Military Auto Insurance Rates

Understanding Military Auto Insurance Rates

Military personnel and their families often face unique challenges when it comes to auto insurance. Frequent moves, deployments, and other aspects of military life can make it difficult to find affordable and comprehensive coverage. In this post, we’ll delve into the world of military auto insurance rates, exploring the factors that affect them and providing tips on how to save money.

Factors Affecting Military Auto Insurance Rates

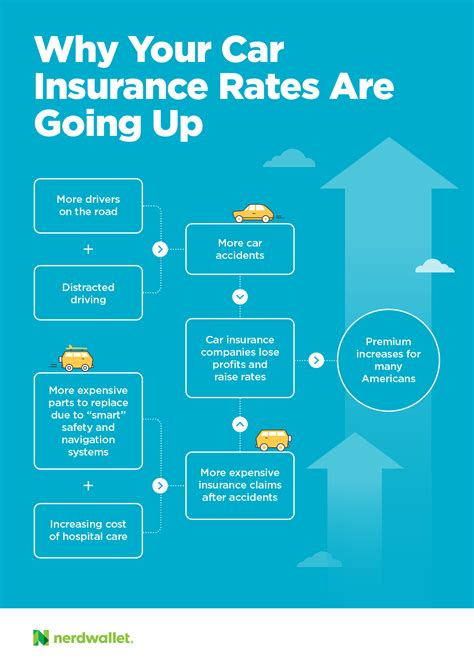

Several factors can influence military auto insurance rates, including:

- Location: Military personnel stationed in high-risk areas or overseas may face higher premiums due to increased theft and accident rates.

- Vehicle type: The make and model of your vehicle can impact your insurance rates, with luxury or high-performance vehicles typically costing more to insure.

- Driving history: A clean driving record can help lower your premiums, while accidents or tickets can increase your rates.

- Coverage levels: The amount of coverage you choose, including deductibles and limits, can also affect your premiums.

- Deployment status: Deployed personnel may be eligible for lower rates or special discounts, as their vehicles are often stored or used less frequently.

Military Auto Insurance Discounts

Many insurance companies offer discounts specifically for military personnel and their families. These may include:

- Military discounts: Some insurers offer discounts of up to 15% for military personnel and their families.

- Deployment discounts: Deployed personnel may be eligible for discounts or waivers on certain coverage types, such as comprehensive or collision insurance.

- Storage discounts: If you store your vehicle while deployed, you may be eligible for discounts on your premiums.

- Bundling discounts: Combining your auto insurance with other policies, such as homeowners or renters insurance, can also help lower your rates.

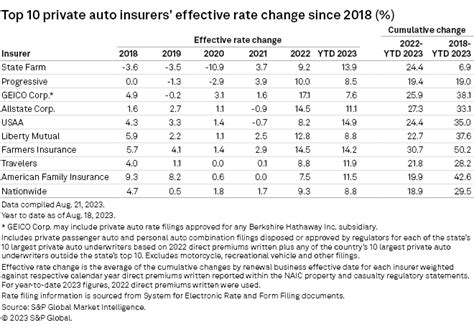

Top Insurance Companies for Military Personnel

Some insurance companies cater specifically to military personnel and their families, offering specialized coverage and discounts. These include:

| Insurance Company | Military Discount |

|---|---|

| USAA | Up to 15% off premiums |

| Geico | Up to 15% off premiums |

| Armed Forces Insurance | Up to 20% off premiums |

🚨 Note: Discounts and coverage options may vary depending on your location, vehicle, and other factors, so be sure to research and compare rates from multiple insurers.

Tips for Lowering Military Auto Insurance Rates

In addition to taking advantage of military discounts, there are several other ways to lower your auto insurance rates:

- Shop around: Compare rates from multiple insurers to find the best coverage at the lowest price.

- Choose a higher deductible: Selecting a higher deductible can lower your premiums, but be sure you can afford to pay the deductible in the event of a claim.

- Drop unnecessary coverage: If you have an older vehicle, you may not need comprehensive or collision coverage, which can help lower your rates.

- Improve your credit score: Maintaining a good credit score can help lower your insurance rates, as insurers often view individuals with good credit as lower-risk drivers.

To summarize the key points, military auto insurance rates can be affected by various factors, including location, vehicle type, driving history, and coverage levels. However, by taking advantage of military discounts, shopping around, and following tips to lower rates, you can find affordable and comprehensive coverage.

What is the best insurance company for military personnel?

+

USAA is often considered one of the best insurance companies for military personnel, offering specialized coverage and discounts. However, it’s essential to research and compare rates from multiple insurers to find the best option for your specific needs.

Can I get a discount on my auto insurance if I’m deployed?

+

Yes, many insurance companies offer discounts or waivers on certain coverage types for deployed personnel. Be sure to contact your insurer to see if you’re eligible for any discounts or special rates.

How can I lower my military auto insurance rates?

+

To lower your military auto insurance rates, consider shopping around, choosing a higher deductible, dropping unnecessary coverage, and improving your credit score. Additionally, take advantage of military discounts and specialized coverage options to find the best rates for your needs.