Tricare Select vs Prime Comparison

Introduction to Tricare

Tricare is a health care program provided by the United States Department of Defense Military Health System. It serves active duty and retired personnel, their families, and dependents. The program offers a range of health care plans, with Tricare Select and Tricare Prime being two of the most popular options. Understanding the differences between these two plans is crucial for beneficiaries to make informed decisions about their health care.

Tricare Select

Tricare Select is a self-managed, preferred provider organization (PPO) plan. It allows beneficiaries to choose their health care providers, both in-network and out-of-network, without a referral. Network providers have agreed to accept a discounted rate for their services, while out-of-network providers may charge higher rates. Beneficiaries are responsible for paying a percentage of the cost, known as cost-sharing, for covered services.

Tricare Prime

Tricare Prime is a managed care plan that requires beneficiaries to choose a primary care manager (PCM) from a network of providers. The PCM coordinates care and provides referrals to specialists when necessary. Tricare Prime is similar to a health maintenance organization (HMO) plan, where beneficiaries receive care from a specific network of providers. This plan offers more comprehensive coverage, with lower out-of-pocket costs compared to Tricare Select.

Key Differences

The main differences between Tricare Select and Tricare Prime are: * Provider Network: Tricare Prime requires beneficiaries to choose a PCM from a network of providers, while Tricare Select allows beneficiaries to choose any provider, in-network or out-of-network. * Referrals: Tricare Prime requires a referral from the PCM to see a specialist, while Tricare Select does not require referrals. * Cost-Sharing: Tricare Prime typically has lower cost-sharing amounts compared to Tricare Select. * Enrollment: Tricare Prime requires beneficiaries to enroll in the plan, while Tricare Select does not require enrollment.

Eligibility and Enrollment

To be eligible for Tricare Select or Tricare Prime, beneficiaries must meet certain requirements, such as: * Being an active duty service member, retired service member, or dependent * Having a qualifying relationship with a sponsor (e.g., spouse, child) * Meeting specific eligibility requirements, such as age or disability status

Enrollment in Tricare Prime is typically required, while Tricare Select does not require enrollment. Beneficiaries can enroll in Tricare Prime during designated enrollment periods or when they experience a qualifying life event (QLE), such as a change in employment status or marriage.

