5 Essential Steps with Nerdwallet's Budget Planner

Managing your finances effectively is a cornerstone of personal stability and growth. Understanding the nuances of your income and expenditures can be both empowering and overwhelming. NerdWallet's Budget Planner is a powerful tool designed to simplify this process. Here are the five essential steps you should follow to make the most out of this tool and ensure your financial health.

Step 1: Assess Your Income

Begin by evaluating your total monthly income. This should include your:

- Primary source of income (salary or wages)

- Any secondary income from freelance work or side gigs

- Investment returns

- Rental income

- Any other predictable sources of money

When calculating your income, always consider the net amount after taxes and deductions. This gives you a realistic figure for planning purposes.

🔍 Note: Always ensure your calculations are accurate to avoid underestimating or overestimating your budget.

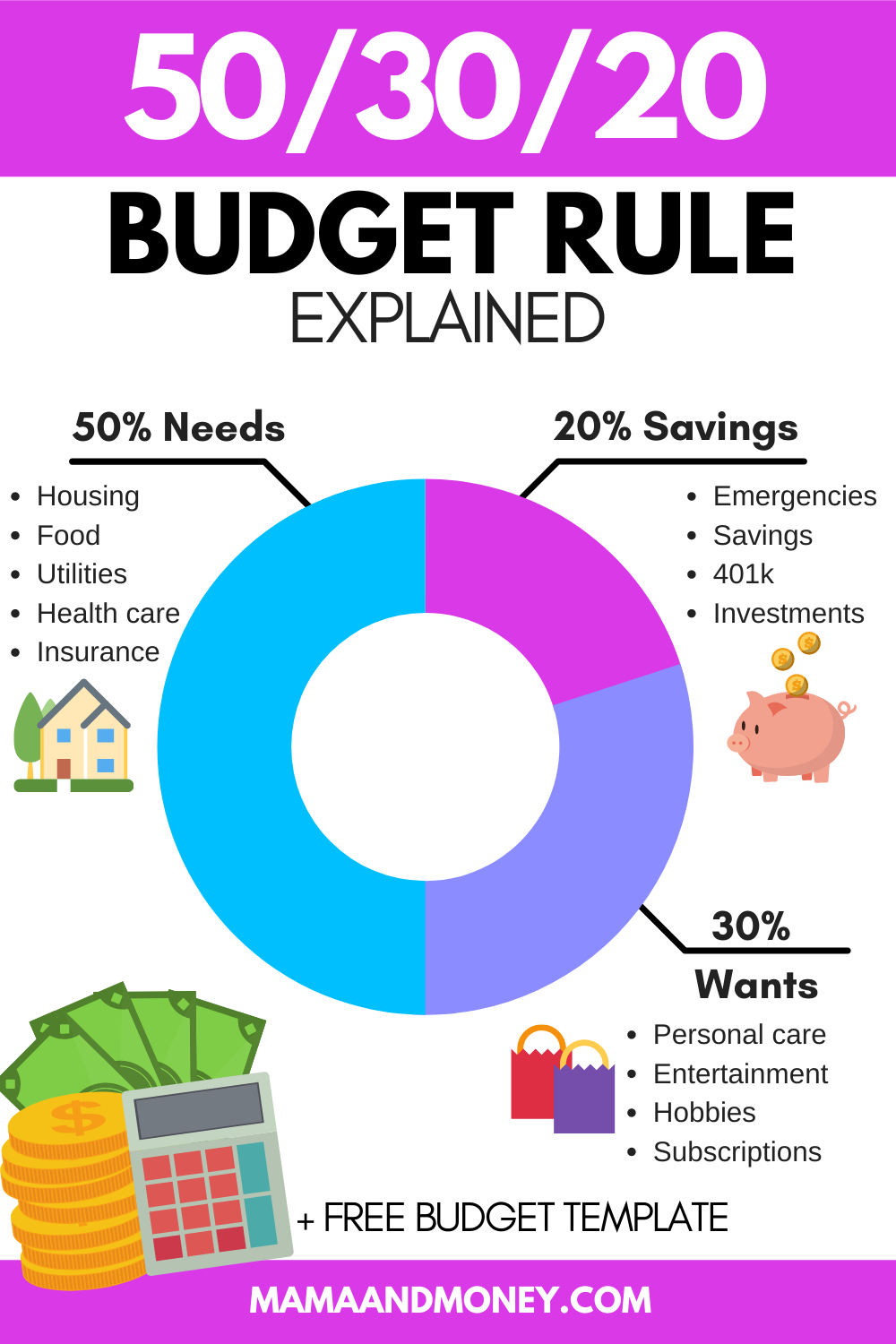

Step 2: Categorize Your Expenses

NerdWallet’s Budget Planner helps categorize your expenses, making it easier to see where your money goes:

- Housing: Rent or mortgage, utilities, home insurance

- Transportation: Car payments, gas, maintenance, public transit fees

- Food: Groceries, dining out, take-out

- Insurance: Health, life, auto

- Debt Payments: Student loans, credit card payments

- Entertainment: Subscriptions, movies, travel

- Savings and Investments: Emergency fund, retirement contributions

Each category should reflect your current spending habits. Use the planner to enter these amounts, ensuring they align with your bank statements for accuracy.

| Category | Percentage of Income |

|---|---|

| Housing | 30% |

| Transportation | 15% |

| Food | 15% |

| Insurance | 10% |

| Debt Payments | 10% |

| Entertainment | 5% |

| Savings and Investments | 15% |

Step 3: Set Financial Goals

After categorizing your expenses, the next step is to define what you’re aiming for financially. This could be:

- Building an emergency fund

- Paying off debt

- Buying a home

- Retirement planning

- Funding education or travel

Establish clear, measurable goals with specific time frames, such as “Save $10,000 for a down payment on a house in three years.”

Step 4: Create and Adjust Your Budget

Now, craft your budget using NerdWallet’s Budget Planner. Here are some tips:

- Allocate funds according to your goals and expenses

- Leave room for miscellaneous or unforeseen expenses

- Adjust for variable income, if applicable

- Track your spending regularly to stay within your budget

This tool allows you to tweak allocations as needed, ensuring your budget reflects your current financial situation accurately.

Step 5: Monitor and Re-evaluate

The final step is continuous monitoring and periodic re-evaluation:

- Regular Monitoring: Use NerdWallet’s app to track expenses in real-time.

- Monthly Review: Compare actual spending against your budgeted amounts. Adjust if necessary.

- Annual Re-evaluation: Update your financial goals and budget to reflect changes in income, expenses, or financial aspirations.

Remember, a budget is a living document, and NerdWallet’s tools can help you make informed decisions to keep your finances on track.

Incorporating these five steps into your financial management routine with NerdWallet's Budget Planner can lead to a deeper understanding and better control of your personal finances. Not only does this tool facilitate budget creation, but it also encourages regular review, fostering habits that promote financial discipline and goal attainment. By setting realistic expectations, categorizing wisely, and maintaining vigilance over your financial behavior, you'll pave the way for a more secure and prosperous future.

How often should I review my budget?

+

Ideally, review your budget monthly to ensure you’re on track with your financial goals and spending habits. An annual review can help adjust for major changes in income or expenses.

Can NerdWallet’s Budget Planner help with debt management?

+

Yes, by categorizing debt payments and setting up a repayment plan within the budget, it aids in managing and reducing debt systematically.

Is the Budget Planner only for monthly planning?

+

While it’s designed for monthly budgeting, you can use it for weekly or bi-weekly reviews or extend your budget planning for longer terms like quarterly or annual planning.