MN Paycheck Calculator Tool

Introduction to MN Paycheck Calculator Tool

The MN Paycheck Calculator Tool is a valuable resource for individuals and businesses in Minnesota, designed to simplify the process of calculating take-home pay. This tool takes into account various factors such as gross income, deductions, and taxes to provide an accurate estimate of an employee’s net pay. In this article, we will explore the features and benefits of the MN Paycheck Calculator Tool, and provide a step-by-step guide on how to use it.

Features of the MN Paycheck Calculator Tool

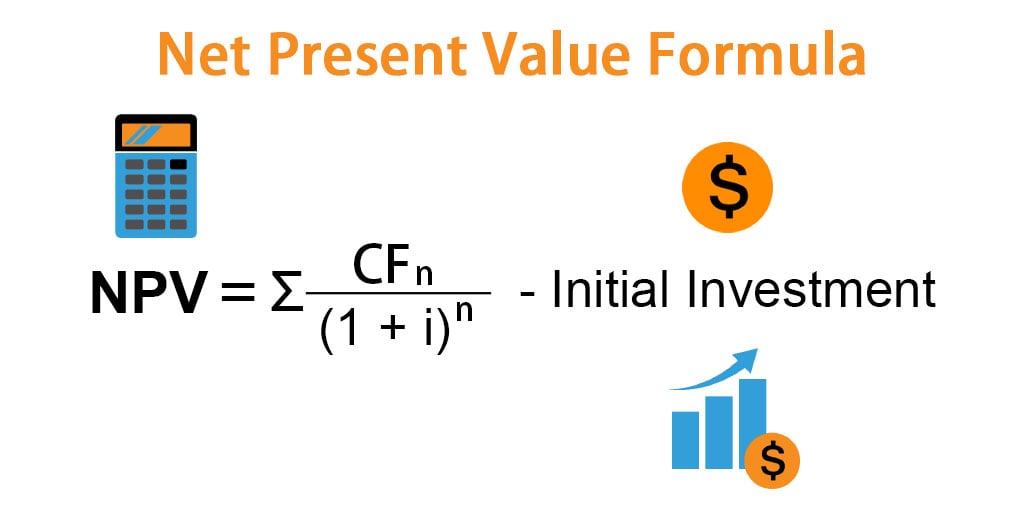

The MN Paycheck Calculator Tool offers a range of features that make it an essential tool for anyone looking to calculate their take-home pay in Minnesota. Some of the key features include: * Gross-to-Net Calculation: The tool calculates the net pay based on the gross income, taking into account federal, state, and local taxes. * Deductions and Exemptions: The tool allows users to input various deductions and exemptions, such as 401(k) contributions, health insurance premiums, and dependent care expenses. * Minnesota State Taxes: The tool is specifically designed for Minnesota, taking into account the state’s tax laws and regulations. * User-Friendly Interface: The tool has a simple and intuitive interface, making it easy to use and navigate.

Benefits of the MN Paycheck Calculator Tool

The MN Paycheck Calculator Tool offers several benefits to individuals and businesses in Minnesota. Some of the key benefits include: * Accurate Calculations: The tool provides accurate calculations, taking into account various factors that affect take-home pay. * Time-Saving: The tool saves time and effort, eliminating the need for manual calculations and reducing the risk of errors. * Increased Transparency: The tool provides a clear breakdown of the calculations, giving users a better understanding of their take-home pay. * Compliance with Tax Laws: The tool ensures compliance with Minnesota tax laws and regulations, reducing the risk of penalties and fines.

