5 Jobs Under Table

Introduction to Under the Table Jobs

Working under the table, also known as being paid “cash in hand,” refers to employment where the employer pays the employee without declaring the income to the government. This practice is often associated with tax evasion and can have significant legal and financial implications for both parties involved. Despite the risks, many individuals engage in under the table jobs due to various reasons, including the need for immediate cash, avoidance of taxes, or because they are not legally allowed to work in their current location. Here, we will explore five common jobs that are often found under the table, the reasons behind their prevalence, and the potential consequences of engaging in such employment.

1. Construction and Handyman Work

Construction sites and handyman services often hire workers on a cash basis, especially for small projects or odd jobs. These jobs can range from building repairs, painting, and plumbing to electrical work and demolition. Workers in this sector may prefer cash payments to avoid taxes or because they are undocumented. However, this practice deprives governments of tax revenues and leaves workers without legal protections or benefits.

2. Childcare and Domestic Work

Many individuals work as nannies, housekeepers, or caregivers for elderly or disabled persons on an under the table basis. This is partly because these jobs often involve private arrangements with families who may not want to deal with the formalities of employment contracts and tax deductions. While this arrangement may seem convenient, it exposes workers to exploitation and lacks the social security benefits and labor protections that come with formal employment.

3. Freelance and Creative Services

Freelancers in writing, design, photography, and other creative fields sometimes receive cash payments for their work. This can be due to the informal nature of freelance contracts or because clients wish to avoid VAT (Value Added Tax) and other taxes. While freelance work offers flexibility, under the table payments can lead to financial instability for freelancers and reduce their access to credit and pension plans.

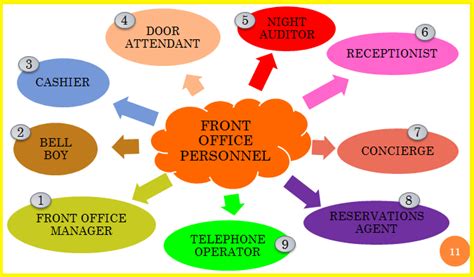

4. Food Service and Hospitality

In the food service industry, including restaurants, bars, and cafes, under the table payments are not uncommon. Tips are often paid in cash and may not be declared, while some employers might pay staff partially or wholly in cash to avoid payroll taxes. This practice is risky for employees, as it can result in wage theft and deny them workers’ compensation and unemployment benefits.

5. Gardening and Landscaping

Gardening and landscaping services, including lawn care, tree trimming, and yard cleanup, are often paid for in cash. Homeowners might prefer this arrangement to save money on taxes, and workers might accept it for the immediate cash benefit. However, like other under the table jobs, this arrangement can leave workers vulnerable to exploitation and without access to health insurance and other benefits.

📝 Note: Engaging in under the table jobs can have serious legal and financial consequences. It's essential for both employers and employees to understand the risks and consider the benefits of formal, taxed employment.

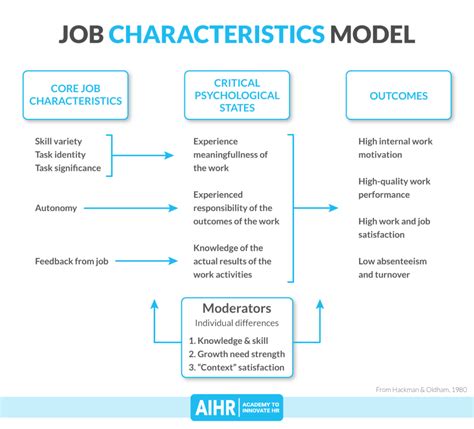

To summarize the key points, under the table jobs are prevalent in various sectors due to reasons such as tax avoidance, immediate cash needs, or legal status issues. However, these jobs come with significant risks, including lack of legal protections, exploitation, and financial instability. It’s crucial for individuals to weigh these factors and consider the long-term implications of their employment choices. Ultimately, the decision to work under the table should be made with a full understanding of the potential consequences and the importance of contributing to and benefiting from a formal, taxed workforce.

What are the risks of working under the table?

+

The risks include lack of legal protections, exploitation, financial instability, and potential legal consequences for tax evasion.

Why do people engage in under the table jobs?

+

People engage in under the table jobs for various reasons, including the need for immediate cash, avoidance of taxes, or because they are not legally allowed to work in their current location.

What sectors are most prone to under the table jobs?

+

Sectors such as construction, childcare, freelance services, food service, and gardening are commonly associated with under the table jobs.