5 CFPB Tips

Introduction to CFPB Tips

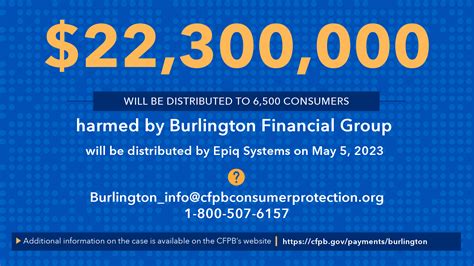

The Consumer Financial Protection Bureau (CFPB) is a U.S. government agency responsible for protecting consumers in the financial marketplace. The CFPB was created in 2010 as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act. One of the key roles of the CFPB is to provide consumers with the information and tools they need to make informed financial decisions. In this article, we will explore 5 CFPB tips that can help consumers manage their finances effectively and avoid common pitfalls.

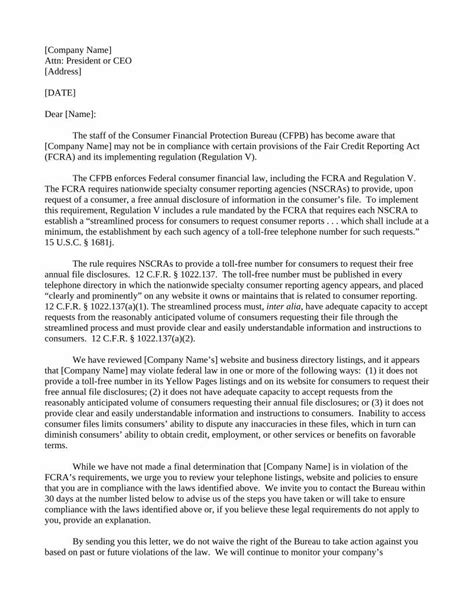

Tip 1: Understand Your Credit Report

Your credit report is a detailed record of your credit history, and it plays a crucial role in determining your credit score. The CFPB recommends that consumers check their credit reports regularly to ensure that they are accurate and up-to-date. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Reviewing your credit report can help you identify errors or inaccuracies that may be affecting your credit score. If you find any errors, you can dispute them with the credit reporting agency and have them corrected.

Tip 2: Manage Your Debt Effectively

Managing debt is a critical aspect of personal finance, and the CFPB provides several tips to help consumers manage their debt effectively. One of the key tips is to prioritize your debts, focusing on high-interest debts first. You can also consider consolidating your debts into a single loan with a lower interest rate. Additionally, the CFPB recommends that consumers create a budget and stick to it, making sure to allocate enough money each month to pay down their debts.

Tip 3: Avoid Overdraft Fees

Overdraft fees can be a significant expense for consumers, and the CFPB provides several tips to help consumers avoid them. One of the key tips is to keep track of your account balance, making sure that you have enough money in your account to cover your transactions. You can also consider setting up low-balance alerts, which can notify you when your account balance falls below a certain threshold. Additionally, the CFPB recommends that consumers consider opting out of overdraft protection, which can help prevent overdraft fees from being charged.

Tip 4: Be Aware of Payday Lending Practices

Payday lending can be a costly and predatory practice, and the CFPB provides several tips to help consumers avoid the pitfalls of payday lending. One of the key tips is to understand the terms of the loan, including the interest rate and any fees associated with the loan. You should also be aware of the risks of payday lending, including the potential for debt traps and cycles of debt. Additionally, the CFPB recommends that consumers consider alternative forms of credit, such as credit unions or community banks, which may offer more affordable and sustainable options.

Tip 5: Protect Yourself from Financial Scams

Financial scams can be a significant threat to consumers, and the CFPB provides several tips to help consumers protect themselves. One of the key tips is to be cautious of unsolicited offers, including phone calls, emails, or letters that offer investment opportunities or request personal financial information. You should also verify the identity of any financial institution or representative, making sure that they are legitimate and authorized to provide financial services. Additionally, the CFPB recommends that consumers monitor their accounts regularly, watching for any suspicious activity or unauthorized transactions.

🔔 Note: Consumers should always be vigilant when it comes to their financial information and should never provide personal financial information to unsolicited callers or emails.

In summary, the CFPB provides several tips to help consumers manage their finances effectively and avoid common pitfalls. By understanding your credit report, managing your debt effectively, avoiding overdraft fees, being aware of payday lending practices, and protecting yourself from financial scams, you can take control of your financial situation and make informed decisions about your money.

What is the role of the CFPB in protecting consumers?

+

The CFPB is responsible for protecting consumers in the financial marketplace by providing them with the information and tools they need to make informed financial decisions.

How can I get a free credit report?

+

You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year.

What are some common financial scams that I should be aware of?

+

Common financial scams include phishing scams, identity theft, and investment scams. You should always be cautious of unsolicited offers and verify the identity of any financial institution or representative.