Free Money Management Worksheets for Kids

Managing money effectively is a skill that can benefit individuals from all walks of life, but it's especially crucial to instill these principles early in life. For children, understanding the basics of budgeting, saving, and investing can lay a strong foundation for financial independence and security as they grow. This blog post will explore various free money management worksheets designed specifically for kids, helping parents and educators teach these essential life skills in a fun and engaging manner.

Why Money Management for Kids?

Financial literacy isn’t typically taught in schools, making it imperative for parents to step in. Here are a few reasons why introducing money management concepts at a young age is beneficial:

- Early Decision Making: Learning to manage money helps kids understand the consequences of financial decisions.

- Habit Formation: It instills positive financial habits which can shape their future behavior with money.

- Empowerment: Knowledge is power. Kids who understand money can better navigate the financial aspects of life.

Types of Money Management Worksheets

There are several types of worksheets tailored for kids of different age groups to help them grasp various financial concepts:

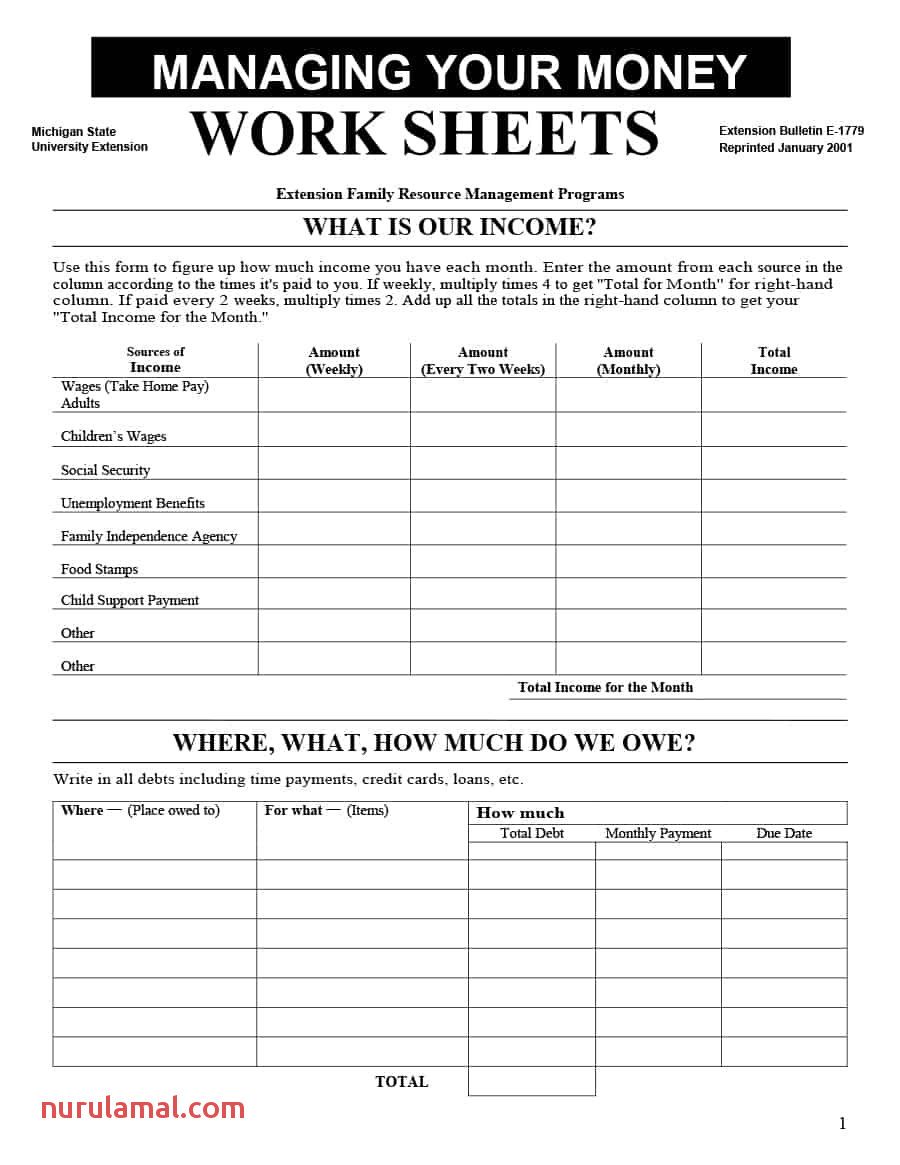

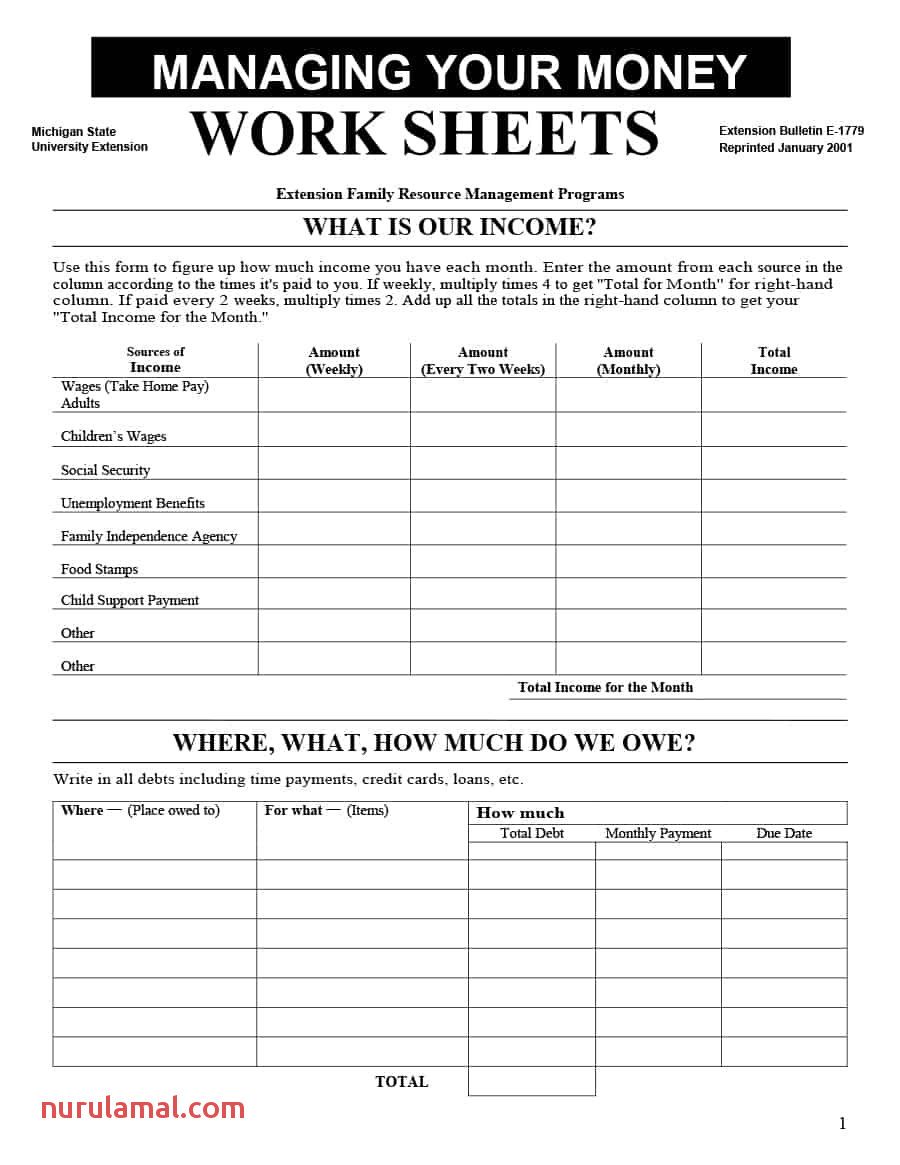

- Budgeting Basics: Worksheets that break down income sources, expenses, savings goals, and charity.

- Saving Strategies: Teach children how to save through activities like setting up savings jars or tracking savings progress.

- Spending Tracker: These help kids categorize their spending to understand where their money goes.