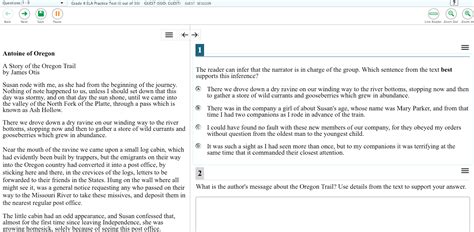

How to Use the MN Paycheck Calculator Tool

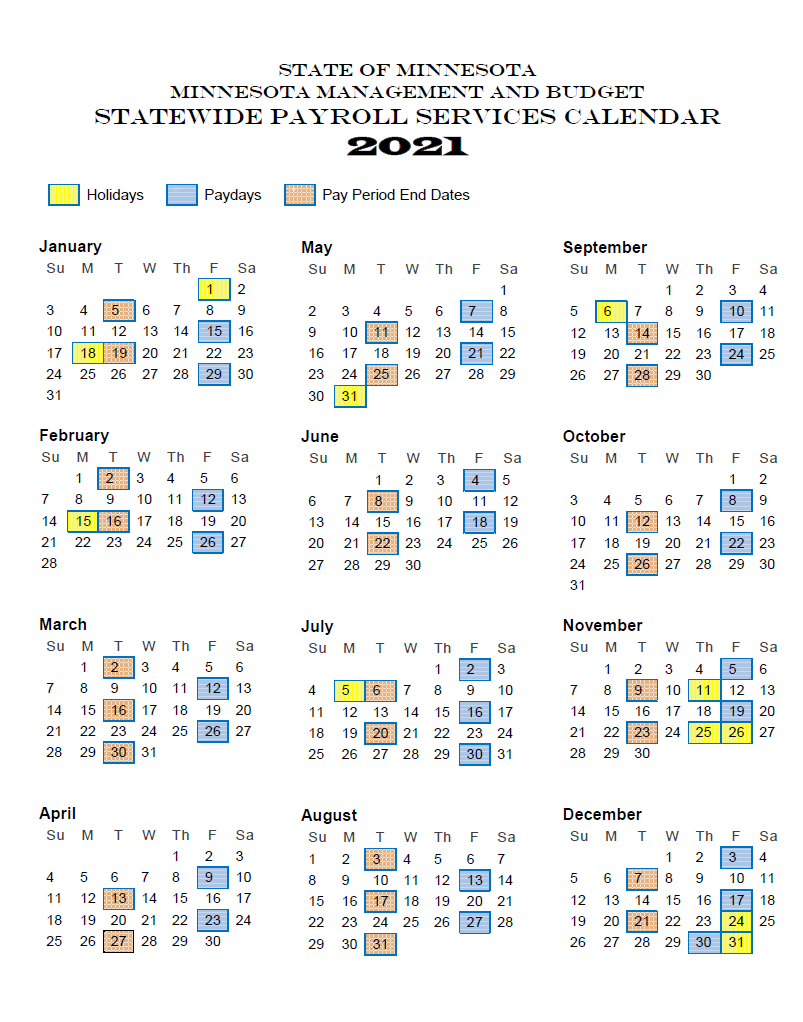

Using the MN Paycheck Calculator Tool is a straightforward process. Here’s a step-by-step guide: * Enter the gross income: Input the employee’s gross income, including any bonuses or overtime pay. * Input deductions and exemptions: Enter any deductions and exemptions, such as 401(k) contributions, health insurance premiums, and dependent care expenses. * Select the pay frequency: Choose the pay frequency, such as weekly, bi-weekly, or monthly. * Calculate the net pay: Click the “Calculate” button to get an estimate of the employee’s net pay.

📝 Note: The MN Paycheck Calculator Tool is for estimation purposes only and should not be used as a substitute for professional tax advice.

Common Deductions and Exemptions in Minnesota

Minnesota offers various deductions and exemptions that can reduce an individual’s tax liability. Some common deductions and exemptions include: * 401(k) Contributions: Contributions to a 401(k) plan are tax-deductible, reducing an individual’s taxable income. * Health Insurance Premiums: Health insurance premiums are tax-deductible, reducing an individual’s taxable income. * Dependent Care Expenses: Dependent care expenses, such as childcare costs, are tax-deductible, reducing an individual’s taxable income. * Student Loan Interest: Interest paid on student loans is tax-deductible, reducing an individual’s taxable income.

| Deduction/Exemption | Limit |

|---|---|

| 401(k) Contributions | $19,500 (2022) |

| Health Insurance Premiums | No limit |

| Dependent Care Expenses | $3,000 (2022) |

| Student Loan Interest | $2,500 (2022) |

In summary, the MN Paycheck Calculator Tool is a valuable resource for individuals and businesses in Minnesota, providing an accurate estimate of take-home pay and helping to ensure compliance with tax laws and regulations. By understanding the features and benefits of the tool, and following the step-by-step guide, users can make informed decisions about their finances and reduce the risk of errors and penalties.

The main points to take away from this article are the importance of accurate calculations, the benefits of using the MN Paycheck Calculator Tool, and the need to understand the various deductions and exemptions available in Minnesota. By using the tool and taking advantage of the available deductions and exemptions, individuals and businesses can optimize their finances and reduce their tax liability.

What is the MN Paycheck Calculator Tool?

+

The MN Paycheck Calculator Tool is a resource for individuals and businesses in Minnesota, designed to simplify the process of calculating take-home pay.

How do I use the MN Paycheck Calculator Tool?

+

Using the MN Paycheck Calculator Tool is a straightforward process. Simply enter the gross income, input deductions and exemptions, select the pay frequency, and calculate the net pay.

What deductions and exemptions are available in Minnesota?

+

Minnesota offers various deductions and exemptions, including 401(k) contributions, health insurance premiums, dependent care expenses, and student loan interest.