5 TSP Retirement Tips

Understanding the TSP Retirement Plan

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the Ready Reserve. It is a defined contribution plan, which means that the amount of money you receive in retirement depends on how much you contribute and the performance of your investments. In this article, we will explore five TSP retirement tips to help you make the most of your retirement savings.

TSP Retirement Tip 1: Start Early and Contribute Consistently

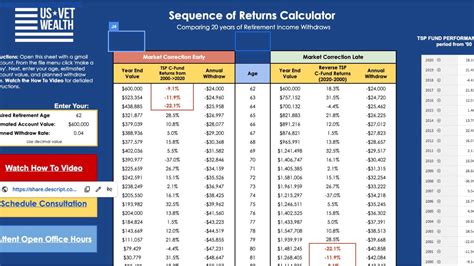

The key to a successful TSP retirement plan is to start early and contribute consistently. The power of compound interest can help your savings grow significantly over time. Even small, regular contributions can add up to a substantial nest egg. For example, if you start contributing $100 per month at age 25 and continue until you retire at 65, you could have a significant amount of money in your TSP account, depending on the performance of your investments.

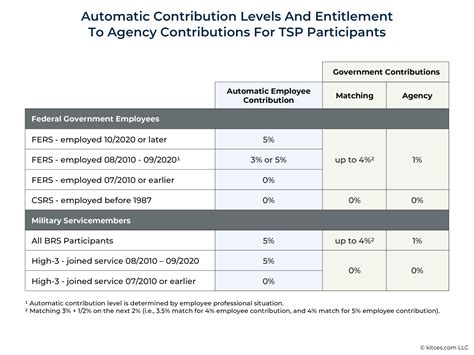

TSP Retirement Tip 2: Take Advantage of Agency Matching Contributions

If you are a federal employee, your agency will match a portion of your contributions to the TSP. The agency matching contributions are as follows: * 1% of basic pay will be contributed by the agency, regardless of whether you contribute to the TSP. * If you contribute 3% or less of your basic pay, the agency will match your contributions dollar-for-dollar. * If you contribute between 3% and 5% of your basic pay, the agency will match your contributions $0.50 on the dollar. * If you contribute more than 5% of your basic pay, the agency will not make any additional matching contributions.

It’s essential to contribute enough to maximize the agency matching contributions, as this is essentially free money that can help your retirement savings grow.

TSP Retirement Tip 3: Choose the Right Investment Options

The TSP offers a range of investment options, including: * G Fund: Government securities fund * F Fund: Fixed income index fund * C Fund: Common stock index fund * S Fund: Small capitalization stock index fund * I Fund: International stock index fund * L Funds: Lifecycle funds, which are a mix of the above funds and are designed to automatically adjust the allocation of your investments based on your age and retirement date.

It’s crucial to choose the right investment options based on your risk tolerance and investment goals. You may want to consider consulting with a financial advisor or using the TSP’s online resources to help you make informed investment decisions.

TSP Retirement Tip 4: Consider a Roth TSP

The Roth TSP is a type of TSP account that allows you to contribute after-tax dollars, which can provide tax-free growth and withdrawals in retirement. The Roth TSP can be a good option if you expect to be in a higher tax bracket in retirement or if you want to leave tax-free money to your heirs. However, it’s essential to consider your individual circumstances and tax situation before deciding whether a Roth TSP is right for you.

TSP Retirement Tip 5: Monitor and Adjust Your TSP Account

It’s essential to regularly monitor and adjust your TSP account to ensure that it remains aligned with your retirement goals. You should: * Review your contribution rate and adjust it as needed to ensure that you are saving enough for retirement. * Monitor your investment options and adjust them as needed to ensure that they remain aligned with your risk tolerance and investment goals. * Consider consolidating your retirement accounts, such as rolling over a previous employer’s 401(k) plan into your TSP account.

By following these five TSP retirement tips, you can help ensure that you are making the most of your retirement savings and are on track to meet your retirement goals.

💡 Note: It's essential to consult with a financial advisor or tax professional to determine the best strategy for your individual circumstances and to ensure that you are in compliance with all applicable laws and regulations.

As you approach retirement, it’s essential to have a clear understanding of your TSP retirement plan and how it fits into your overall retirement strategy. By starting early, contributing consistently, taking advantage of agency matching contributions, choosing the right investment options, considering a Roth TSP, and monitoring and adjusting your TSP account, you can help ensure that you have a comfortable and secure retirement.

The key to a successful retirement is to plan carefully and make informed decisions about your retirement savings. By following these five TSP retirement tips, you can help ensure that you are on track to meet your retirement goals and enjoy a comfortable and secure retirement.

What is the Thrift Savings Plan (TSP)?

+

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the Ready Reserve.

How do I contribute to the TSP?

+

You can contribute to the TSP through payroll deductions, which can be set up through your agency’s payroll office or online through the TSP website.

Can I withdraw money from my TSP account at any time?

+

No, you can only withdraw money from your TSP account in certain circumstances, such as when you leave federal service or reach age 59 1⁄2. You may also be able to take a loan from your TSP account, but this is subject to certain rules and limitations.