Military

5 Oregon Kicker Tips

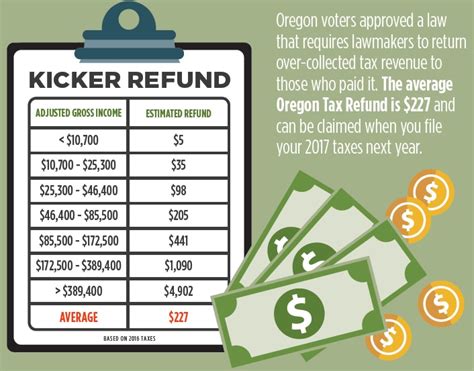

Introduction to Oregon Kicker

The Oregon kicker is a unique tax mechanism that refunds excess revenue collected by the state to its residents. It’s a vital aspect of Oregon’s tax system, aiming to prevent the state from having too much money. To fully understand and benefit from the Oregon kicker, it’s essential to grasp its intricacies and how it affects taxpayers. In this article, we will delve into five valuable tips related to the Oregon kicker, ensuring you make the most out of this refund.

Understanding the Oregon Kicker

Before diving into the tips, let’s briefly explore what the Oregon kicker is. The kicker is a refund of excess revenue collected by the state when its revenue exceeds a certain threshold. This threshold is typically 2% more than predicted during the budgeting process. The excess amount is then returned to taxpayers, usually in the form of a credit on their tax return. This mechanism is in place to prevent the state from accumulating too much money, keeping the government’s spending in check with the state’s economic growth.

Tips for Navigating the Oregon Kicker

Here are five tips to help you navigate and potentially maximize your Oregon kicker refund: - Stay Informed: The first tip is to stay updated with the latest news and forecasts regarding the Oregon kicker. The state regularly updates its revenue forecasts, which can impact the kicker amount. By staying informed, you can better plan your finances and anticipate potential refunds. - Understand Eligibility: Not everyone is eligible for the Oregon kicker. Generally, you must have filed a tax return and had a tax liability to qualify. It’s crucial to review the eligibility criteria each year, as they can change, affecting your potential refund. - Review Your Tax Liability: Your tax liability plays a significant role in determining your kicker refund. If you have a higher tax liability, you might receive a larger kicker refund. Consider consulting with a tax professional to optimize your tax strategy and potentially increase your refund. - Consider Timing: The timing of your tax filing can impact when you receive your kicker refund. Filing your taxes early can lead to receiving your refund sooner. However, it’s essential to ensure you have all the necessary documents to avoid delays or complications. - Plan Your Refund Wisely: Once you receive your kicker refund, it’s crucial to plan how you’ll use it wisely. You might consider saving it, paying off debts, or investing it. A well-thought-out plan can help you make the most of your refund and improve your financial stability.

Benefits of the Oregon Kicker

The Oregon kicker provides several benefits to both the state and its residents. It ensures that the state government does not accumulate excessive funds, promoting fiscal responsibility. For residents, it offers an opportunity to receive a refund, which can be used to bolster personal finances. This refund can be particularly beneficial during economic downturns or when personal financial situations are challenging.

Challenges and Considerations

While the Oregon kicker can be beneficial, there are also challenges and considerations to be aware of. The amount of the kicker can fluctuate significantly from year to year, based on the state’s revenue. This unpredictability can make financial planning difficult for residents who rely on the refund. Additionally, the eligibility criteria and refund calculation can be complex, requiring careful review and potentially professional advice to navigate effectively.

💡 Note: It's always a good idea to consult with a tax professional to ensure you're taking full advantage of the Oregon kicker and to navigate any complexities associated with it.

Maximizing Your Oregon Kicker Refund

To maximize your Oregon kicker refund, consider the following strategies: - Optimize Your Tax Strategy: Work with a tax professional to ensure you’re taking advantage of all deductions and credits available to you. This can help increase your tax liability, potentially leading to a larger kicker refund. - Stay Up-to-Date with Tax Law Changes: Tax laws and regulations can change, impacting your eligibility for the kicker or the amount you’re eligible to receive. Staying informed about these changes can help you adjust your tax strategy accordingly. - Plan Ahead: Anticipate the potential for a kicker refund when planning your finances. This can help you make informed decisions about savings, investments, and debt repayment.

| Year | Revenue Forecast | Kicker Amount |

|---|---|---|

| 2020 | $20 Billion | $500 Million |

| 2021 | $22 Billion | $600 Million |

| 2022 | $25 Billion | $700 Million |

Conclusion and Final Thoughts

In conclusion, the Oregon kicker is a unique aspect of the state’s tax system that can provide significant refunds to residents. By understanding how the kicker works, staying informed about revenue forecasts, reviewing your tax liability, considering the timing of your tax filing, and planning your refund wisely, you can navigate the Oregon kicker effectively. Remember, maximizing your kicker refund often requires careful planning and potentially professional advice. As you look to the future, keeping these tips and strategies in mind can help you make the most of the Oregon kicker and improve your financial situation.

What is the Oregon kicker?

+

The Oregon kicker is a refund of excess revenue collected by the state when its revenue exceeds a certain threshold, typically 2% more than predicted during the budgeting process.

Who is eligible for the Oregon kicker?

+

Generally, individuals who have filed a tax return and had a tax liability are eligible for the Oregon kicker. However, eligibility criteria can change, so it’s essential to review them each year.

How can I maximize my Oregon kicker refund?

+

You can maximize your Oregon kicker refund by optimizing your tax strategy, staying up-to-date with tax law changes, and planning ahead. Consulting with a tax professional can also be beneficial.