5 NC Payroll Tips

Introduction to NC Payroll Tips

Managing payroll can be a complex and time-consuming task, especially for businesses in North Carolina. With numerous regulations and laws to comply with, it’s essential to stay up-to-date on the latest requirements to avoid penalties and fines. In this article, we’ll provide you with five valuable NC payroll tips to help you navigate the process with ease. Whether you’re a small business owner or a large corporation, these tips will help you ensure compliance and streamline your payroll operations.

Tip 1: Understand NC Payroll Laws and Regulations

North Carolina has its own set of payroll laws and regulations that employers must comply with. For example, the North Carolina Wage and Hour Act requires employers to pay employees at least the minimum wage, which is currently $7.25 per hour. Additionally, employers must also comply with the Fair Labor Standards Act (FLSA), which sets forth requirements for overtime pay, record-keeping, and child labor. It’s crucial to understand these laws and regulations to avoid non-compliance and potential penalties.

Some key NC payroll laws and regulations include: * Minimum wage: $7.25 per hour * Overtime pay: 1.5 times the regular rate for hours worked over 40 in a workweek * Record-keeping: Employers must maintain accurate records of employee hours, wages, and other relevant information * Child labor: Restrictions on the employment of minors, including hours and occupations

Tip 2: Accurately Calculate Employee Wages and Deductions

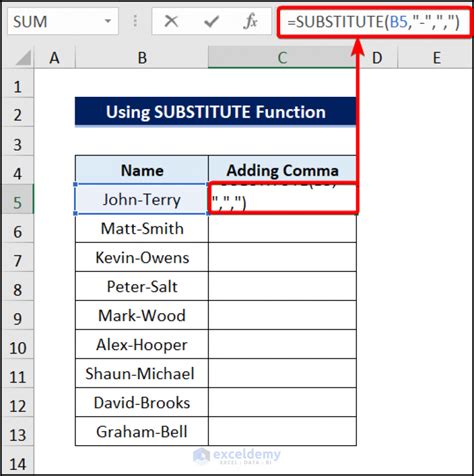

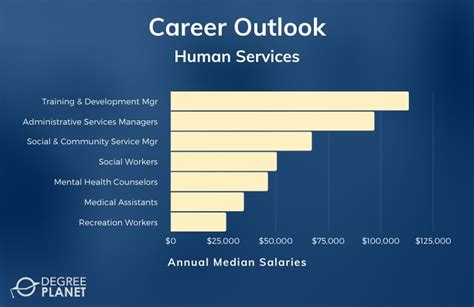

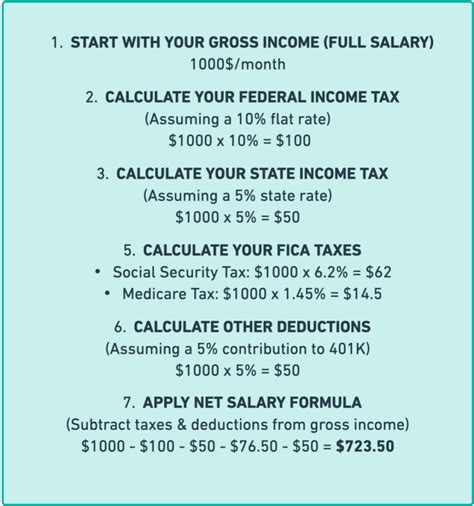

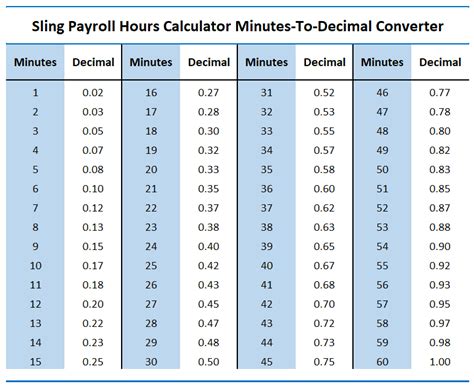

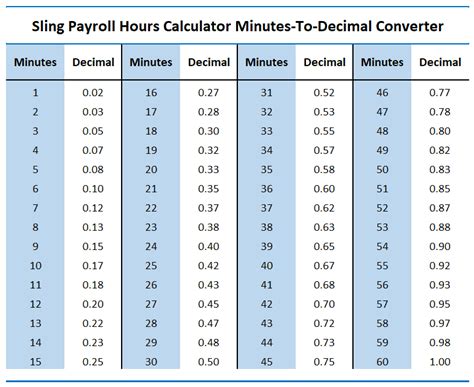

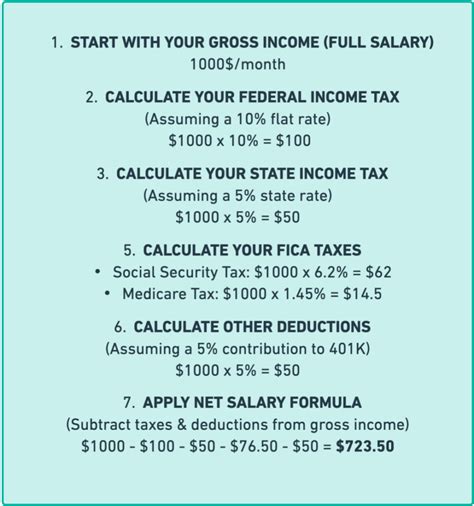

Accurate calculation of employee wages and deductions is critical to ensuring compliance with NC payroll laws and regulations. Employers must calculate wages correctly, including overtime pay, and deduct the correct amount of taxes and other deductions. Some common deductions include: * Federal income tax * State income tax * Social Security tax * Medicare tax * Health insurance premiums * 401(k) or other retirement plan contributions

To ensure accuracy, employers can use payroll software or consult with a payroll professional. It’s also essential to communicate with employees about their wages and deductions to avoid disputes and ensure transparency.

Tip 3: Comply with NC Unemployment Insurance and Workers’ Compensation

North Carolina requires employers to comply with unemployment insurance and workers’ compensation laws. Unemployment insurance provides financial assistance to employees who lose their jobs through no fault of their own, while workers’ compensation provides benefits to employees who are injured on the job. Employers must contribute to these programs and maintain accurate records of employee wages and hours worked.

