MD Tax Calculator Tool

Introduction to MD Tax Calculator Tool

The MD Tax Calculator Tool is a valuable resource for individuals and businesses in Maryland, designed to help calculate taxes owed to the state. Understanding how to use this tool and the implications of Maryland’s tax system can greatly simplify the process of managing financial obligations to the state. In this article, we will delve into the details of the MD Tax Calculator Tool, its features, how to use it, and the broader context of Maryland’s tax landscape.

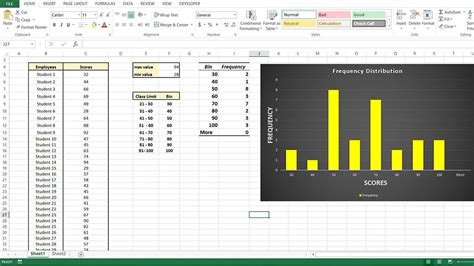

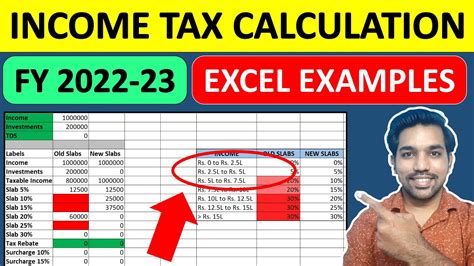

Understanding Maryland’s Tax System

Before diving into the specifics of the calculator tool, it’s essential to have a basic understanding of Maryland’s tax system. Maryland is one of the states with a progressive income tax system, meaning that higher income levels are taxed at a higher rate. The state also imposes taxes on corporations and has a sales tax, although the rate can vary by jurisdiction within the state. For individuals, understanding the tax brackets and how they apply to different income levels is crucial for accurately estimating tax liabilities.

Features of the MD Tax Calculator Tool

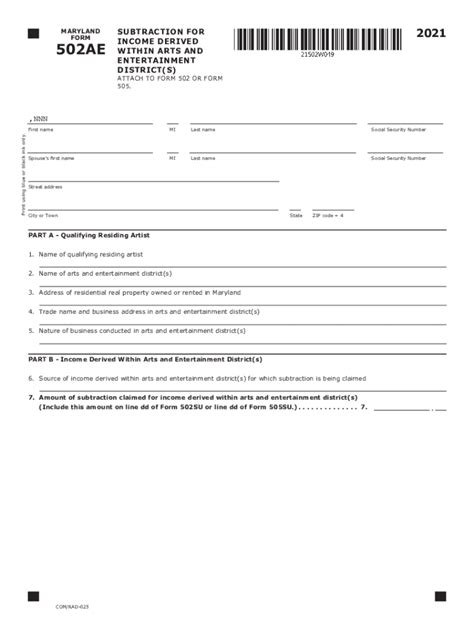

The MD Tax Calculator Tool is designed with user-friendly features to make tax calculations straightforward. Some of the key features include: - Tax Brackets: The tool accounts for Maryland’s tax brackets, ensuring that calculations are based on the most current tax rates. - Deductions and Credits: It allows users to input deductions and credits they are eligible for, providing a more accurate estimate of their tax liability. - Income Types: The tool can handle various types of income, including wages, interest, dividends, and capital gains, making it comprehensive for individuals with diverse income sources. - Business Tax Calculations: For businesses, it can calculate corporate income taxes, taking into account the specific tax rates and deductions applicable to businesses in Maryland.

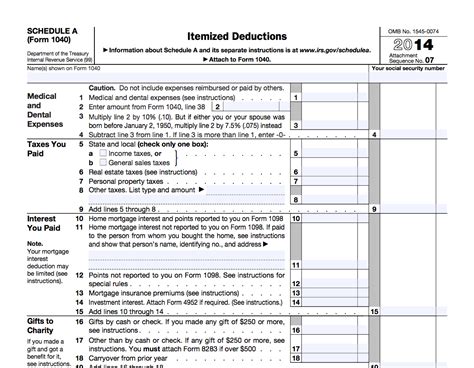

How to Use the MD Tax Calculator Tool

Using the MD Tax Calculator Tool involves several steps: 1. Gather Necessary Information: Before starting, ensure you have all relevant financial information, including total income from all sources, any deductions you plan to claim, and information about any tax credits you are eligible for. 2. Input Your Income: Enter your total income, selecting the appropriate type (e.g., wages, business income) to ensure the correct tax rates are applied. 3. Claim Deductions and Credits: Input any deductions or credits you are eligible for. This could include things like charitable donations, mortgage interest, or education credits. 4. Review and Calculate: Once all information is entered, the tool will calculate your estimated tax liability based on Maryland’s tax laws and your specific situation. 5. Adjust and Refine: If necessary, you can adjust your inputs to see how different scenarios might affect your tax liability, helping with financial planning and decision-making.

Benefits of Using the MD Tax Calculator Tool

The benefits of using the MD Tax Calculator Tool are numerous: - Accuracy: It provides accurate estimates of tax liabilities, reducing the risk of underpayment or overpayment. - Convenience: The tool is accessible online, making it easy to use from anywhere. - Planning: By allowing users to explore different scenarios, it facilitates better financial planning and tax strategy development. - Compliance: It helps individuals and businesses ensure they are in compliance with Maryland’s tax laws, avoiding potential penalties.

Common Mistakes to Avoid

When using the MD Tax Calculator Tool, there are several common mistakes to be aware of and avoid: - Inaccurate Income Reporting: Ensure all income is accurately reported, as underreporting can lead to penalties. - Overlooking Deductions and Credits: Failing to claim eligible deductions and credits can result in overpaying taxes. - Not Accounting for Tax Law Changes: Tax laws can change, so it’s essential to use the most current version of the tool and be aware of any updates to tax rates or regulations.

💡 Note: Always consult with a tax professional if you are unsure about any aspect of your tax situation, as they can provide personalized advice and help navigate complex tax issues.

Conclusion and Final Thoughts

In conclusion, the MD Tax Calculator Tool is a powerful resource for managing tax obligations in Maryland. By understanding how to use this tool effectively and being aware of the broader tax landscape in Maryland, individuals and businesses can better navigate their tax responsibilities. Whether you’re a resident, business owner, or just looking to understand more about Maryland’s tax system, this tool can provide valuable insights and help in planning for tax liabilities. Remember, tax laws and regulations can change, so staying informed and seeking professional advice when needed is key to ensuring compliance and optimizing your financial situation.

What is the purpose of the MD Tax Calculator Tool?

+

The MD Tax Calculator Tool is designed to help individuals and businesses in Maryland estimate their tax liabilities based on the state’s tax laws and their specific financial situations.

How do I use the MD Tax Calculator Tool for business tax calculations?

+

To use the tool for business tax calculations, you will need to input your business income and expenses, and then the tool will estimate your corporate income tax liability based on Maryland’s tax rates and laws applicable to businesses.

What if I am unsure about how to use the MD Tax Calculator Tool or have complex tax questions?

+

If you are unsure about using the tool or have complex tax questions, it is recommended to consult with a tax professional who can provide personalized advice and guidance tailored to your specific situation.