5 Ohio Tax Calculators

Introduction to Ohio Tax Calculators

When it comes to managing your finances, understanding your tax obligations is crucial. For residents of Ohio, navigating the state’s tax laws can be complex. This is where Ohio tax calculators come into play, offering a straightforward way to estimate your tax liability. In this article, we will delve into the world of Ohio tax calculators, exploring what they are, how they work, and highlighting five key calculators that can make a significant difference in your financial planning.

Understanding Ohio Tax Calculators

Ohio tax calculators are tools designed to help individuals and businesses calculate their tax obligations to the state of Ohio. These calculators take into account various factors such as income, deductions, and credits to provide an estimate of the taxes owed. They are especially useful for planning purposes, allowing individuals to anticipate their tax burden and make informed decisions about their financial affairs.

How Ohio Tax Calculators Work

The operation of Ohio tax calculators is relatively straightforward. Users input their relevant financial information, such as income level, number of dependents, and any deductions or credits they are eligible for. The calculator then uses this information, along with the current tax rates and laws in Ohio, to calculate an estimate of the user’s tax liability. This process can be completed online, making it convenient and accessible for everyone.

5 Key Ohio Tax Calculators

Here are five Ohio tax calculators that can be particularly useful for residents and businesses in the state:

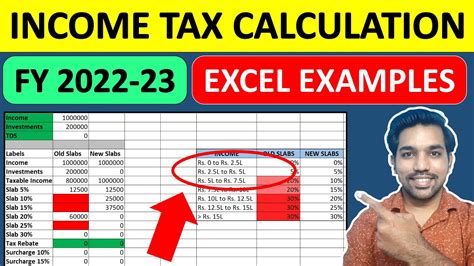

- Ohio Income Tax Calculator: This calculator is designed to estimate an individual’s income tax liability based on their income, filing status, and number of dependents.

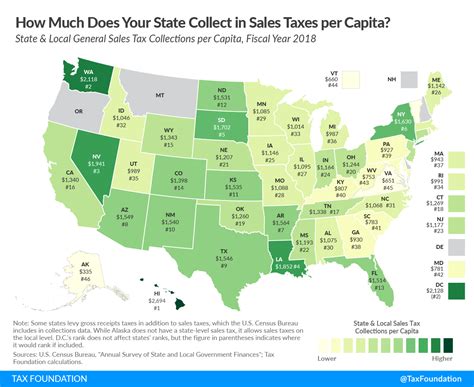

- Ohio Sales Tax Calculator: For businesses and individuals who need to calculate sales tax on purchases, this calculator is indispensable. It considers the sales tax rate and the purchase amount to provide an accurate calculation.

- Ohio Property Tax Calculator: Property owners in Ohio can use this calculator to estimate their property tax liability. It takes into account the value of the property and the local tax rate.

- Ohio Small Business Tax Calculator: Small businesses in Ohio can benefit from this calculator, which helps estimate their tax obligations based on business income, expenses, and applicable tax credits.

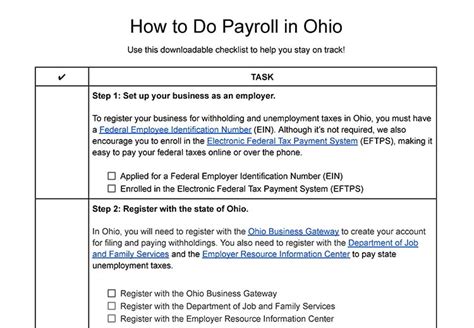

- Ohio Tax Withholding Calculator: This calculator is useful for employers and employees alike, helping to determine the correct amount of state income tax to withhold from employee wages.

Benefits of Using Ohio Tax Calculators

Using Ohio tax calculators offers several benefits, including: - Accuracy: They provide accurate estimates of tax liabilities, reducing the risk of errors. - Convenience: Most calculators are available online, making them easily accessible. - Time Savings: Calculators automate the calculation process, saving time that would be spent on manual calculations. - Financial Planning: By knowing their tax obligations in advance, individuals and businesses can plan their finances more effectively.