Some key requirements include: * Registering with the NC Department of Commerce, Division of Employment Security * Contributing to the unemployment insurance fund * Maintaining accurate records of employee wages and hours worked * Reporting workplace injuries and illnesses to the NC Industrial Commission

Tip 4: Implement a Payroll Schedule and Calendar

Implementing a payroll schedule and calendar can help employers stay organized and ensure timely payment of employee wages. A payroll schedule outlines the frequency and timing of payroll payments, while a calendar provides a visual representation of important payroll dates and deadlines.

Some key benefits of a payroll schedule and calendar include: * Improved accuracy and timeliness of payroll payments * Enhanced communication with employees about pay dates and deadlines * Better planning and budgeting for payroll expenses * Reduced risk of non-compliance with NC payroll laws and regulations

Tip 5: Maintain Accurate Payroll Records and Reporting

Maintaining accurate payroll records and reporting is essential for compliance with NC payroll laws and regulations. Employers must maintain records of employee wages, hours worked, and other relevant information, including: * Payroll registers and journals * Employee earnings records * Tax returns and reports * Workers’ compensation and unemployment insurance records

Some key benefits of accurate payroll records and reporting include: * Improved compliance with NC payroll laws and regulations * Enhanced accuracy and timeliness of payroll payments * Better planning and budgeting for payroll expenses * Reduced risk of audits and penalties

| Payroll Record | Description |

|---|---|

| Payroll Register | A record of all payroll transactions, including wages, taxes, and deductions |

| Employee Earnings Record | A record of an employee's earnings, including wages, taxes, and deductions |

| Tax Return | A report of an employer's tax liability, including federal and state income taxes |

💡 Note: Employers must maintain accurate payroll records for at least three years, as required by the FLSA.

In summary, managing payroll in North Carolina requires a thorough understanding of the state’s payroll laws and regulations, accurate calculation of employee wages and deductions, compliance with unemployment insurance and workers’ compensation, implementation of a payroll schedule and calendar, and maintenance of accurate payroll records and reporting. By following these five NC payroll tips, employers can ensure compliance, streamline their payroll operations, and reduce the risk of audits and penalties.

Related Terms:

- Free payroll calculator nc

- North Carolina payroll tax calculator

- Paycheck calculator nc hourly

- Payroll calculator nc with taxes

- Payroll calculator nc 2022

- Tax calculator NC