for employers and employees in Florida, providing accurate calculations of gross pay, deductions, and net pay. By understanding how to use the calculator and the common deductions in Florida, employers and employees can ensure compliance with federal and state tax laws and regulations, simplify the payroll calculation process, and save time and effort.

What is the Florida Payroll Check Calculator?

+

The Florida Payroll Check Calculator is a tool designed to simplify the payroll calculation process, providing employers and employees with an accurate calculation of gross pay, deductions, and net pay.

How do I use the Florida Payroll Check Calculator?

+

To use the Florida Payroll Check Calculator, enter the employee’s gross pay, select the pay frequency, enter the number of dependents, enter the filing status, select the state income tax rate, enter any additional deductions, and click the calculate button.

What are some common deductions in Florida?

+

Some common deductions in Florida include health insurance premiums, 401(k) contributions, life insurance premiums, and disability insurance premiums.