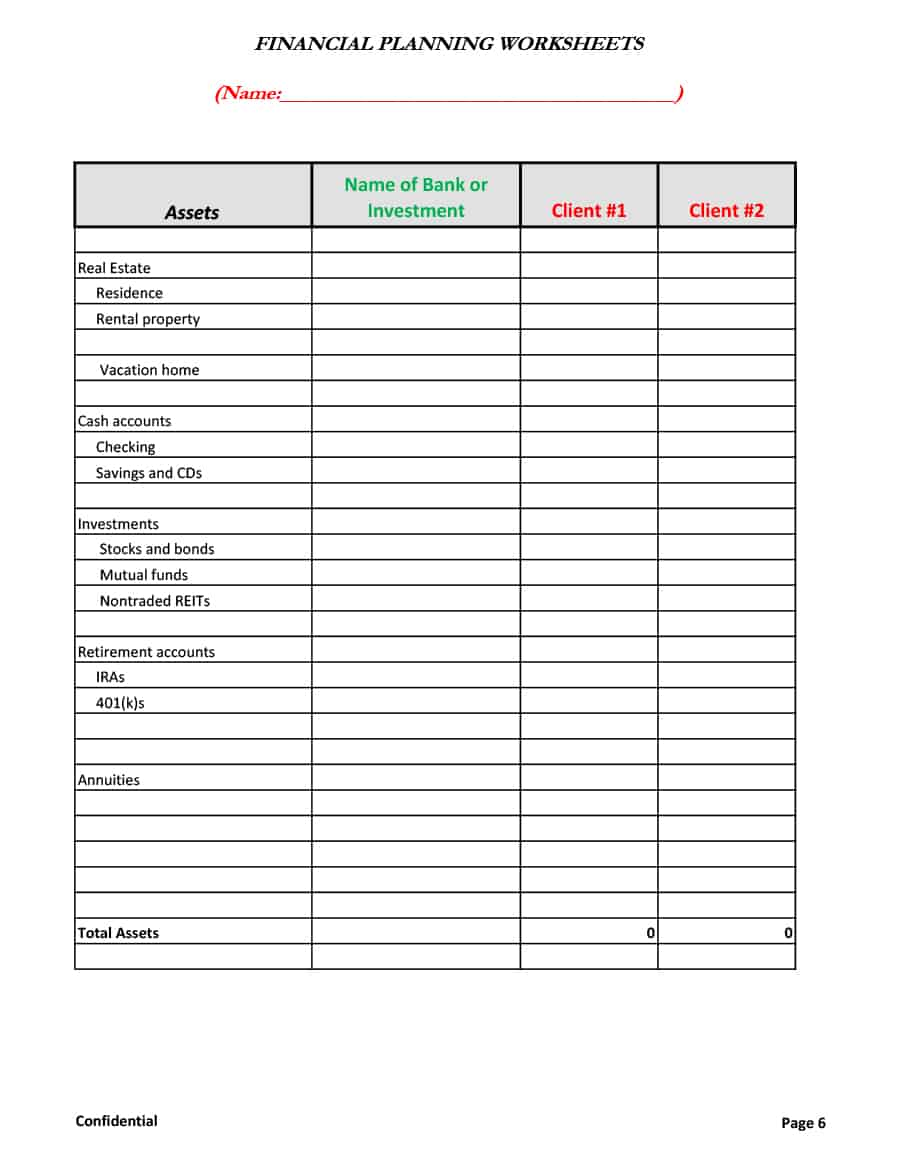

- Investment Introduction: Worksheets can introduce the basics of investment, like understanding stocks, bonds, or even simple interest.

Free Money Management Worksheets

Below are some free resources available online that can make teaching money management engaging:

| Name | Focus | Age Range | Download Link |

|---|---|---|---|

| Money Management Wheel | Budgeting | 7-12 | [Download Here] |

| My Savings Goals | Saving | 5-9 | [Download Here] |

| Kids Money Tracker | Spending | 8-14 | [Download Here] |

| Investing Basics | Investing | 10-16 | [Download Here] |

💡 Note: Remember to choose worksheets that match your child’s cognitive level and interest.

How to Use These Worksheets

Here’s a guide on effectively incorporating these worksheets into your child’s learning routine:

- Regular Practice: Make it a habit to do these worksheets weekly or monthly to keep the financial concepts fresh.

- Interactive Learning: Use real-life examples, like their allowance, to make the lessons practical and relatable.

- Discussion: Engage with your child about their choices in spending or saving, reinforcing the lessons learned.

- Reward System: Consider setting up small rewards for meeting savings goals or sticking to their budget.

Tips for Parents and Educators

Here are some strategies to maximize the effectiveness of these worksheets:

- Encourage Participation: Let kids have a say in how they use their money to make the process more engaging.

- Real-World Application: Link money management lessons to real-world scenarios, like shopping or planning for future purchases.

- Consistency is Key: Regularly review these lessons to ensure the habits become second nature.

- Collaborative Learning: Make it a family or class activity where everyone shares their experiences with money.

Extending Financial Literacy Beyond Worksheets

While worksheets are a fantastic tool, financial literacy extends beyond paper exercises:

- Board Games: Games like Monopoly or Moneybags can teach budgeting, investing, and more through play.

- Field Trips: Visiting banks, financial institutions, or even markets can provide practical exposure.

- Allowance: Providing an allowance and guiding them on its use reinforces money management.

- Charity: Encouraging kids to donate part of their money teaches them the value of sharing and social responsibility.

Additional Online Resources

Here are some websites and apps to complement your teaching efforts:

- Website 1: Interactive games and financial tools for kids.

- Website 2: Free financial literacy courses tailored for young learners.

- App: An app that helps kids manage their money through gamification.

🔗 Note: Always supervise your child’s online activities to ensure they are safe and age-appropriate.

In this journey to financial literacy, the tools provided here are but the first step. Encourage your children to ask questions, explore, and learn from their financial mistakes. The goal isn't to make them overnight finance wizards but to equip them with the tools for a lifetime of sound financial decisions. From budgeting basics to understanding the value of saving and investing, these lessons will shape their future. Remember, patience, consistency, and real-world application are key. By integrating these principles into daily life, you're setting your child on a path to not only manage money but to truly understand its worth and potential.

How often should my child do these worksheets?

+

Weekly or monthly sessions are ideal, depending on your child’s age and engagement level.

What age is appropriate for these worksheets?

+

Worksheets can be adapted for children from age 5 upwards, focusing on basic concepts first and then expanding as they grow.

Are there versions for older kids?

+

Yes, there are more advanced worksheets for teenagers that delve deeper into budgeting, investing, and financial planning.

How can I make these lessons fun?

+

Incorporate games, stories, and real-life scenarios. Gamifying the process can make financial education engaging and enjoyable.

Should I start teaching my child about money management before they have their own income?

+

Absolutely. Early education in money management sets the stage for understanding value and making informed financial decisions later in life.