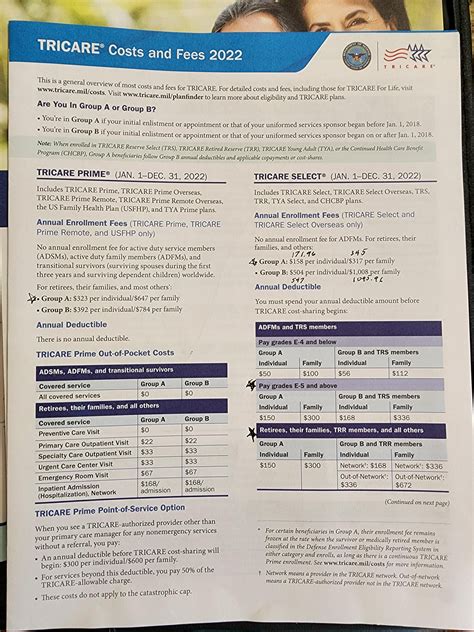

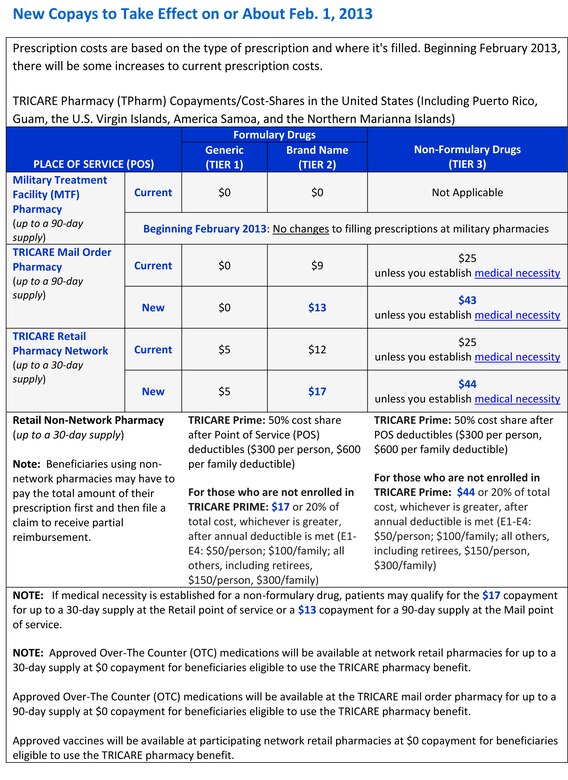

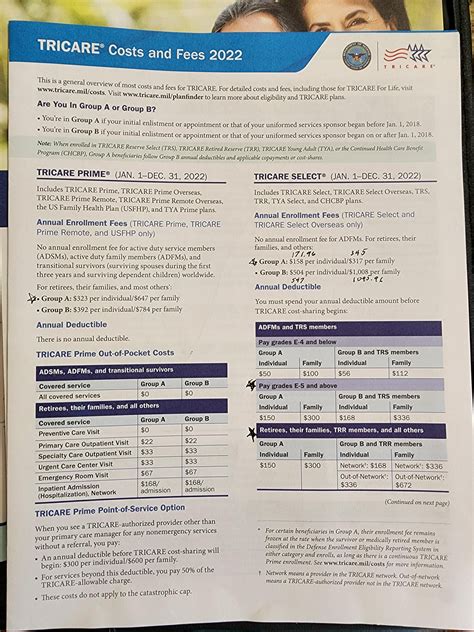

Costs and Fees

The costs and fees associated with Tricare Select and Tricare Prime vary depending on the beneficiary’s status and the services received. Some common costs and fees include: * Premiums: Monthly premiums for Tricare Prime, which vary based on the beneficiary’s status and family size. * Copays: Fixed amounts paid for specific services, such as doctor visits or prescriptions. * Coinsurance: A percentage of the cost paid for covered services. * Deductibles: Annual amounts that must be paid out-of-pocket before Tricare begins covering costs.

| Plan | Premiums | Copays | Coinsurance | Deductibles |

|---|---|---|---|---|

| Tricare Select | None | $15-$30 | 20%-30% | $150-$300 |

| Tricare Prime | $30-$100 | $10-$20 | 10%-20% | $50-$150 |

📝 Note: The costs and fees listed above are examples and may vary depending on the beneficiary's status and the services received.

Making a Decision

When choosing between Tricare Select and Tricare Prime, beneficiaries should consider their individual needs and preferences. Tricare Select may be a good option for those who: * Prefer to choose their own providers * Need more flexibility in their health care plan * Are willing to pay higher cost-sharing amounts

On the other hand, Tricare Prime may be a good option for those who: * Prefer a more structured health care plan * Are willing to choose a PCM from a network of providers * Want lower cost-sharing amounts

Ultimately, the decision between Tricare Select and Tricare Prime depends on the beneficiary’s unique circumstances and priorities. It is essential to carefully review the plans’ features, costs, and benefits before making a decision.

In the end, understanding the differences between Tricare Select and Tricare Prime can help beneficiaries make informed decisions about their health care. By considering their individual needs and preferences, beneficiaries can choose the plan that best suits their lifestyle and budget.

What is the main difference between Tricare Select and Tricare Prime?

+

The main difference between Tricare Select and Tricare Prime is the provider network and referral requirements. Tricare Prime requires beneficiaries to choose a primary care manager (PCM) from a network of providers, while Tricare Select allows beneficiaries to choose any provider, in-network or out-of-network.

Do I need to enroll in Tricare Select?

+

No, you do not need to enroll in Tricare Select. However, you must meet the eligibility requirements and have a qualifying relationship with a sponsor.

Can I change from Tricare Select to Tricare Prime?

+

Yes, you can change from Tricare Select to Tricare Prime during designated enrollment periods or when you experience a qualifying life event (QLE). However, you must meet the eligibility requirements and follow the enrollment procedures.