Choosing the Right Ohio Tax Calculator

With so many Ohio tax calculators available, choosing the right one can seem daunting. Consider the following factors: - Purpose: Determine what you need the calculator for (income tax, sales tax, property tax, etc.). - Accuracy: Look for calculators that use the most current tax rates and laws. - Ease of Use: Opt for calculators with user-friendly interfaces. - Reputation: Choose calculators from reputable sources to ensure reliability.

📝 Note: Always verify the information and calculations provided by tax calculators with a tax professional or the Ohio Department of Taxation to ensure accuracy and compliance with current tax laws.

Future of Ohio Tax Calculators

As technology advances, Ohio tax calculators are likely to become even more sophisticated, offering more precise calculations and additional features such as automated tax filing and personalized financial advice. This evolution will further simplify the tax calculation process, making it easier for individuals and businesses to manage their tax obligations.

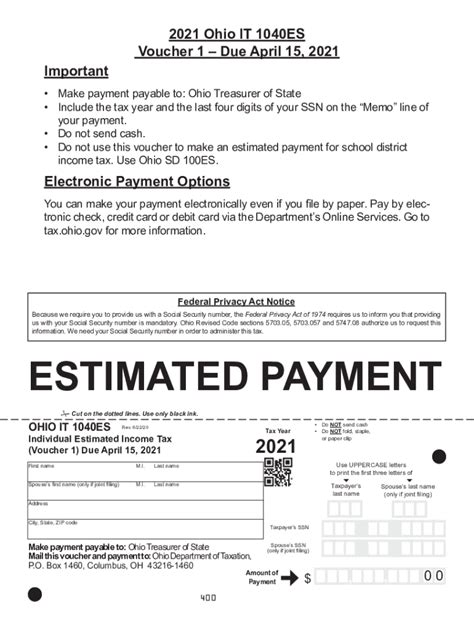

Embedding Images for Better Understanding

This image represents the various Ohio tax calculators available, showcasing their user-friendly interfaces and the range of tax calculations they can perform.

This image represents the various Ohio tax calculators available, showcasing their user-friendly interfaces and the range of tax calculations they can perform.

| Calculator Name | Purpose | Benefits |

|---|---|---|

| Ohio Income Tax Calculator | Estimates income tax liability | Accurate income tax estimation, planning |

| Ohio Sales Tax Calculator | Calculates sales tax on purchases | Helps with budgeting, financial planning for purchases |

| Ohio Property Tax Calculator | Estimates property tax liability | Aids in planning and budgeting for property owners |

| Ohio Small Business Tax Calculator | Estimates small business tax obligations | Facilitates financial planning and tax compliance for small businesses |

| Ohio Tax Withholding Calculator | Determines correct state income tax withholding | Ensures accurate tax withholding, avoids penalties |

In summary, Ohio tax calculators are invaluable tools for anyone looking to understand and manage their tax obligations in the state. By providing accurate estimates and simplifying the calculation process, these calculators play a crucial role in financial planning and tax compliance. Whether you’re an individual or a business, leveraging the right Ohio tax calculator can make a significant difference in navigating the complexities of state taxation.

What is the primary purpose of Ohio tax calculators?

+

The primary purpose of Ohio tax calculators is to help individuals and businesses estimate their tax obligations to the state of Ohio, making it easier to plan finances and comply with tax laws.

How do I choose the right Ohio tax calculator for my needs?

+

To choose the right Ohio tax calculator, consider the purpose (income tax, sales tax, etc.), ensure it uses current tax rates and laws, look for a user-friendly interface, and opt for calculators from reputable sources.

Are Ohio tax calculators accurate and reliable?

+

Most Ohio tax calculators are designed to provide accurate and reliable estimates. However, it’s always a good idea to verify the calculations with a tax professional or the Ohio Department of Taxation to ensure compliance with the latest tax laws and regulations.