5 Essential Tips for Navigating Monetary Policy Changes

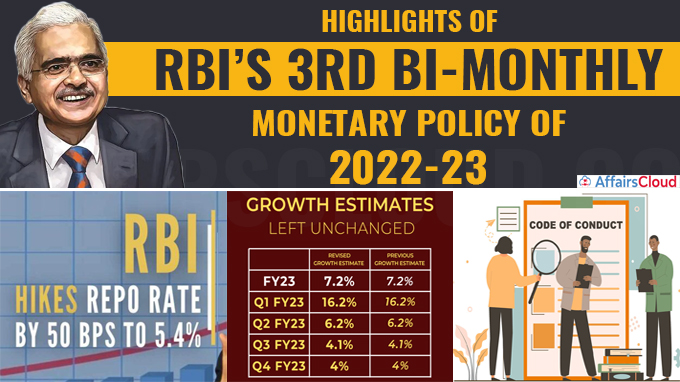

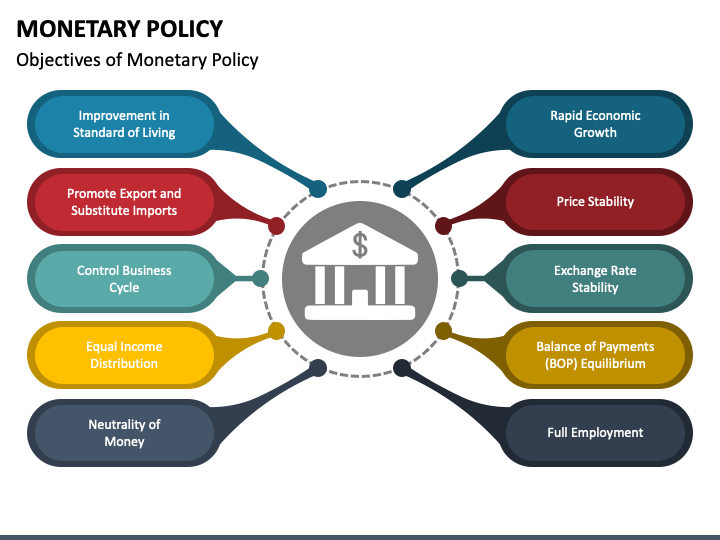

Understanding monetary policy is crucial for anyone involved in financial decision-making, from individuals managing personal finances to businesses planning long-term strategies. Monetary policy, set by central banks, directly impacts interest rates, inflation, economic growth, and more. In this article, we'll explore five essential tips for navigating changes in monetary policy, ensuring you stay informed and agile in your financial maneuvers.

Stay Informed with Regular Updates

Monetary policy can shift dramatically with economic conditions. Here are some ways to ensure you’re always in the loop:

- Follow Economic News: News outlets like Bloomberg, Reuters, and The Financial Times provide comprehensive coverage of policy decisions.

- Subscribe to Central Bank Announcements: Register for notifications from central banks like the Federal Reserve, the Bank of England, or the European Central Bank to receive real-time updates.

- Economic Calendars: Utilize economic calendars provided by financial institutions to track policy meeting dates, rate decisions, and other announcements.

Understand the Economic Indicators

Various indicators signal potential changes in monetary policy. Here are key ones to monitor:

| Indicator | What It Signals |

|---|---|

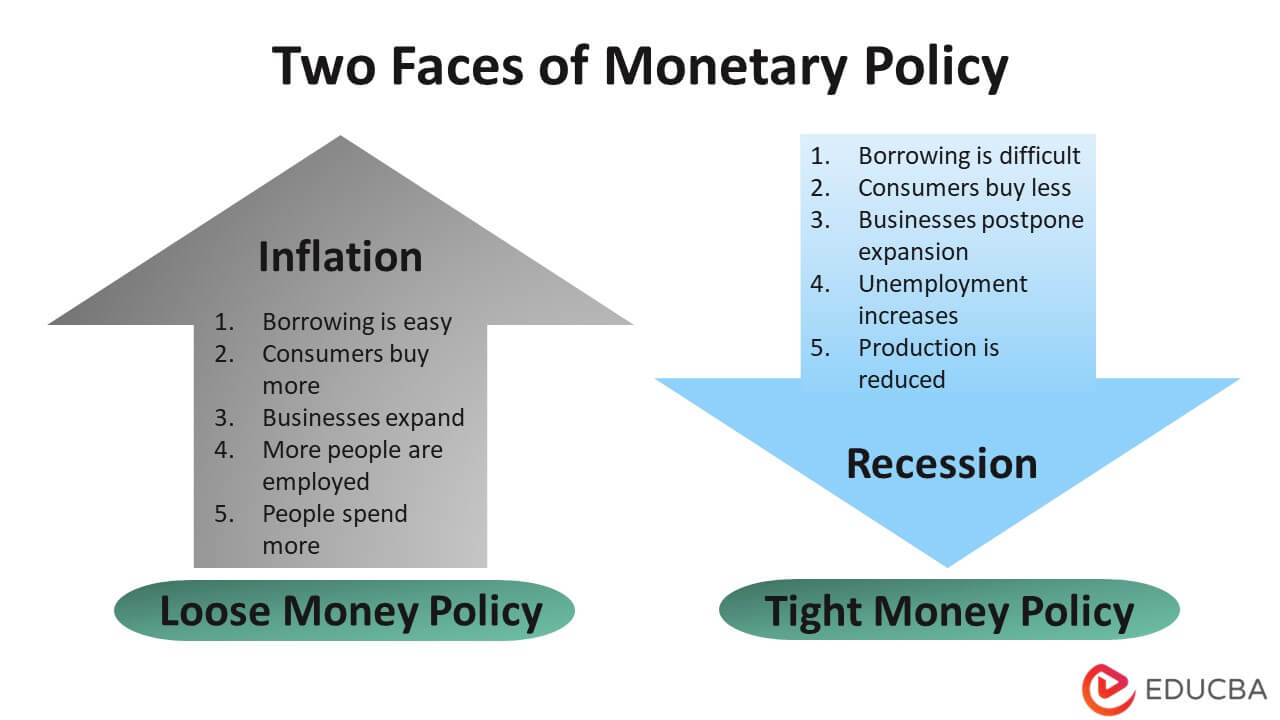

| Inflation Rate | High inflation might lead to rate hikes; low inflation or deflation might prompt rate cuts. |

