Mississippi Paycheck Calculator Tool

Introduction to Paycheck Calculators

When it comes to managing finances, understanding how much you take home from your paycheck is crucial. This is where a paycheck calculator comes in handy, especially for residents of Mississippi. A Mississippi paycheck calculator is a tool designed to help individuals calculate their net pay, considering various factors such as gross income, deductions, and taxes. In this post, we will delve into the details of how a Mississippi paycheck calculator works, its benefits, and how it can be a valuable resource for financial planning.

How Does a Mississippi Paycheck Calculator Work?

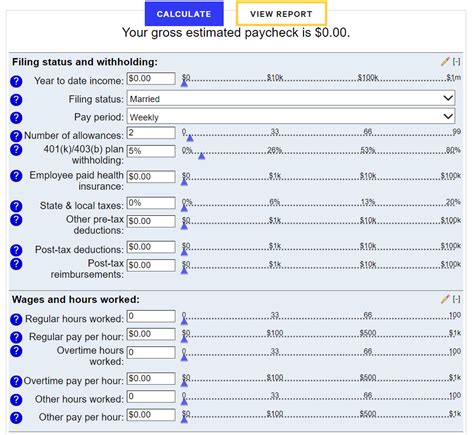

A Mississippi paycheck calculator typically takes into account several factors to provide an accurate estimate of your take-home pay. These factors include: - Gross Income: Your total income before any deductions. - Federal Income Taxes: The amount withheld for federal taxes, which depends on your income level and filing status. - State Income Taxes: Mississippi state income taxes, which range from 3% to 5% depending on your income level. - Local Taxes: Some cities or counties in Mississippi may have local income taxes. - Deductions: Contributions to 401(k), health insurance premiums, and other pre-tax deductions.

Using these inputs, the calculator provides a breakdown of your paycheck, showing how much goes towards taxes and deductions, and how much you can expect as your net pay.

Benefits of Using a Mississippi Paycheck Calculator

There are several benefits to using a paycheck calculator specific to Mississippi: - Accurate Financial Planning: By knowing exactly how much you take home, you can plan your expenses and savings more effectively. - Tax Planning: Understanding how much you pay in taxes can help you make informed decisions about tax-advantaged savings options. - Budgeting: A clear picture of your net income helps in creating a realistic budget that accounts for all your necessities and discretionary spending.

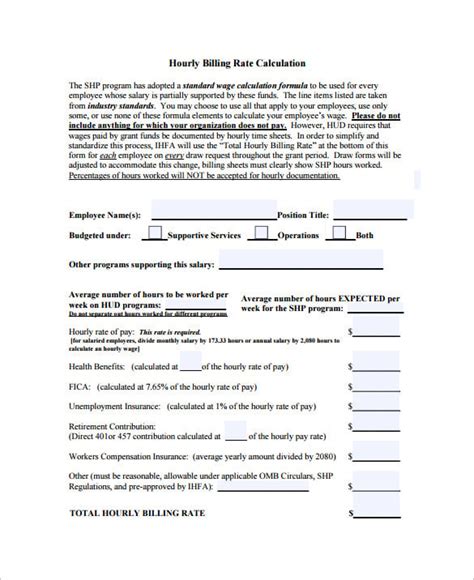

Steps to Use a Mississippi Paycheck Calculator

Using a paycheck calculator is straightforward: 1. Input Your Gross Income: Enter your annual or monthly gross income. 2. Select Your Filing Status: Choose your marital status and the number of dependents you claim. 3. Enter Deductions: Input any pre-tax deductions you have, such as 401(k) contributions or health insurance premiums. 4. Calculate: Press the calculate button to get your estimated net pay.

📝 Note: Ensure you have the most current tax rates and regulations to get the most accurate calculation.

Features of a Comprehensive Paycheck Calculator

A comprehensive Mississippi paycheck calculator should include the following features: - Tax Bracket Information: Details on Mississippi’s tax brackets and how they apply to your income. - Deduction Calculator: A tool to calculate the impact of various deductions on your net pay. - Comparison Tool: The ability to compare different scenarios, such as the effect of increasing your 401(k) contributions.

Conclusion

In essence, a Mississippi paycheck calculator is an indispensable tool for anyone looking to manage their finances effectively. By providing a clear and accurate picture of your net pay, it helps in planning expenses, making informed decisions about taxes and deductions, and ultimately achieving financial stability. Whether you’re a resident of Mississippi or an employer looking to understand payroll better, utilizing a paycheck calculator can significantly simplify your financial planning process.

What is the purpose of a Mississippi paycheck calculator?

+

The purpose of a Mississippi paycheck calculator is to help individuals estimate their net pay after deductions and taxes, facilitating better financial planning and management.

How do I choose the best paycheck calculator for my needs?

+

Look for a calculator that is updated with the latest tax laws, includes all relevant deductions, and is easy to use. Additionally, consider one that offers scenario comparisons to help with financial decisions.

Can a paycheck calculator help with tax planning?

+

Yes, a paycheck calculator can help with tax planning by showing how different deductions and contributions affect your net pay and tax liability, allowing for more informed financial decisions.