5 Ways Arthur Andersen's Demise Changed Accounting

The Rise and Fall of Arthur Andersen

Arthur Andersen, once one of the “Big Five” accounting firms, left an indelible mark on the accounting industry before its demise in 2002. The firm’s meteoric rise was matched only by the speed of its downfall, which was precipitated by its role in the Enron scandal. In this article, we will explore five ways in which Arthur Andersen’s demise changed the accounting industry forever.

Increased Regulatory Oversight

The collapse of Arthur Andersen led to a significant increase in regulatory oversight of the accounting industry. The Sarbanes-Oxley Act of 2002, signed into law by President George W. Bush, imposed stricter regulations on publicly traded companies and their auditors. The Act created the Public Company Accounting Oversight Board (PCAOB), which is responsible for overseeing the audits of public companies.

The PCAOB has played a crucial role in ensuring that accounting firms are held to high standards of quality and integrity. The Board conducts regular inspections of accounting firms and has the authority to impose sanctions on firms that fail to meet its standards.

🚨 Note: The Sarbanes-Oxley Act has had a profound impact on the accounting industry, and its provisions continue to shape the regulatory landscape today.

Changes in Auditor Independence

The Enron scandal highlighted the importance of auditor independence. Arthur Andersen’s close relationship with Enron was seen as a major contributor to the firm’s failure to detect and prevent Enron’s accounting irregularities.

In response to these concerns, the Securities and Exchange Commission (SEC) issued new rules governing auditor independence. The rules prohibit accounting firms from providing certain non-audit services to their audit clients, such as financial information systems design and implementation, and internal audit services.

These changes have helped to ensure that auditors are able to maintain their independence and objectivity, which is essential for ensuring the accuracy and reliability of financial statements.

Greater Transparency and Disclosure

The Enron scandal also highlighted the need for greater transparency and disclosure in financial reporting. The Sarbanes-Oxley Act requires publicly traded companies to disclose more information about their financial condition and results of operations.

The Act also requires companies to provide more detailed information about their internal controls and procedures for financial reporting. This information is designed to help investors and other stakeholders assess the effectiveness of a company’s internal controls and procedures.

| Disclosure Requirements | Pre-Sarbanes-Oxley | Post-Sarbanes-Oxley |

|---|---|---|

| Internal Controls | Limited disclosure | Detailed disclosure required |

| Financial Condition | General disclosure | More detailed disclosure required |

| Results of Operations | General disclosure | More detailed disclosure required |

Increased Focus on Professional Skepticism

The Enron scandal also highlighted the importance of professional skepticism in auditing. Arthur Andersen’s failure to detect Enron’s accounting irregularities was seen as a result of the firm’s lack of professional skepticism.

In response to these concerns, the auditing standards have been revised to place greater emphasis on professional skepticism. Auditors are now required to approach their work with a more questioning mindset, and to be more vigilant in their detection of potential irregularities.

Changes in the Structure of Accounting Firms

The demise of Arthur Andersen also led to changes in the structure of accounting firms. The firm’s consulting business was seen as a major contributor to its downfall, as it created conflicts of interest and compromised the firm’s independence.

In response to these concerns, many accounting firms have spun off their consulting businesses or have created separate entities to provide these services. This has helped to ensure that accounting firms are able to maintain their independence and objectivity, which is essential for ensuring the accuracy and reliability of financial statements.

The collapse of Arthur Andersen was a watershed moment in the accounting industry. It led to significant changes in regulatory oversight, auditor independence, transparency and disclosure, professional skepticism, and the structure of accounting firms. These changes have helped to ensure that the accounting industry is more robust and resilient, and that financial statements are more accurate and reliable.

As we reflect on the demise of Arthur Andersen, we are reminded of the importance of integrity, objectivity, and independence in the accounting industry. The lessons learned from this experience will continue to shape the industry for years to come.

What led to the demise of Arthur Andersen?

+

Arthur Andersen’s demise was precipitated by its role in the Enron scandal. The firm’s close relationship with Enron and its failure to detect and prevent Enron’s accounting irregularities led to a loss of public trust and confidence in the firm.

What is the Sarbanes-Oxley Act?

+

The Sarbanes-Oxley Act is a federal law that was enacted in 2002 in response to the Enron scandal. The Act imposes stricter regulations on publicly traded companies and their auditors, and created the Public Company Accounting Oversight Board (PCAOB) to oversee the audits of public companies.

What is professional skepticism?

+

Professional skepticism is a critical thinking approach that auditors use to evaluate evidence and make judgments about the fairness and accuracy of financial statements. It involves approaching one’s work with a questioning mindset and being vigilant in the detection of potential irregularities.

Related Terms:

- Arthur Andersen Indonesia

- Arthur Andersen Enron

- Sejarah KAP Arthur Andersen

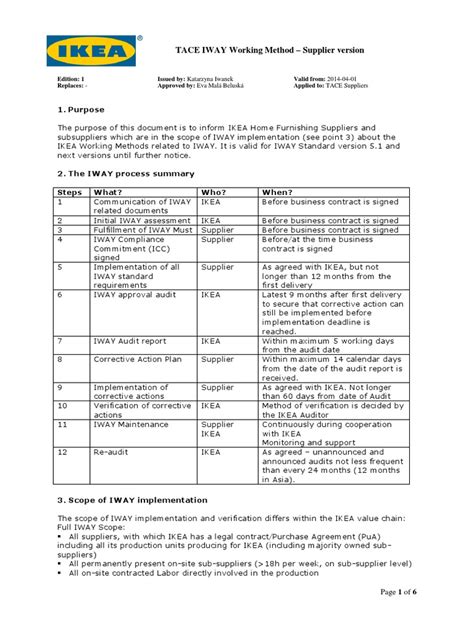

- IWAY audit

- Kasus Big 4

- Enron Wikipedia