Utah Payroll Calculator Tool

Introduction to Utah Payroll Calculator Tool

The Utah Payroll Calculator Tool is a vital resource for employers and employees alike, designed to simplify the process of calculating payroll taxes and ensuring compliance with state and federal regulations. In this blog post, we will delve into the features and benefits of the Utah Payroll Calculator Tool, exploring its functionality, advantages, and how it can be used to streamline payroll processing.

Understanding Utah Payroll Taxes

Before we dive into the specifics of the Utah Payroll Calculator Tool, it’s essential to understand the basics of Utah payroll taxes. Utah state income tax rates range from 4.95% to 4.95%, with a flat tax rate applicable to all taxpayers. Additionally, employers must also consider federal income tax withholdings, as well as Social Security and Medicare taxes. The Utah Payroll Calculator Tool takes into account these various tax rates and regulations, ensuring accurate calculations and minimizing the risk of errors.

Features of the Utah Payroll Calculator Tool

The Utah Payroll Calculator Tool boasts a range of features that make it an indispensable resource for payroll processing. Some of the key features include: * Tax calculation: The tool accurately calculates Utah state income tax, federal income tax, Social Security tax, and Medicare tax withholdings. * Gross-to-net calculation: The tool calculates the net pay for employees based on their gross income, taking into account all applicable taxes and deductions. * Payroll compliance: The tool ensures compliance with Utah state and federal regulations, reducing the risk of errors and penalties. * Customizable: The tool allows users to customize calculations based on specific employee data, including salary, deductions, and benefits.

Benefits of Using the Utah Payroll Calculator Tool

The Utah Payroll Calculator Tool offers numerous benefits to employers and employees, including: * Accuracy: The tool ensures accurate calculations, reducing the risk of errors and associated penalties. * Efficiency: The tool streamlines payroll processing, saving time and increasing productivity. * Compliance: The tool ensures compliance with Utah state and federal regulations, minimizing the risk of non-compliance. * Convenience: The tool is user-friendly and easily accessible, making it a convenient resource for payroll processing.

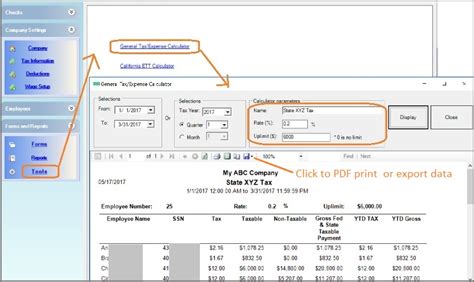

How to Use the Utah Payroll Calculator Tool

Using the Utah Payroll Calculator Tool is straightforward and easy. To get started, simply follow these steps: * Enter the employee’s gross income and select the desired pay frequency (e.g., weekly, bi-weekly, monthly). * Enter any applicable deductions, such as health insurance premiums or 401(k) contributions. * Select the employee’s filing status and number of dependents. * The tool will then calculate the net pay, taking into account all applicable taxes and deductions.

💡 Note: It's essential to ensure that all employee data is accurate and up-to-date to ensure accurate calculations and compliance with regulations.

Utah Payroll Tax Rates and Regulations

The following table outlines the current Utah payroll tax rates and regulations:

| Tax Type | Tax Rate |

|---|---|

| Utah State Income Tax | 4.95% |

| Federal Income Tax | Varies (10% - 37%) |

| Social Security Tax | 6.2% |

| Medicare Tax | 1.45% |

Conclusion and Final Thoughts

In conclusion, the Utah Payroll Calculator Tool is a valuable resource for employers and employees, providing accurate calculations and ensuring compliance with Utah state and federal regulations. By understanding the features and benefits of the tool, as well as the underlying tax rates and regulations, users can streamline payroll processing and minimize the risk of errors. Whether you’re an employer or employee, the Utah Payroll Calculator Tool is an essential resource for navigating the complexities of payroll taxes.

What is the current Utah state income tax rate?

+

The current Utah state income tax rate is 4.95%, with a flat tax rate applicable to all taxpayers.

How do I use the Utah Payroll Calculator Tool?

+

To use the Utah Payroll Calculator Tool, simply enter the employee’s gross income, select the desired pay frequency, and enter any applicable deductions. The tool will then calculate the net pay, taking into account all applicable taxes and deductions.

What are the benefits of using the Utah Payroll Calculator Tool?

+

The Utah Payroll Calculator Tool offers numerous benefits, including accuracy, efficiency, compliance, and convenience. By using the tool, employers and employees can ensure accurate calculations, streamline payroll processing, and minimize the risk of errors and penalties.