5 In Out Pay Rates

Understanding 5 In Out Pay Rates

The concept of 5 in out pay rates has gained significant attention in recent years, particularly among individuals seeking to understand how their compensation is structured. Essentially, this term refers to a payment schedule where an employee receives five weeks of pay in a row, followed by one week without pay. This cycle repeats throughout the year, affecting the overall annual salary and how it’s perceived by the employee.

How 5 In Out Pay Rates Work

To grasp the mechanics of 5 in out pay rates, it’s essential to break down the payment cycle. The cycle consists of five weeks where the employee receives their regular pay, followed by a week where no payment is made. This pattern continues, resulting in a total of 48 paid weeks and 4 unpaid weeks in a year. The key to understanding this system lies in recognizing how it impacts the employee’s take-home pay and budgeting.

Benefits and Drawbacks

The 5 in out pay system presents both benefits and drawbacks for employees. On the positive side, it can help employers manage payroll costs more effectively, potentially leading to job security. Additionally, for some employees, the predictable payment cycle can aid in financial planning. However, the unpaid weeks can pose challenges for budgeting and may lead to financial strain if not managed properly.

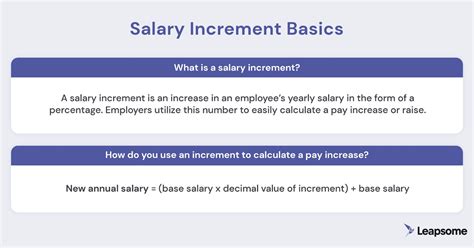

Calculating Annual Salary

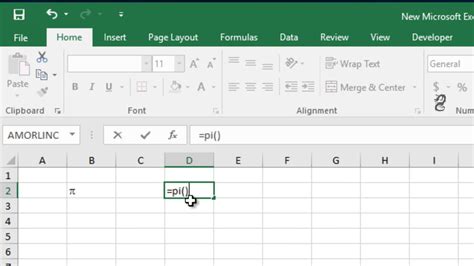

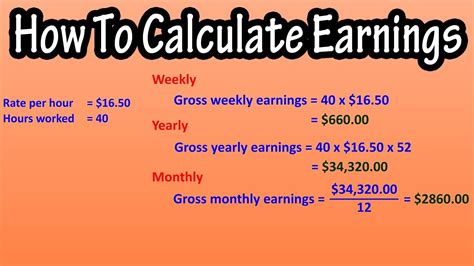

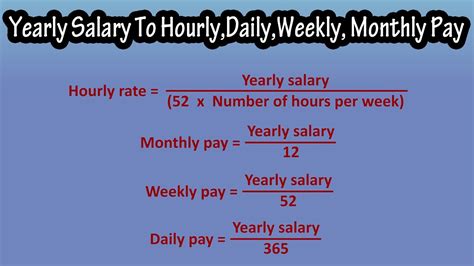

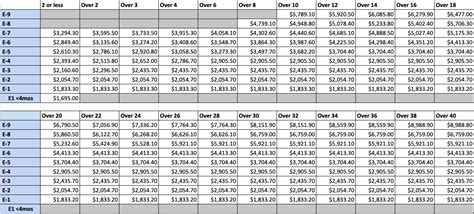

To calculate the annual salary under the 5 in out system, one must consider the number of paid weeks and the weekly pay rate. The formula is straightforward: Annual Salary = Weekly Pay Rate * Number of Paid Weeks. Given that there are 48 paid weeks in a year under this system, the calculation would be Annual Salary = Weekly Pay Rate * 48.

| Weekly Pay Rate | Number of Paid Weeks | Annual Salary |

|---|---|---|

| $1,000 | 48 | $48,000 |

Impact on Employees

The impact of the 5 in out pay rates on employees can vary significantly. For some, the predictable income can be beneficial for planning and managing finances. However, the unpaid weeks can be challenging, especially for those with fixed expenses or variable income. It’s crucial for employees to budget carefully and possibly seek financial advice to navigate this payment structure effectively.

📝 Note: Employees should carefully review their employment contracts to understand the payment terms and how they might affect their financial situation.

Alternatives and Considerations

For employers and employees alike, it’s worth considering alternative payment structures that might offer more financial stability or flexibility. Options such as bi-weekly or monthly pay might better suit the needs of some employees, especially those who struggle with the unpaid weeks in the 5 in out system. Open communication between employers and employees is key to finding a payment structure that meets everyone’s needs.

In summary, the 5 in out pay rates system is a unique payment structure that can have significant implications for both employers and employees. Understanding how this system works, its benefits and drawbacks, and considering alternative payment structures can help in making informed decisions about compensation and financial planning.

What is the 5 in out pay rate system?

+

The 5 in out pay rate system is a payment schedule where an employee receives pay for five weeks in a row, followed by one unpaid week, repeating throughout the year.

How does the 5 in out system affect annual salary?

+

The annual salary is calculated by multiplying the weekly pay rate by the number of paid weeks, which is 48 in the 5 in out system.

What are the benefits of the 5 in out pay system?

+

The benefits include predictable income for better financial planning and potential job security due to effective payroll cost management by employers.