| Unemployment Rate | A rising rate can lead to lower interest rates to stimulate job growth; vice versa for decreasing rates. |

| GDP Growth | Strong growth might cause the central bank to tighten policy to prevent overheating. |

| Bond Yields | Changes in yields can preempt policy moves; low yields often mean dovish policy. |

Anticipate and Plan for Changes

Having a proactive approach can mitigate risks associated with policy changes:

- Scenario Planning: Consider different scenarios like rate hikes or cuts, and plan accordingly for investments, loans, or savings.

- Fixed vs. Variable Rates: Decide if you should opt for fixed or variable interest rates based on future expectations.

- Cash Flow Management: Prepare to adjust your cash flow strategies when borrowing costs change.

Diversify Your Portfolio

Diversification is not just a risk management strategy; it’s also a shield against policy changes:

- Asset Allocation: Spread investments across various asset classes like stocks, bonds, and commodities.

- Global Exposure: Incorporate international assets to hedge against domestic policy volatility.

- Rebalancing: Regularly adjust your portfolio to maintain your desired risk and return profile.

Engage with Financial Experts

Expert advice can provide insights that are not only timely but also tailored to your specific situation:

- Consult Financial Advisors: They can offer customized strategies that align with your financial goals.

- Attend Seminars and Webinars: Central banks, financial institutions, and universities often host events discussing policy implications.

- Join Economic Forums: Participate in discussions with peers to share insights and stay updated.

📚 Note: Always verify sources of information to avoid acting on rumors or misinformation.

💡 Note: Remember that monetary policy impacts all sectors differently, so tailor your strategies accordingly.

By implementing these strategies, you'll not only manage but also potentially benefit from monetary policy changes. The key is to anticipate and adapt rather than react. Staying informed, understanding the implications of economic indicators, planning for different scenarios, diversifying investments, and seeking expert advice are fundamental steps. Whether you're an individual saver or an investor, these tips ensure you're better equipped to navigate the financial landscape shaped by central bank policies.

How often do central banks change monetary policy?

+

Typically, central banks review their monetary policy every 4 to 8 weeks, depending on the institution, with major decisions being made less frequently unless there are significant economic changes.

Can individual consumers affect monetary policy?

+

While individual consumers can’t directly influence policy, their collective actions in spending, saving, and investment can create economic conditions that central banks respond to with policy changes.

What’s the difference between fiscal and monetary policy?

+

Fiscal policy involves government spending and taxation, while monetary policy focuses on the money supply and interest rates, managed by the central bank.

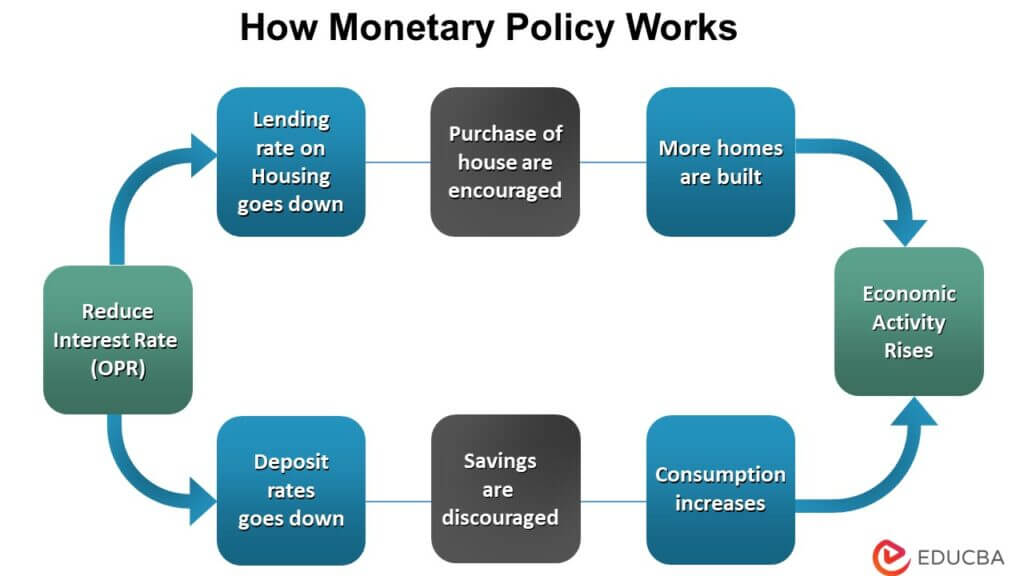

How does monetary policy affect interest rates?

+

Monetary policy directly controls short-term interest rates by adjusting the rate at which banks lend to each other overnight. This policy rate influences all other interest rates in the economy, from mortgages to car loans.

Are monetary policy changes predictable?

+

While central banks provide forward guidance, policy changes can be influenced by unexpected economic data or external shocks, making them somewhat unpredictable.